Angels and VCs are not trying to be Fortune Tellers who can predict the future, as much as we want to. Our immediate goal after investing in your seed round is that you get to your next round by hitting your numbers/projections in around a year so. With momentum behind you, you can then spend the next 3–6 months raising your next round with money still in the bank (so 18 months in total). This is where the term “runway” comes from — how much time do you have before you run out of money.

As I wrote about in my last post, we invest in founders first. We invest in founders that we believe can execute, hit or exceed their expectations and projections… why? So they can raise their next round!

We all know the odds that roughly 2% of startups will get angel/seed funding (VCs only invest in 1% of the companies they see). Based on that, we need to be really picky, which is why we always say hope for the best, plan for the worst.

Our goal at the seed stage is to help you get to the next round and strengthen your startup runway. By raising your next round, you have bought another 12–18 months of time, along with some new connections, credibility and added pressure to grow. Startups are all about momentum — have you figured something out or are really close, that a few million dollars and some added time will ensure you get there.

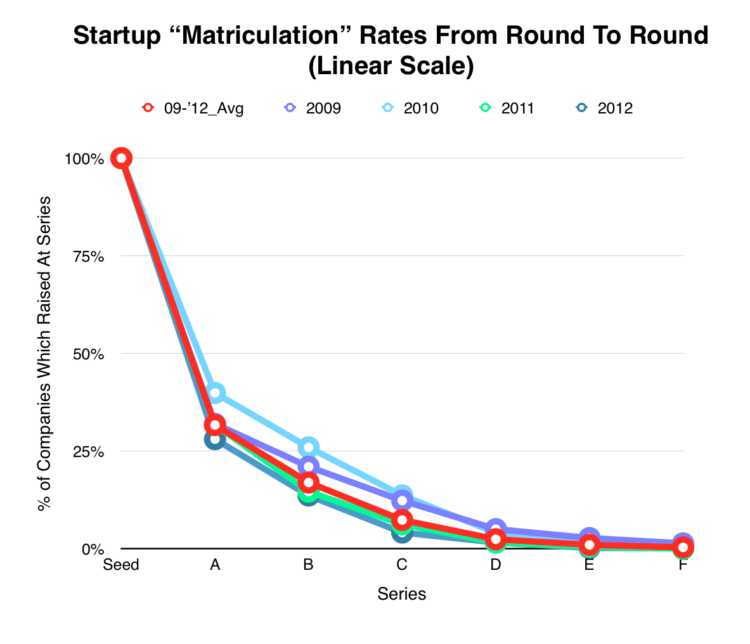

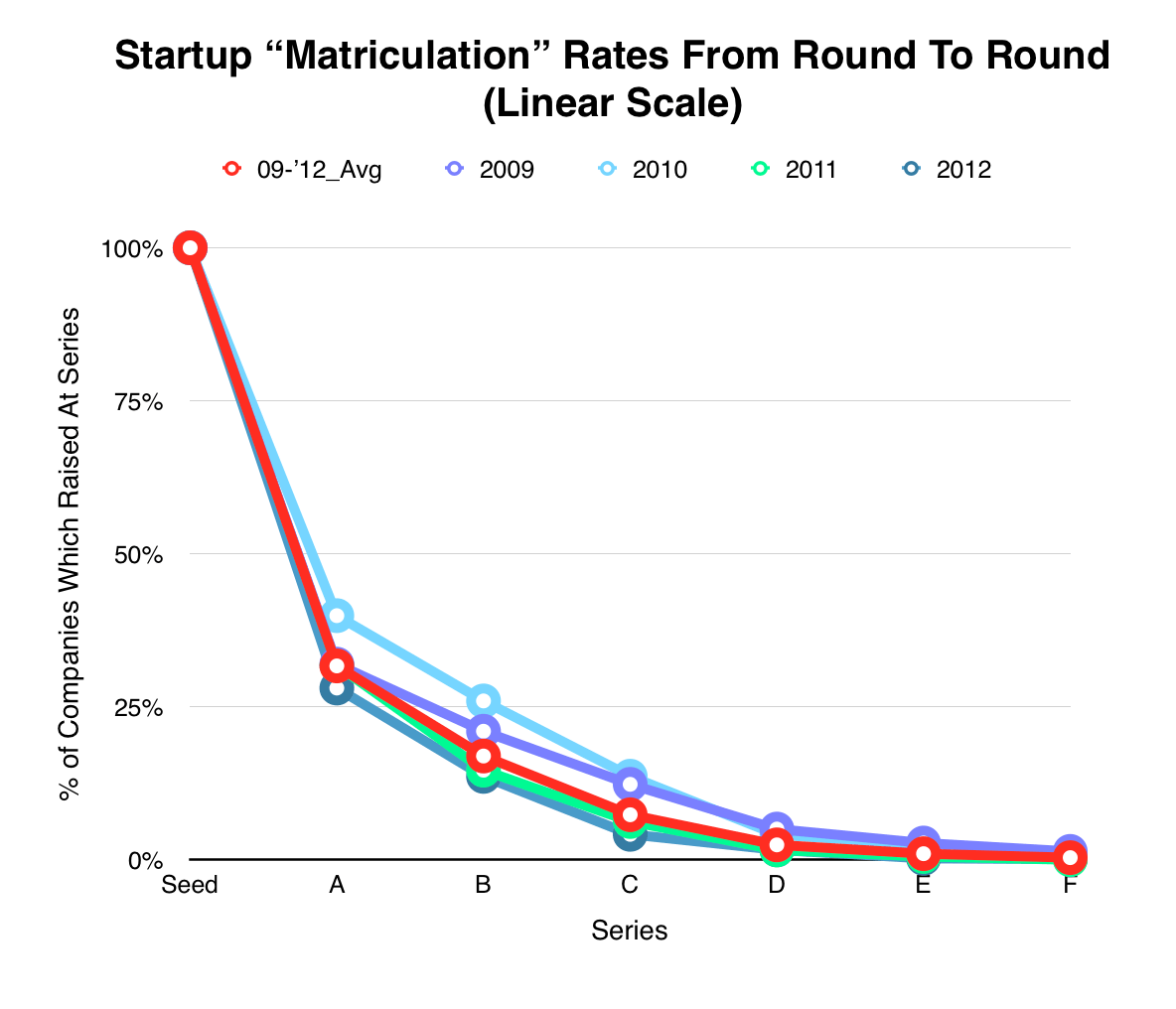

Here is a great chart from Mattermark showing the huge drop-off from every round and your odds of making it to the next round. Things haven’t really changed much over the years based on this also outdated CB Insights chart that shows the same thing in a different way. Ironically it’s really hard to quantify all of this precisely because most of it never gets reported on or announced and most companies just fade awa

I can continue to bore you and be a rational pessimist, which is easy to do but I’d rather focus on the questions we ask ourselves when we meet you:

- Can these founders close this round and subsequent ones?

- Does the market broadly need this product and will they get their adoption in a year to show enough traction and interest?

- Is the founding team enough / can this round help your hire the right people, to build and sell this product?

- Is this a trend or hype that will go away in a year when everyone comes back to reality?

- Will people actually pay for this? Most early surveys you do are friends and family who generally tell you what you want to hear

- You have a lot of interest, pilots, LOI etc. but can you convert them and how long is the sales cycle?

- Are you raising enough money? We sometimes encourage startups to add an additional 10% of what they think they need as everything always takes longer than they think

- If it does take longer, when and how much more money will you need? Will it be a bridge to a Series A or nowhere?

- Will making money get in the way? This is a tough one… yes having revenue is great but if and when you miss your projections, you’ll only hurt your momentum and chances of raising more money

- If you succeed at building the early business, do enough people care? We see so many startups raise capital and become nice lifestyle businesses but not acquirable ones

- Other competitors are raising capital right now, so does that prove there is a need or are you too late to the game?

- What metrics do you need to hit in order to get your next round? VCs usually have benchmarks for what they will invest in

- How much help will you need raising your next round? Some founders have a gift for raising money, whiles others are really bad at it

In life, time is one of your most precious resources, so whether you raised $500k or $500M, it is always against you. In the game of startups, capital only cheats time until it catches up to you; so don’t get comfortable or complacent. Hopefully that wasn’t too deep and professorial but you get my point.