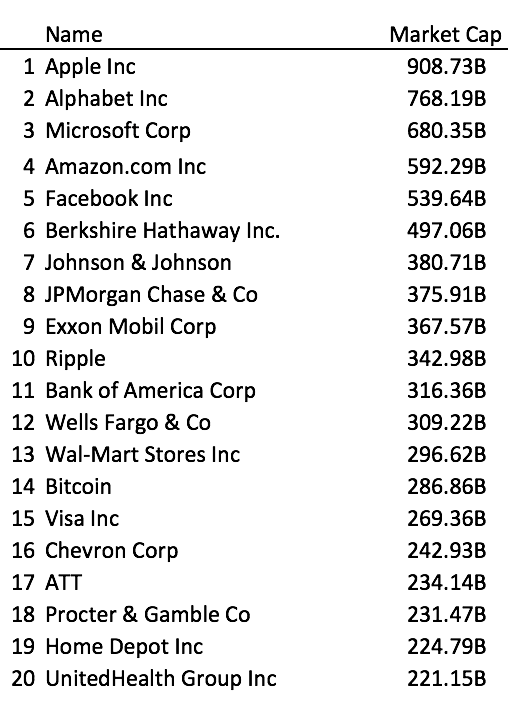

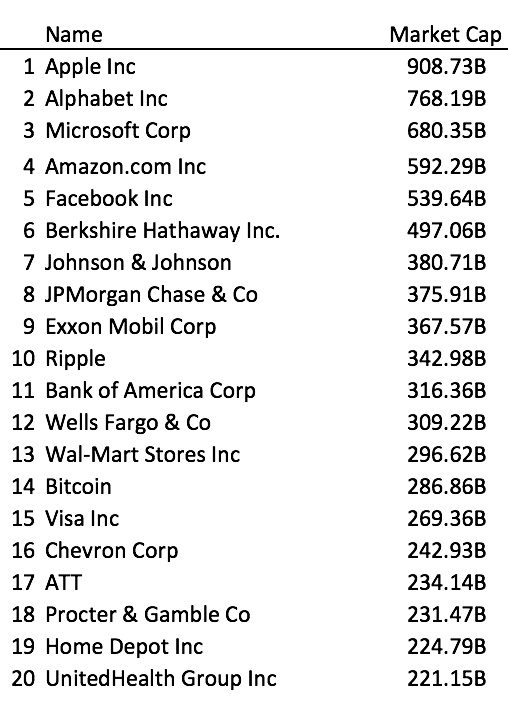

With Ripple’s fully diluted value at $343 billion, it’s the 10th most valuable company in the U.S., ahead of Bitcoin (not to mention P&Gamble and …).

How can that be? I’m reminded of one of the classic lines in movie history, the reason Captain Louis Renault gave Humphrey Bogart (Rick) for shutting Rick’s Cafe in Casablanca:

1. The Difference Between Investing & Gambling Is ….

According to Investopedia, Investing is “The act of committing money to an endeavor with the expectation of obtaining an additional income or profit.” Warren Buffett defines investing as “… the process of laying out money now to receive more money in the future.” Interestingly, you can use those same definitions for gambling. So what’s the difference between the two?

I believe the fundamental difference between the two is that gambling involves random chance while investing requires RESEARCH. That’s what I used to do for a living. I was a research analyst at Goldman Sachs. It was hard work. But I loved it because I love doing learning.

But many “investors” think investing in the stock market, or Crypto, is like walking into a casino. They throw money at a stock or a token, or a basket of stocks or tokens, based on a rumor, tip, or something they believe. They do little research (if any) into each token. Traditionally, it goes great (see internet investing 1996–1999) until it doesn’t (see internet investing 2000)

There are two reasonable explanations for Ripple being worth more than many of the greatest company’s on the planet. The first is that it’s different this time. Could be. But if you read “This Time Is Different: Eight Centuries of Financial Folly”, you probably think it’s reason #2. That people are just simply gambling, without care or concern for things as mundane as valuation.

2. Crypto Has Evolved In To The First Global Casino

For the first time ever, anyone anywhere, can take money, and buy some tokens. If they were doing research, I’d call that investing. But they’re not doing research. Therefor, all they’re doing is gambling. Crypto has evolved in to the world’s first global casino.

And the reality is, there’s NOTHING shocking about it. Humans love gambling. I have a word for the tendency of markets to become bubbles, crash, and become bubbles again. I call that CAPITALISM. That’s what we do (see U.S. stock market circa 1927, 1937, 1973, 1987, 1999, 2008). It’s not just Americans. When the great Japanese land bubble peaked in 1989, at $1 million/square meter, the Imperial Palace in Tokyo became worth more than all of the real estate in California combined. The Japanese weren’t investing in real estate, they were gambling in real estate. For ten years (1980–1989) it worked, until it din’t. By the time that bear market ended, in 2005, prices were down 99%, right back to where they started 25 tears earlier.

To put things in to perspective, all of crypto is worth about $830 billion. That’s about 1% of the total global equities market, which is over $80 trillion.

3. The Crypto Gambling Going On Today Will Be An Asterik When The History Of The Greatest Wealth Creation Period Ever Is Written In 20 Years

In an earlier post I titled “The Crypto Bubble Isn’t A Bubble It’s A…”, I put this Crypto moment in to perspective relative to where I believe Crypto is going to be in 20 years. This bubble, and eventual crash, will just be a blip when viewed in the context of the massive wealth creation to come from Crypto.

As I’ve written previously, Amara’s Law: We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run, is part of the reason we get bubbles.