In Q4, competition heats up as more dollars chase fewer seed deals

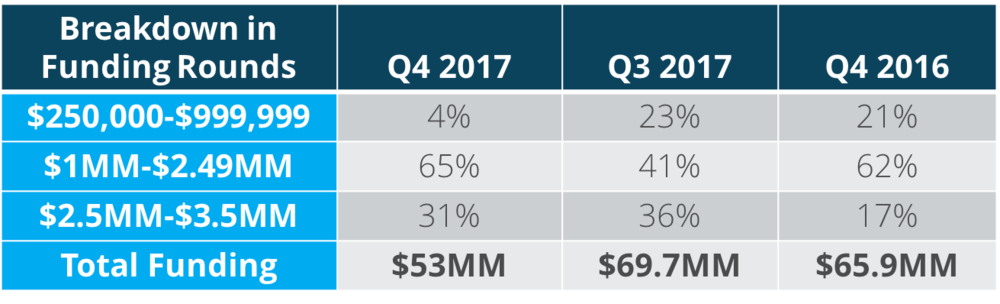

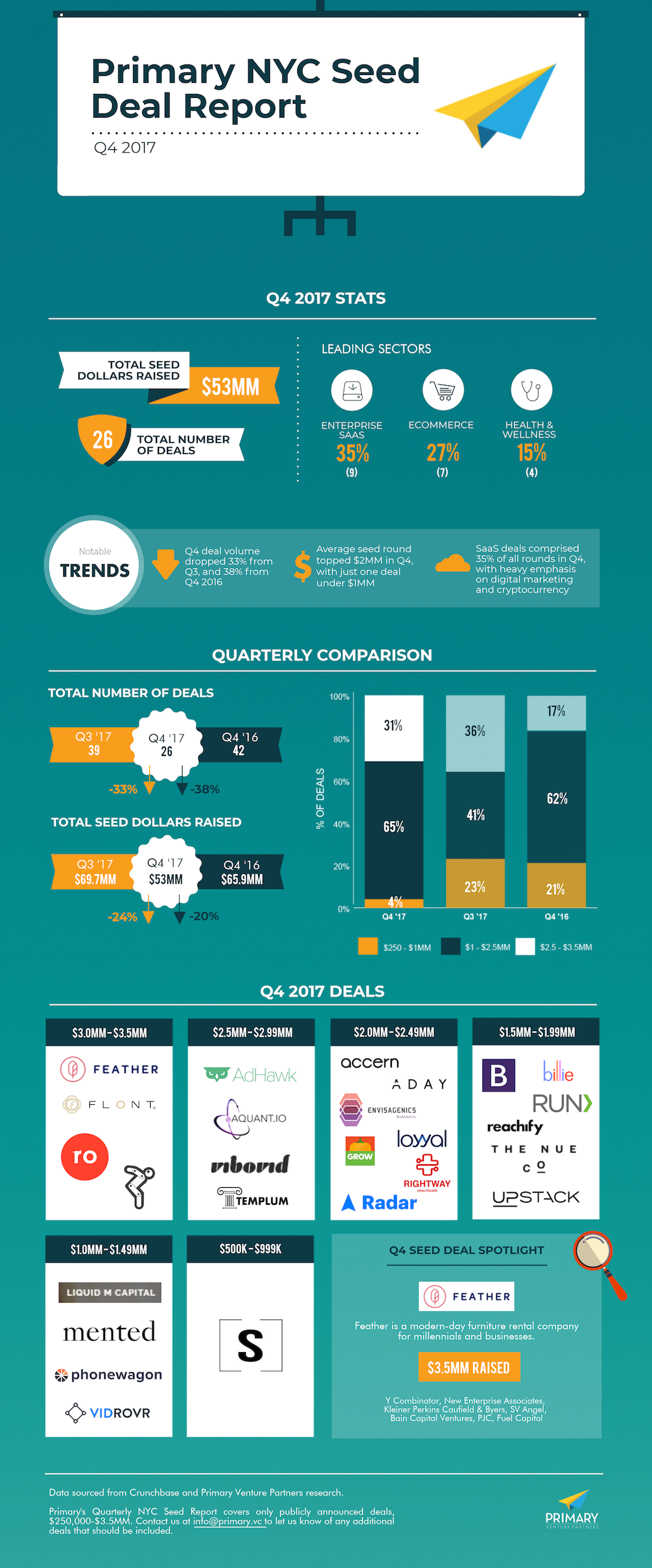

In a year that held no shortage of dramatic twists and turns on the national and international stages, NYC’s seed market came to its own interesting conclusion. In Q4, the city saw just 26 seed deals, a figure down 33% from Q3 and 38% from this time last year. Despite this drop, however, total funding came in at a healthy $53 million, increasing average check size to $2 million – up 11% over last quarter, and 25% over Q4 2016.

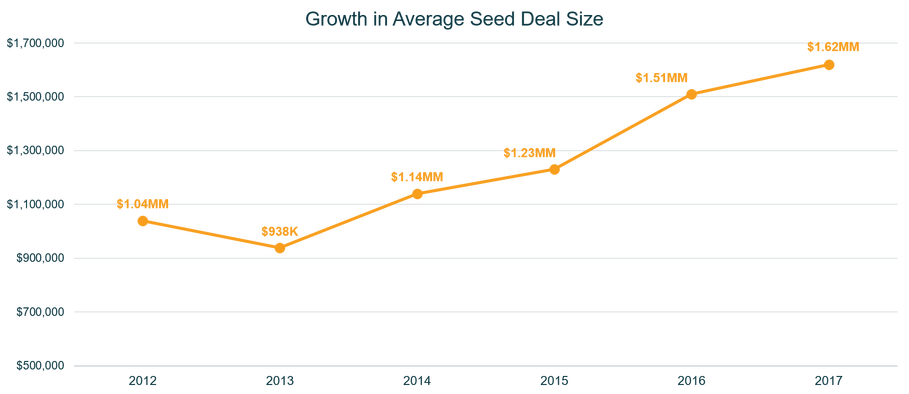

Fewer deals at heftier price tags is a trend we’ve observed over the course of the last year – and that’s true not just in New York, but across the country, as well. While total seed deal count in NYC has retreated from its 2015 peak, the city has continued to witness high levels of invested capital. The impact of that growing investment can be seen in steadily rising average deal size since 2012, as illustrated in the graph below.

The end of the year also saw constriction in the range of deal size. Almost two-thirds of Q4 financings came in the form of $1-$2.5MM checks, with only one company having raised a round below $1MM. This is in contrast to the first three quarters of 2017 that exhibited greater diversity of investment size.

Seed Is The New A

It’s interesting to note the shift in common parlance when it comes to early-stage investing. Compared to the more typical $500K-900K seed deal range of just a few years ago, today’s $2MM average seed round looks more like the smaller end of the traditional Series A market of 10 years ago. There are a few factors that play into this shift. Perhaps most notable is the healthy VC fundraising that took place over 2016 and 2017, which has left investors with plenty of cash on hand. Moreover, many seed investors have replaced the earlier “spray and pray” approach with a more targeted, data-driven investment strategy focused on high-conviction companies that can really prove their worth. And importantly, as Series A investors have continued to move the goalposts on the metrics required for a larger Series A, seed syndicates appear to be prioritizing building longer runways before their companies need to raise that A round.

So where does this leave us for the coming year? More dollars chasing fewer opportunities will continue to drive up competition among investors vying for their share of the most promising pies. Simultaneously, it puts pressure on founders to step up their game and demonstrate a clear path to profitability as they seek larger seed rounds from an increasingly sophisticated and choosy investor base.

Industries To Watch

Getting To Know You

As enterprises continue to feel pressure to personalize their product offerings, new tools have emerged to paint a more detailed picture of end users in order to maximize efficiencies for marketers. This starts at the developer level, where companies like Radar, a location platform for mobile apps, and PhoneWagon, a creator of call tracking and analytics software, help companies build products with richer data and minimal code requirements. Other digital marketing platforms that raised funding this quarter include marketing data aggregator AdHawk and RUN, which offers mobile-first advertising solutions.

Tech To Attract, Retain And Engage

While some aspects of HR software are mature, Q4 saw a rise in new software startups focused on finding and retaining employees. Companies are approaching this problem in various ways, from improving talent search to empowering current employees with additional resources. Our own investment in Bravely – a platform for confidential communication guidance for employees navigating workplace issues – exemplifies this trend.

Sharing Means Caring

The model of leveraging fixed assets to lower costs and enhance the consumer experience has been well-proven by AirBnB and WeWork. Q4 saw several new fixed-asset emergents, including furniture rental platform Feather (which raised the largest deal of the quarter) and luxury jewelry sharing service Flont, largely in categories where incumbent talent resides in NYC. These models will proliferate, as long as they can significantly improve the customer experience and provide compelling unit economics to incentivize users.

From The Comfort Of Your Own Home

Q4 saw increased interest in the intersection of direct-to-consumer and health and wellness, as consumers grow more willing to experiment with new brands that they discover online. In Q4, new entrants included mens’ health company Roman; proprietary supplement company The Nue Co; and luxury beauty company Mented Cosmetics.

Crypto Building Blocks Take Shape

Cryptocurrency continues to fascinate the masses, including the SEC, which concluded this summer that sales of digital assets are subject to federal securities laws. Notably, all FinTech companies announced in Q4 are immersed in cryptocurrency. As blockchain remains top of mind for both individuals and enterprises, and regulatory pressures continue to brew, Templum, a regulatory-compliant platform for ICOs, hopes to become the new market infrastructure for digital assets, offering a solution for both registered and unregistered assets. Templum and its broker-dealer affiliate, Liquid M Capital, may just be the beginning of a new wave of companies responding to crypto’s infiltration to the mass market. And finally, Accern provides news analytics solutions for multi-asset class, including cryptocurrencies.

It Eeny, Meeny, Miny, Moe

Increased need for software and infrastructure solutions has led to an overabundance of platforms from which to choose. Confusion often ensues. Enter companies like Reachify and UpStack, which aggregate available products to recommend tailored solutions to users. Yet data continues to be the real play for these startups, as businesses must provide information about their operations to ensure the right products are chosen.