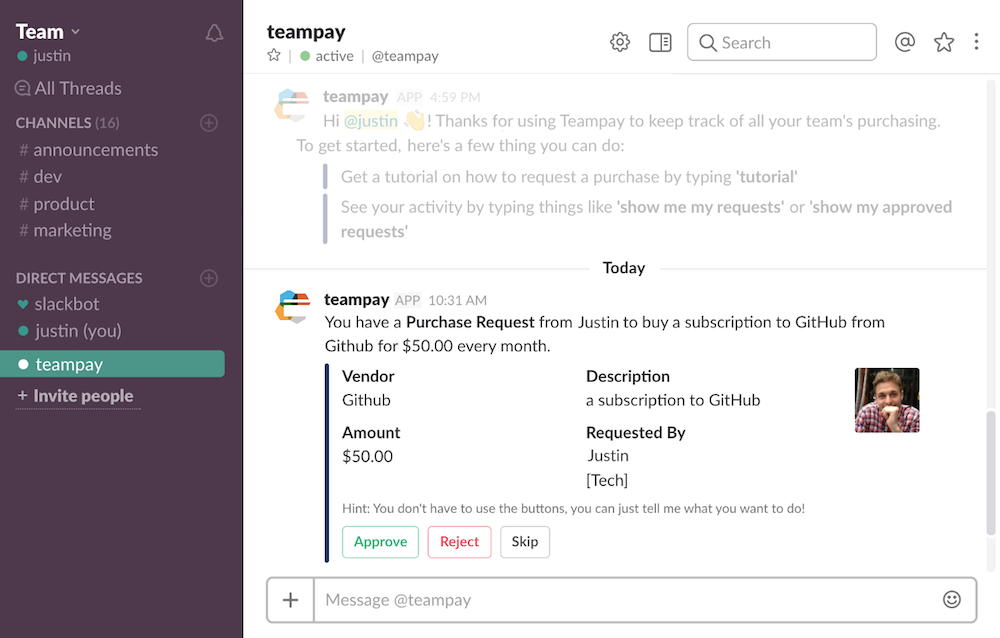

As your team scales, managing employee spend becomes another one of those inevitable things that you now need to add to your roster of growing responsibilities. Handing your corporate card to your employees may not be the most ideal situation. Teampay is a new and innovate way for company’s to manage employee expenses through virtual cards that are secure, can be preset in amount, and restricted to approved vendors. The platform has the ability to approve all expenditures before they happen and reconcile seamlessly without the need for your employees to fill out an expense report. This is expensing for the modern era.

AlleyWatch chatted with CEO Andrew Hoag about the company’s start, its future plans, and its first round of funding.

Who were your investors and how much did you raise?

$4 million Seed round. The round was led by Rick Smith at Crosscut Ventures, and also included KEC Ventures, Precursor Ventures, CoVenture, and a select group of angels and funds.

Tell us about your product or service.

Teampay is a completely new way for companies to stay on top of employee purchasing, enabling businesses to request, approve, pay for, and track employee spend in real-time.

What inspired you to start the company?

What inspired you to start the company?

As a former entrepreneur and operator, I realized I had great tools across other areas of my organization that enabled me to easily share & control access to resources, and yet when it came to the company’s money everything was very process-based or after-the-fact.

How is it different?

We think of ourselves almost as single-sign on for the corporate bank account. The various pieces (request / approval, virtual cards) have existed before, but no one has brought them together in a way that is compelling and easy-to-use.

What market you are targeting and how big is it?

We’re targeting mid-market companies in the 200-1000 employee range, typically knowledge-worker businesses where employees have a high degree of autonomy. By 2020, $1.1T will be transacted in B2B e-commerce, and it’s an exciting market that is just emerging.

What’s your business model?

We charge a license fee for the software (SaaS) based on usage. We’ve already had customers be able to save headcount & avoid runaway spending, so the ROI is very clear.

What are users saying that have made the shift to Teampay?

Our users forward us love letters all the time. Despite shifting to an approval-based system, we find the typical employee loves using Teampay because they can go about their job, without trying to track down someone to pay for something. Managers love it because they stay in control of spending with a simple button-click, and most importantly finance teams love it because they aren’t creating a bureaucratic goat rodeo later when trying to figure out who purchased what and why.

What was the funding process like?

Q4 was a challenging time to be raising a Seed round in SaaS, but we were fortunate to hit our targets within about 3 months of starting the raise.

What are the biggest challenges that you faced while raising capital?

When you aren’t making a better mousetrap, but a completely different way to get rid of mice, the story is critical. When we first went to market, the narrative we went out with wasn’t landing. Probably 3-4 weeks into the raise, we adjusted the pitch and things went a lot better after that.

What factors about your business led your investors to write the check?

You would have to ask them. But I suspect it was the experience of our team and overall size of the opportunity. It’s not often you get to enter a market that has been underserved for more than decade, powered by the tailwind of massive market changes in how companies are working.

What are the milestones you plan to achieve in the next six months?

We are now just working to get the word out, including bringing on larger customers.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

While there is a lot of money sloshing around in Seed stage, it’s clear that the fundraising climate is getting more bifurcated in terms of have and have-nots. While you are working on hitting new milestones, I think it’s important to conserve every penny.

Where do you see the company going now over the near term?

Now that we’ve started to talk publicly about what we are doing, we are excited about some of the new customers we’ve signed and expanding the number of companies that we are serving. We also have a very exciting set of new features in the pipeline for 2018 that will broaden our reach.

What’s your favorite rooftop bar in NYC to unwind?

I have a favorite, hidden gem in the West Village, but if I told you, I wouldn’t really be able to unwind there anymore.