About four months ago, during a conference call I held with four crypto thought leaders, I saw the Crypto light. Some refer to the light as Decentralization. Others call it Blockchain. I refer to it as Crypto. The Crypto light is so shiny, so luminous, I can’t divert my eyes.

Over the last four months, I’ve met hundreds of amazing people who’ve also seen the Crypto light. But even with Bitcoin at $100 billion in market cap, the number of people who have seen the Crypto light is miniscule. According to this Cambridge University study, published in May, 2107, between 3–6 million people own cryptocurrency. And how many of them are true believers?

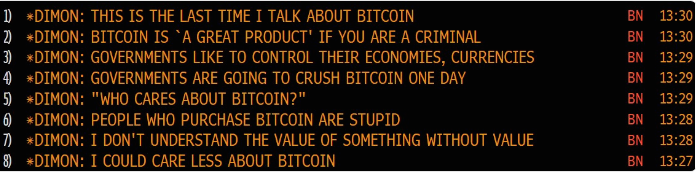

Crypto also has it’s blasphemous heathens on CNBC and the Bloomberg tape:

But I don’t wast mindshare on the haters. I continue to post on Medium, hold new Crypto conference calls, and hold Crypto Meetups, as my way to spread the Crypto gospel. I spend my time learning from, teaching, and helping, the Crypto converted. That’s the highest ROI for the Crypto community. I’m also spend time with the curious and the open minded. But everyone has to come to the Crypto light on their own path. I mean, how do you help someone appreciate that an algorithm is more trustworthy than their government?

So is Crypto a like a religion? Well, some of the words used to describe Crypto do have religious connotations. But, to me, Crypto is more like physics. The blockchain enables trust (if you don’t get that watch this compelling TED Talk by Bettina Warburg). And then Blockchain and cryptocurrency couple to enable Decentralization at a scale never previously imagined. So to me, Crypto isn’t a religion. Rather, Crypto is the strongly held belief that because of these technologies, there’s going to be massive disruption and wealth creation (greater than the Internet), and the world’s going to be a better place. If that belief system is a religion, then I’m a happy Crypto disciple.

2. When Will Crypto Go Mainstream?

The question I get asked the most is when is Crypto going mainstream? When will my parents, or wife, or friends stop thinking I’m an idiot for investing in tulips. Will they ever see the light?

That question makes me think of the Andy Samberg’s SNL video Lazy Sunday.

Even though YouTube was the 2nd or 3rd largest streamer of user uploaded content in December, 2005, it was still tiny. Then someone uploaded Lazy Sunday on to YouTube, and that day, YouTube became the fastest growing website in the history of the Inernet.

No one could have forecasted the impact of uploading Lazy Sunday on YouTube. It was lightning in a bottle. That’s the way these things generally happen. That’s the way it will happen with Crypto.

As a final note, I’ll mention that I was running the largest UGC streaming company in 2005 (Yashi) when YouTube blew by us. Five years later when Chad Hurley invited me to speak at a YouTube event, I couldn’t help myself. I laughed and told Chad that if Lazy Sunday had been uploaded on to Yashi, we would have been YouTube. Chad laughed, told me I was totally right, and then asked “But why would my brother have uploaded it to Yashi?”.

So the point is, it’s lightning in a bottle. but the harder we work, the smarter we worker, the more together we work, the likelier we are to capture that lightning and go mainstream.

3. Governance & Token Economics Are The Biggest Crypto Risks

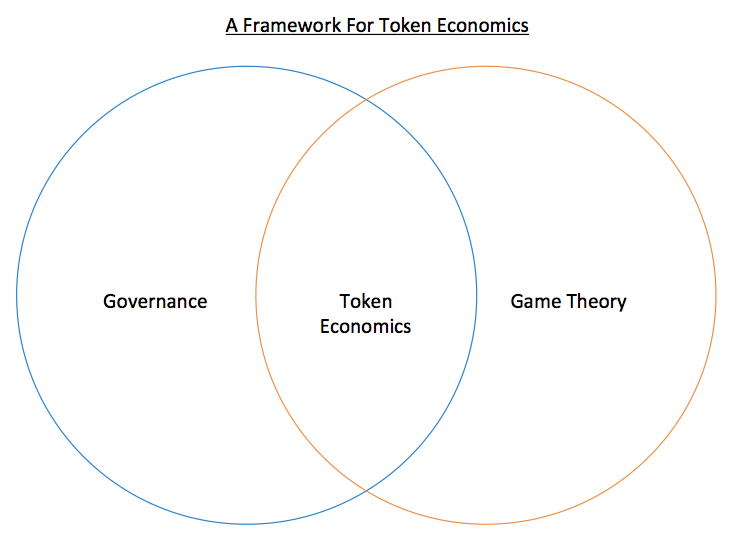

Two weeks ag I wrote that the biggest risk to cryptocurrency is governance. Whether it’s SegWit2x, or the unfolding governance caused Tezos disaster, governance is an entire discipline we need to get better at.

Bad token economics are also a major risk to cryptocurrency. It’s an area I’m diving deep in to at the moment. If your interested, join the NYC Token Economics Meetup. If your a token economics expert, or want help opening a Token Economics Meetup in your city, LMK via comments on this post.

Token economics and governance are also very related. Not sure if this captures it perfectly, but I like graphs that provide mental frameworks:

4. With Volatility Decreasing, Is It Time To Sunset HODL’ers?

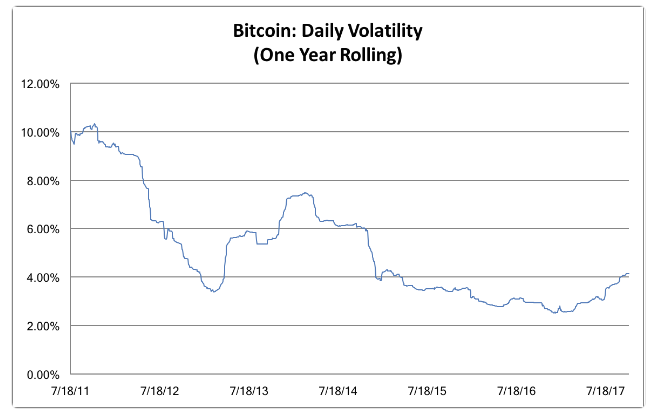

Chris Burniske posted a great graph on Twitter showing the long term decline in daily volatility of Bitcoin over the last six years:

While HODL’ing is a great term to describe how to deal with the gut wrenching volatility of Bitcoin, volatility has largely been decreasing for six years. In addition, HODL’ing has negative connotations that the those of us trying to move the industry forward should be trying to shed.

I’m not a branding guy, but I like “Fellow Traveler” to describe fellow crypto enthusiasts. We’re all going down this amazing path together, not knowing for sure exactly where it’s heading, but pretty confident it’s a better world. The term’s antecedent is from the Bolshevik revolutionary Trotsky who coined the term poputchik (‘one who travels the same path’) in the 20’s to identify the intellectual supporters of the Bolshevik régime. In the 40’s and 50’s in the U.S. it was a pejorative term for a person who was philosophically sympathetic to Communism. I’m going to use “Fellow Traveler” and see if it catches on. I’m also still working on FAMGA.

5. DAG’s Are A Thing

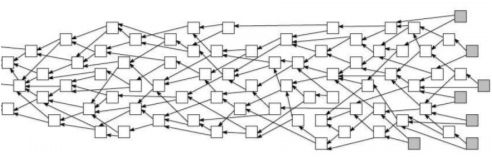

Back in the old days, around two weeks ago, I used to think that the serial nature of the blockchain was the key to it’s immutability. It turns out that blocks (i.e. information) don’t have to be serial (in a chain). In fact, they don’t even need to be blocks. And that being serial, by definition, slows down the speed of the network. Hence the opportunity for DAGs.

DAG stands for “Distributed Acrylic Graph” with a block structure that can look like this:

The most famous DAG is Tangle, the DAG structure underlying IOTA, a $1.2 billion market cap cryptocurrency establishing a machine-to-machine micropayment system. It’s early days for DAGs, and crypto message boards are filled with haters, but based on multiple conversations I had this week with entities at the forefront of DAGs, I’m pretty sure they’re a thing.

6. Videos of The Week

Last week I wrote about the awesome Credit Suisse Crypto Sympsoium. You can see a video of A16Z’s crypto expert, Balaji Srinivasan’s data filled opening keynote here.

7. Tweet of the Week

Whenever anyone asks me if it’s too late to get in to Bitcoin, I’ll just share this tweet from 2011: