Governor Andrew Cuomo of the State of New York declared last month that New York City will join 13 other states in testing self-driving cars: “Autonomous vehicles have the potential to save time and save lives, and we are proud to be working with GM and Cruise on the future of this exciting new technology.” For General Motors, this represents a major milestone in the development of its Cruise software, since the the knowledge gained on Manhattan’s busy streets will be invaluable in accelerating its deep learning technology. In the spirit of one-upmanship, Waymo went one step further by declaring this week that it will be the first car company in the world to ferry passengers completely autonomously (without human engineers safeguarding the wheel).

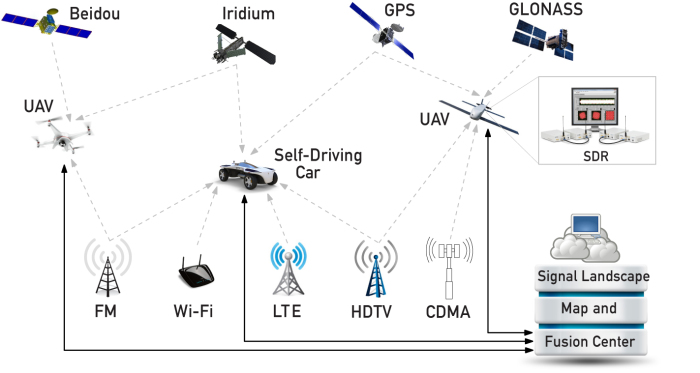

As unmanned systems are speeding ahead toward consumer adoption, one challenge that Cruise, Waymo and others may counter within the busy canyons of urban centers is the loss of Global Positioning System (GPS) satellite data. Robots require a complex suite of coordinating data systems that bounce between orbiting satellites to provide positioning and communication links to accurately navigate our world. The only thing that is certain as competing technologies and standards wrestle in this nascent marketplace for adoption is the critical connection between Earth and space. Based upon the estimated growth of autonomous systems on the road, in the workplace and home in the next ten years, most unmanned systems rely heavily on the ability of commercial space providers to fulfill their boastful mission plans to launch thousands of new satellites into an already crowded lower earth orbit.

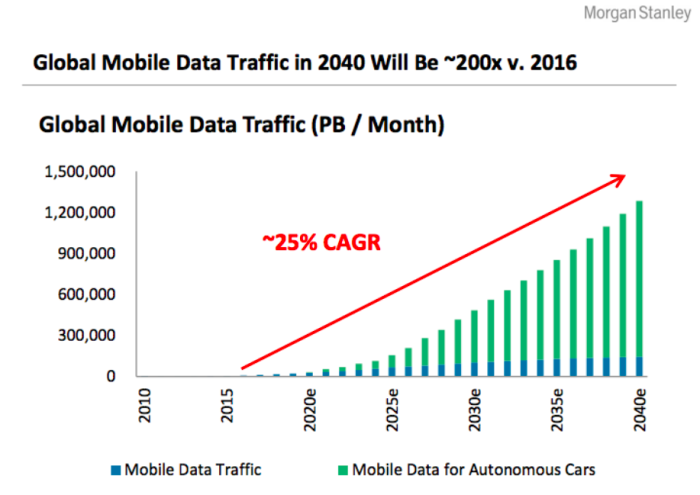

As shown by the chart below, the entry of autonomous systems will drive an explosion of data communications between terrestrial machines and space, leading to tens of thousands of new rocket launches over the next two decades. In a study done by Northern Sky Research (NSR) it projected that by 2023 there will be an estimated 5.8 million satellite Machine-to-Machine (M2M) and Internet Of Things (IOT) connections to approximately 50 billion global Internet-connected devices. In order to meet this demand, satellite providers are racing to the launch pads and raising billions in capital, even before firing up the rockets. As an example, OneWeb, which has raised more than $1.5 billion from Softbank, Qualcomm and Airbus, plans to launch its first 10 satellite constellations in 2018 which will eventually grow to 650 in the next decade. OneWeb competes with Space X, Boeing, Immarsat, Iridium, and others in deploying new satellites offering high-speed communication spectrums, such as Ku Band (12 GHz Wireless), K Band (18 GHz – 27 GHz), Ka Band (27 GHz – 40 GHz) and V Band (40 GHz – 75 GHz). The opening of new higher frequency spectrums is critical to support the explosion of increased data demands. Today there are more than 250 million cars on the road in the United States and in the future these cars will connect to the Internet, transmitting 200 million lines of code or 50 billion pings of data to safely and reliably transport passengers to their destinations everyday.

Satellites already provide millions of GPS coordinates for connected systems. However, the accuracy of GPS has been off by as many as 5 meters, which in a fully autonomous world could mean the difference between life and death. Chip manufacturer Broadcom aims to reduce the error margin to 30 centimeters. According to a press release this summer, Broadcom’s technology works better in concrete canyons like New York which have plagued Uber drivers for years with wrong fare destinations. Using new L5 satellite signals the chips are able to calculate receptions between points at a fast rate with lower power consumption (see diagram). Manuel del Castillo of Broadcom explained, “Up to now there haven’t been enough L5 satellites in orbit.” Currently there are approximately 30 L5 satellites in orbit. However, del Castillo suggests that could be enough to begin shipping the new chip next year, “[Even in a city’s] narrow window of sky you can see six or seven, which is pretty good. So now is the right moment to launch.”

AMG is not the only company focused on utilizing a wide breadth of data points to accurately steer robotic systems. Sandy Lobenstein, Vice President of Toyota Connected Services, explains that the Japanese car maker has been working with the antenna satellite company Kymeta to expand the data connectivity bandwidth in preparation for Toyota’s autonomous future. “We just announced a consortium with companies such as Intel and a few others to find ways to use edge computing and create standards around managing data flow in and out of vehicles with the cellphone industries or the hardware industries. Working with a company like Kymeta helps us find ways to use their technology to handle larger amounts of data and make use of large amounts of bandwidth that is available through satellite,” said Lobenstein.

In a world of fully autonomous vehicles the road of the next decade truly will become an information superhighway – with data streams flowing down from thousands of satellites to receiving towers littered across the horizon, bouncing between radio masts, antennas and cars (Vehicle to Vehicle [V2V] and Vehicle to Infrastructure [V2X] communications). Last week, Broadcom ratcheted up its autonomous vehicle business by announcing the largest tech-deal ever to acquire Qualcomm for $103 billion. The acquisition would enable Broadcom to dominate both aspects of autonomous communications that rely heavily on satellite uplinks, GPS and vehicle communications. Broadcom CEO Hock Tan said, “This complementary transaction will position the combined company as a global communications leader with an impressive portfolio of technologies and products.” Days earlier, Tan attend a White House press conference with President Trump boasting of plans to move Broadcom’s corporate office back to the United States, a very timely move as federal regulators will have to approve the Broadcom/Qualcomm merger.

The merger news comes months after Intel acquired Israeli computer vision company, Mobileye for $15 billion. In addition to Intel, Broadcom also competes with Nvidia which is leading the charge to enable artificial intelligence on the road. Last month, Nvidia CEO Jensen Huang predicted that “It will take no more than 4 years to have fully autonomous cars on the road. How long it takes for the vast majority of cars on the road to become that, it really just depends.” Nvidia, which traditionally has been a computer graphics chip company, has invested heavily in developing AI chips for automated systems. Huang shares his vision, “There are many tasks in companies that can be automated… the productivity of society will go up.”

Industry consolidation represents the current state of the autonomous car race as chip makers volley to own the next generation of wireless communications. Tomorrow’s 5G mobile networks promise a tenfold increase in data streams for phones, cars, drones, industrial robots and smart city infrastructure. Researchers estimate that the number of Internet-connected chips could grow from 12 million to 90 million by the end of this year; making connectivity as ubiquitous as gasoline for connected cars. Karl Ackerman, analyst at Cowen & Co., said it best, “[Broadcom] would basically own the majority of the high-end components in the smart phone market and they would have a very significant influence on 5G standards, which are paramount as you think about autonomous vehicles and connected factories.”