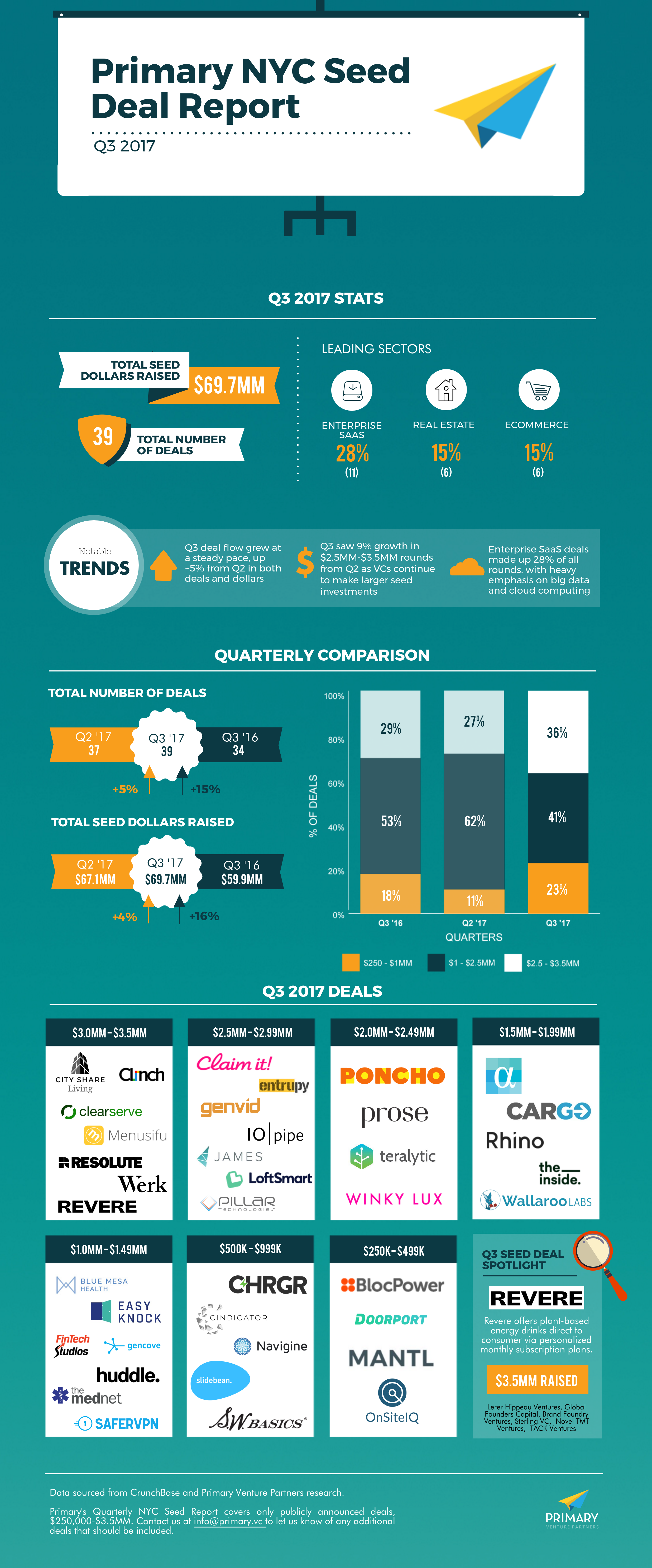

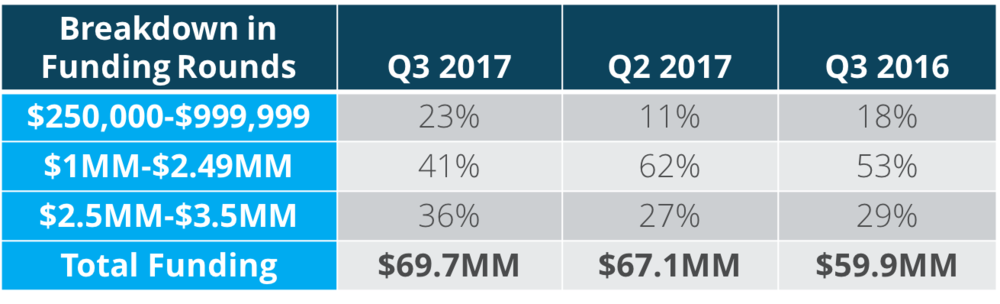

We’re on a roll now! Initial Q3 data shows modest but steady growth in seed deals in NYC, both in completed deals and dollars raised. To date, 39 deals have been reported, up 5% from this time last quarter and 15% from Q3 last year. These deals raked in a total of $69.7MM in funding, which is up 4% from Q2 and 16% from Q3 2016.

Average round size continues to hover around $1.8MM, but investors continue to show favor toward larger round sizes. In Q3, 36% of deals fell into the $2.5MM-$3.5MM bucket, up almost 10% from last quarter. The quarter also saw an uptick in smaller rounds – $250K-$1MM – perhaps a sign of renewed confidence in the ecosystem as investors take pre-seed bets on promising companies. And thanks to a record-breaking run of VC fundraising in the first half of the year ($19 billion, to be exact), capital investments should continue to stay apace well into next year.

INDUSTRIES TO WATCH

MIRROR, MIRROR ON THE WALL…

Beauty was one of the most active verticals in Q3. As disruption in CPG continues, and discovery increasingly shifts from offline retail to ecommerce, emerging brands have broader opportunity to build direct relationships with consumers. This quarter saw new rounds for AI-powered Prose, which aims to change the way consumers purchase beauty products, as well as Winky Lux and S.W. Basics, which seek to differentiate themselves on the quality of their ingredients and efficacy of their products.

GOING AU NATURALE

Product innovation continues to shift toward all natural ingredients. In Q3, brands seeking to attract a loyal following among the ecologically minded included S.W. Basics, which prides itself on cosmetics made of simple, whole ingredients, as well as Revere, which offers plant-based energy drinks direct to consumers. The company raised the largest seed round of the quarter, having secured financing from Lerer Hippeau Ventures, Global Founders Capital, Brand Foundry Ventures, Sterling.VC, Novel TMT Ventures, and TACK Ventures.

MAKE YOURSELF A HOME IN NYC

New York continues to be a hotbed of real estate disruption, given the density of lenders, investors, developers, and landlords. In Q3, 15% of deals were real estate-focused, with emerging startups focused on everything from the search layer (LoftSmart) through products that reduce friction between renters/landlords (Rhino) and residential buyers/sellers (Easyknock, Doorport).

BUILDING MORE WITH BIG DATA

The intersection of hardware and software continues to permeate industrial sectors as real-time data allows for better decision management, while improving workplace safety and minimizing downstream costs. Q3 saw financings for agriculture tech company Teralytic, which monitors soil health to improve farm yield; Pillar Technologies, a risk management platform for general contractors; and Navigine, a high-accuracy platform for indoor navigation and tracking.