On October 8th last year I published 7 Thoughts On Crypto After Three Months Down The Rabbit Hole. It laid out my framework for putting the Crypto moment in to context. It became the #1 Crypto post on Medium, changing my life, and making the last five months a whirlwind. That said, for everyone in Crypto, it’s been a crazy five months:

Amid the craziness over the past five months, I wrote another 30 Crypto related posts, as the Crypto landscape, and my framework for understanding Crypto, both evolved. At the end of this post I highlight five important things I’ve learned over the past five months. But I start the post by revisiting the 7 Thoughts to see how they hold up.

1. Nobody Knows Anything

One of the things I know for sure is that whatever Crypto ends up being, it’s different from what anybody thinks it will be today. We’re still at the very beginning of this incredible journey, and nobody really knows anything yet.

2. Bitcoin Is A Confidence Game, Utility Tokens Are Awesome But Legally Challenging, Security Tokens Are Going To Be Huge

This looks pretty prescient at the moment. Bitcoin has almost doubled, Utility Tokens have come under intense SEC scrutiny, and in a recent piece titled The Flippening Is Coming, I predict that the value of security tokens issued will overtake the value of utility tokens issued in 2019.

3. Blockchain Technology Is Going To Be A Disruptive Force Across Industries

Though this was the most obvious of the 7 Thoughts, I’ve come to believe that there is a next generation Blockchain called a DAG (Direct Acyclic Graph), that will be the disruptive force I thought Blockchain was going to be. To learn more, read my recent piece Is The Future Of Blockchains DAGs?

4. DECENTRALIZATION Is Potentially The Most Disruptive Force

When I published 7 Thoughts, I wrote that “Blockchains, cryptocurrencies, together with smart contracts are enabling Decentralization, which is the REALLY disruptive thing.” I’ve added a two new elements, which I discuss below, to the factors enabling Decentralization. I now believe that it is these six elements in combination that is the disruptive force, and none is more important then the other. In fact, when I use the word Crypto, I’m referring to the combination of these six elements. For further insight, read my piece Why Decentralized Companies Are So F****** Cool To Work At.

5. It’s A Bubble….So What

I said “so what” because I believe in Amara’s Law: We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run. This is why we get bubbles. I further explain why I think “SoWhat” in The “Crypto Bubble” Isn’t A Bubble, It’s A …

6. Governance Is The Biggest Risk To Bitcoin

My thinking here is now more nuanced. I still believe governance is the biggest risk to Bitcoin becoming a currency, because it needs a functional governance to evolve and solve the technical problems it’s facing. But governance is not a risk to Bitcoin replacing gold, as Bitcoin doesn’t need to evolve to replace gold. It’s a far superior store of value than gold today. But I still believe that governance is the biggest risk to other decentralized projects.

7. Don’t Hate The Haters. Love The HODL’ers

I still believe that time spent hating the haters is wasted (see My Seven Crypto New Year’s Resolutions). The haters aren’t convincing the HODLers any more than the HODLers are convincing the haters. So let’s spend our time helping the believers.

Overall, I think the 7 Thoughts have held up well over the last five months.

Finally, over the last five months, I’ve come to believe five new things that help put Crypto in to context:

1. Community Is A Major Differentiating Factor In Crypto

The Crypto industry is a vibrant community, that’s why we started CryptoMondays. It’s so early, that no one in Crypto is really competing with anyone as much as we’re all working together to grow the industry.

Every Crypto project is also a community that works together to make the project a success. It’s developers on Github. It’s Telegram members. It’s Reddit and Twitter followers. It’s Meetup attendees. Community members have multiple reasons to want the project to be a success. Much has been written about Bitcoin’s ability to provide powerful incentives to the community. And while were still early going there, as this great piece by Elad Verbin highlights, the impact of Crypto projects getting incentives right can be both very powerful and very difficult to achieve.

It’s important to note that the incentives that power a community don’t have to be via product usage or financial gain. In fact, a very useful incentive is status in a community. This can be conveyed by followers, or by other rewards conveying status that the community can provide. The reward can also be intrinsic, making one feel good about making the world a better place.

Community can be used to further entrench early projects. The Bitcoin community has a big incentive to help make Lightning Networks a success. You can also take existing non-Crypto communities, like Telegram, and tokenize it.

Community is even an offsetting force to forking, which some see as destabilizing. When a community gets forked, those that remain generally get even more engaged in the Community.

2. Zero Knowledge Proof Is A Thing

Zero Knowledge Proof (ZKP) allow ones party to prove to another that a statement is true, without revealing any information. Here’s a good Medium post on the topic. If it sounds like magic, it’s because it kind of is. ZKP enables enterprises to use public blockchains, because they don’t have to be worried about disclosing information. I think ZKP is going to be such a fundamental part of the Crypto architecture, that I include it with Blockchain, cryptocurrency, smart contracts, community, and decentralization, as one of the six key elements of Crypto. The most notable examples of ZKP today is Zcash. QEDit is also doing great work to further the technology.

3. Crypto Will Have The Greatest Impact In Social Good

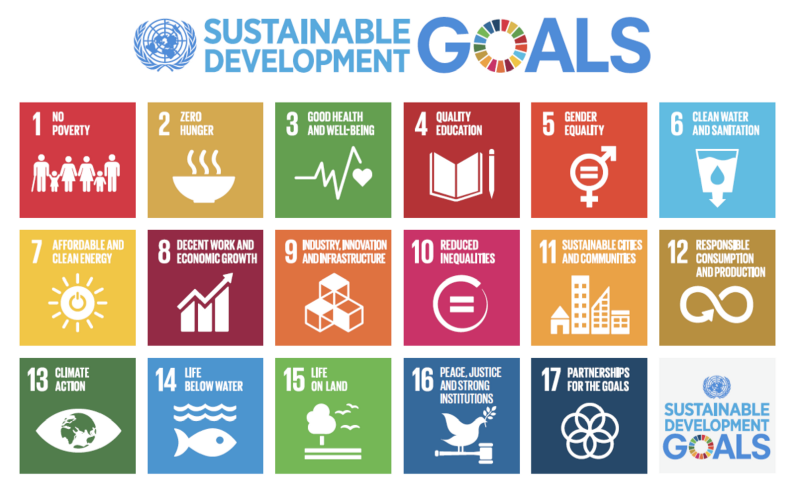

As massive as Crypto’s the wealth creation is going to be, the potential is even greater for those technologies to impact social good. From solving for identity for the 1.5 billion people who lack identity papers, to solving for climate change, crypto is enabling amazing new ways to tackle the world’s biggest problems. For example, there are blockchain applications for nearly all of the U.N.’s 17 goals for 2030.

I applaud the great social good work being done by various Crypto initiatives around the world, including ConsenSys’ Blockchain For Social Impact Coalition, and their 38 members, who are working to develop blockchain products and solutions that address the 17 U.N.’s Goals.

4. Many Cities Will Be Crypto Powerhouses

While, to some degree, I do believe, that the next Silicon Valley is in the clouds, at the moment, I believe that New York is the Crypto capital of the world (and Silicon Valley is rapidly catching up).

In addition to the Valley, over the last five months I’ve visited booming Crypto ecosystems in Tel Aviv, Los Angeles, and Toronto. I’ve read how Crypto is booming in Berlin. China has given us NEO, VeChain and QTUM, the 9th, 17th, and 18th largest Crypto projects by market cap. Due to a culture built on neutrality and privacy, ZUG has emerged as Crypto Valley. Brock Pierce and others are working to make Puerto Rico a Crypto utopia.

The point is that the decentralization at the core of much of Crypto is decentralizing the traditional Silicon Valley power structure it’s wealth creation mechanism.

5. Crypto Will Go Mainstream When It Goes Mainstream

One of the three questions I get asked most often is “When will Crypto go mainstream?”. I answer by telling the story of “Lazy Sunday”, an Andy Samberg SNL video uploaded to YouTube five months after YouTube was launched. After “Lazy Sunday” was uploaded to YouTube, it became the fastest growing website in the world. Six months later, Google bought YouTube for $1.65 billion. The story highlights the “lightening in a bottle” aspect of YouTube’s success. And that’s how it works most often in tech. It’s about the right product, at the right time, combined with luck.

I don’t know what’s going to make Crypto go mainstream. Nobody does. But with all the amazing work going on in Crypto around the world, Crypto will have it’s Lazy Sunday moment in 2018. But even if it take longer than that, I’m not worried. As this AWESOME clip from “The Hudsucker Proxy” highlights, even the Hula Hoop had a circuitous route to becoming mainstream.