Private equity and venture capital investors are copying our sisters in the hedge fund and mutual fund world: we’re trying to automate more of our job. But we’re doing it slowly.

VCs tout themselves as frontier technology investors, but most are using the same infrastructure tools they have used for the past 20+ years: Excel and recent college grads searching Google. We’ve seen some modest progress in people upgrading from Excel to Google Sheets; use of some CRM; and a cloud-based storage service. But beyond that, not much. According to Knowledge.VC, under 5% of US VCs have a full-time team member focused on technology.

My colleagues Sebastian Soler, Steven Greenberg and I recently launched a new online community, PEVCTech.com, exclusively for PE/VC investors; engineers who work at PE/VC funds; and other technologists who specialize in working on this problem. PEVCTech is partnering with Blue Future Partners to run the first large-scale survey of VCs’ technology stack. You can register for the survey here. Funds which fill out the survey will get access to the detailed results of what technology their peers are using. Five randomly chosen respondents will also win a $100 American Express shopping vouchers.

Johann Kratzer of Blue Future Partners, a fund of funds, observed, “The majority of the hundreds of funds we’ve diligenced rely predominantly on their relationships to source deals. However, about 5% of the VCs in our database, mostly younger ones, are trying to build a competitive advantage by crawling large amounts of publicly available data and building analytical functions to flag companies with accelerating traction to them. We cannot wait to see how (and if) the use of technology correlates with financial returns for VC firms.”

Historically, investing was a manual, artisan process. An investor had few hard metrics other than the actual financials, and little technology to make the process scaleable. Over the past few decades, better metrics became available, and investors could take a more analytical, data-driven approach. The extreme example of this are algorithmic investors in the public markets, who design algorithms which trade on the designer’s behalf, as opposed to making trading decisions directly. High-frequency trading, algorithmic by its nature, is estimated to account for at least 50% of US equity markets trading volume.

Quantitative, technology-enabled investing in private companies makes sense, but is structurally very difficult, and will become a more common strategy at a much slower rate. The private markets are more opaque; they offer less of the hard data critical to a true quant approach. In venture capital in particular, early-stage companies are often operating in frontier industries, where the rules are unpredictable and conventional analytic frameworks may be misleading. For brand new companies, inherently there is little data available on the corporation, and also typically little data on the efficacy of the newly composed team as a group. Even for later-stage companies with predictable financials, the lack of liquidity, audited financials, and standardized metrics creates real challenges to scaling quantitative investing. However, there is a lot of room to use technology to make the actual investing process more efficient.

Why is it now more feasible to use technology in the VC investing process? Sebastian Soler, CEO of Knowledge.VC, observes, “Structured, accurate and accessible data never really existed before for the private markets, at scale. Advances in machine learning, specifically natural language processing, have made generating these baseline, aggregate datasets possible, at scale, with high accuracy. Sources like Crunchbase, Angel List, and Seed Invest even give this data away for free or very low cost. The only problem that faces startup investors now is how to mine this new data layer efficiently to increase returns.”

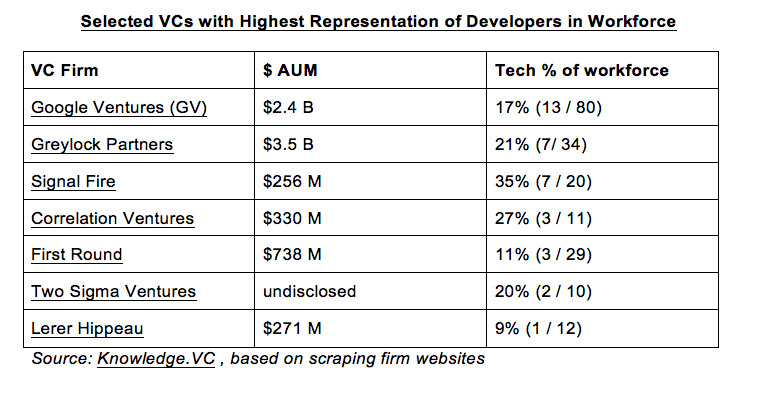

Among the VC firms which have publicly invested the most resources in their technology stack are Andreessen Horowitz, Correlation Ventures, First Round Capital, Google Ventures, Greylock Partners, Ironstone Group, Kleiner Perkins, Lux Capital, Right Side Capital, Signalfire, Ulu Ventures, Union Square Ventures, and Venture Science. Knowledge.VC produced this analysis of engineering representation within VC firms:

I’ve primarily seen quantitative analytic techniques used in origination, filtering, and in portfolio company recruiting, but technology can be used throughout the nine steps of the private company investing process:

The 9 Steps of the Private Company Investing Process

1) Market fund

Many tools designed for B2B marketing in general are also relevant to investors. We know of funds using Constant Contact, Goodbits, MailChimp, Pardot and Publicate to create light newsletters for internal and external consumption. A major angel group used Influitive, an advocate management tool, to track, activate and motivate their members. Other VCs use Klout* to identify relevant influencers who can evangelize their ideas and Contently* or Social Native (HOF Capital company) to create relevant content. Meyler Capital is taking the analytical rigor of modern internet marketing and applying it to fund marketing.

2) Raise capital

The historic capital-raising process is driven by face-to-face networking and salesmanship. A more efficient approach is to mine the data exhaust from the Limited Partner universe to identify those LPs most likely to find your fund attractive, and focus all your energy on them. I previously posted a detailed presentation with sales technology tools useful for B2B sales.

We are heavy users of DocSend, a secure content sharing and tracking platform that can be used to seamlessly share recurring materials with potential LPs. It provides analytics to track shared materials across target senders, and improve the content for future leads.

Most Funds open data rooms to share previous reports, performance data, pitch decks, legal docs and other fundraising material with LPs. We’ve seen Funds using AltaReturn, Box, CapLinked, dfsco, Dropbox, Digify, Drooms, Google Drive, iDeals, Intralinks, Ipreo, Merrill Corporation, SecureDocs for their Virtual Data Rooms. These same tools are used by companies raising capital.

Some funds are using intermediaries to help them sell to retail LPs (Artivest, iCapital Network). HOF Capital has experimented with using services for targeting institutional LPs (e.g., CEPRES, Drooms Dealflow, Harvest Exchange, Palico, Trusted Insight). We make a point of keeping our records updated in the major data-trackers tracking the VC industry, e.g., CB Insights, Crunchbase, Dow Jones, Mattermark, Palico, Preqin, Pitchbook, and ThomsonReuters, since they are a source of data to LPs and to potential co-investors interested in us.

Relationship Science makes it easier to understand and map social networks into potential limited partners. Cobalt helps GPs to optimize their fundraising strategy. MandateWire and FinSearches provide leads on limited partners with new mandates which might fit your fund. Evestment is a platform for capital-raisers; Evestment TopQ automates private markets performance calculation.

On the other side of the table: FundAmerica, iDisclose, RegisteredTransferAgent, VStock Transfer, and Wealthforge helps companies (as well as funds) who are crowdfunding manage the process in a legally compliant way. Pitchbot.vc is an AI bot which helps companies refine their sales pitch to VCs. Signal is a fundraising tool for founders run by NFX Guild, which identifies the most relevant VCs for you.

3) Originate investments

Chris Dixon, Partner, A16Z, observes, “Success in VC is probably 10% about picking, and 90% about sourcing the right deals and having entrepreneurs choose your firm as a partner”.

One VC said, “I’m a heavy user of Streak which is a CRM that lives in your Gmail and allows you to create contact pipelines, snooze / track e-mails, save snippets, etc. For networking I’ve started using Clearbit and Hunter to verify e-mails, and have Dux-Soup plugged into my LinkedIn to streamline some of the sourcing processes.” I personally use Feedly to track information sources and share them internally.

For both origination and due diligence, a host of companies aspire to be the “Bloomberg of private companies”, including CB Insights, Crunchbase, DataFox, FuelUp, fundsUP, Mattermark, Qodeo, Quid, Tracxn, Unomy.com, and Zirra. A number of analysts have particular focus on serving the customers of technology companies, e.g., Gartner and 451 Research. Similar companies more focused on later-stage investors include Avention, Bureau Van Dijk, Dow Jones, FactSet, Genesis, S&P S&P Global Market Intelligence, DueDil, Core 2 Group, D&B Hoovers, InsideView, LexisNexis, Pitchbook, Preqin, PrivCo, Thomson Reuters, and Unquote. Coalesce address the more general problem of searching through large data sets for best fits.

HOF Capital is currently developing a proprietary sourcing tool to automatically filter for potential deal prospects that fit our criteria. We started with a large data set, and are building algorithms on top of that to filter our data set. Examples of characteristics we look for include whether the founders of a company previously worked at a successful tech company; whether a company has a certain number of PhDs on the team; and/or if team members studied at a tier 1 university. We plan on setting certain triggers and identifiers for our sourcing tool and testing this over the next few quarters to be able to leverage this tool, and automate prospecting attractive opportunities.

Early stage investors are also mining product crowdfunding sites (Indiegogo*); lists of product launches (Producthunt); angel group platforms (Gust, Proseeder); and equity crowdfunding sites (AngelList, CircleUp, FundersClub, OurCrowd, SeedInvest) for leads. Later stage investors are using private company marketplace services focused on more established companies, listed below under “Exit Investments”.

DealSheet and Sutton Place Strategies help private equity funds identify the best-positioned intermediaries (investment banks) for their sector.

Sebastian Soler recently launched Knowledge.vc, which uses software and machine learning to enhance deal sourcing and diligence for VC firms.

4) Manage deal flow

Hilary Mason, Data Scientist in Residence at Accel Partners, has a TED talk on how she replaces herself with a shell script to handle her email deluge. She is a model for us all!

HOF Capital has stitched together our workflow across Google Suite, Slack, Airtable, Asana, Streak, and some other tools (leveraging Zapier for basic 3rd party integration, in addition to custom development for certain other integrations).

For example, we created a pipeline management tool that automatically adds deals along with relevant information (such as attachments received) to our funnel. This tool serves to standardize & automate the process of collecting inbound deal flow. It seamlessly creates a deal folder (company name) in our Google Drive, and notifies us that a new deal has entered the pipeline via Slack. Furthermore, on Streak (our deal board), a due date of two business days is automatically set for us to review the opportunity.

Custom CRM solutions for PE/VC funds are offered by Altvia, Backstop Solutions, DealCloud, EquityTouch, SalesLogistix, Satuit, Sevanta Dealflow, Navatar, Salesforce, SalesforceIQ, and Touchstone. Numerous VC funds rely on more general CRM and sales funnel solutions like Pipedrive and Streak. Some VCs are using Ebsta, FullContact and Hubspot to support their CRMs. Talent Relationship Management tools (e.g., Thrive) also are relevant.

5) Due diligence

HOF Capital uses some of the data-tracking services I list above for analyzing competitors and funding trends. I’ve also used research vendors such as AskWonder* and Earnest Research*. To measure product usage and traction over time, we use tools like Alexa, AppAnnie and Google Analytics. To quantify consumer trends and market opportunities, useful tools for “top down” assessments include IBIS World and eMarketer. For more rigorous, bottoms-up sizing exercises we use tools such as Statista and the United States Census Bureau (also their North American Industry Classification System database) to help identify more specific data.

The majority of funds are using the popular B2C websites and services for basic due diligence, e.g., Linkedin, Twitter, HackerNews. Some VCs are using automated tools to assess companies’ stacks, e.g., Builtwith provides insights into how a website was built.

6) Negotiate deal

We gain insight into the management style of portfolio company management by assessing their social media activities and digital exhaust, e.g., I use Fullcontact as my “chief of staff” to brief me on the interests and backgrounds of the people I meet. Accompany focuses on this use case. The Pocket Negotiator is very early-stage attempt to aid in the negotiating process itself.

For negotiating a contract, we’re looking at Aduin Transactions, IroncladApp, SpringCM, Concord, ContractRoom, Dolphin Contract Manager, and Juro, and SRS Acquiom. Contract Logix helps to generate contracts with preapproved terms. Agiloft, ContractSafe and Contractworks help in managing your set of executed contracts. DocuSign is steadily reducing the need for paper signatures, and is a more streamlined method for communicating contract changes in a secure manner. For the broader use case of helping startups execute their legal paperwork, Clerky is a focused solution.

7) Monitor and report investments

Melissa Craig of Fintech Ecosystem observes, “LPs want to know and have a right to know, in near real time, how each company in the fund is performing. But, GPs are overwhelmed by investor requests because they don’t have the technology that makes transparency possible. All the outputs that investors want are in the monthly financial data that funds collect, normalize, analyze and report. Yet, according to my own surveys, a majority of private capital funds (including funds that specialize in fintech!) still perform the repetitive functions of data collection and investor reporting manually.”

Jaime Hildreth, Managing Director of GP and LP Strategies at Ipreo, informed us that 97% of Ipreo’s GP clients report that data requests from LP’s have increased over the past two years. Close to 80% responded that manual processes, such as tracking down support, preparing reports and pulling data from different sources, are the biggest pain points they face in the valuation process. Satisfying LP demands and streamlining the valuation process are primary drivers in those clients’ adoption of Ipreo’s portfolio monitoring and valuation solutions, iLEVEL, iVAL, and Qval.

Kushim, Totem, and VisibleVC focus on serving this need among VCs. EShares is an increasingly popular tool in our portfolio for tracking private company cap tables. Many PE and VC firms use AltaReturn, eFront, or Sungard Investran for their fund accounting. ComputerShare provides financial administration for private and public companies.

Other players include BaseVenture, Burgiss, Davigold, DocDep, eFront FrontInvest, Framework, Investors Economic Assurance CapAssure, Netage Dynamo PE, Q-Biz Solutions, Qualtrics, SS&C GlobeOp, and Vantage Software. Advise Technologies focuses on regulatory reporting.

8) Accelerate portfolio company value

Many portfolio acceleration VCs work to evangelize modern analytical tools to our portfolio companies, particularly to improve their board management, research into new business ideas, sales, recruiting, and financial management. FounderSuite* helps early-stage companies in their fundraising process.

I’m particularly interested in how companies like Flight.VC are using AngelMob.co to motivate their angel community to support their startups. I also am excited to see how vendors like Stackshare and Stacklist are helping founders identify the right tech tools for their business.

Foundry Group is using their portfolio company Monday to aggregate portfolio companies’ job postings on their own jobs page.

Most of our companies will need to raise further rounds. We use the vendors of PE/VC investing data I list above to track the interests of potential private equity/VC coinvestors, and selectively introduce our companies as I build out a syndicate.

9) Time, market, and exit investment

ExitRound helps early stage companies identify buyers. A range of companies are working to make the M&A process more transparent and less haphazard for later-stage companies, including Axial, BankerBay, CapMarket, Intralinks Deal Nexus, MergerMarket. EquityZen, SharesPost, and ZenPrivEx help employees and investors liquidate their positions in late-stage companies. Fortis manages the post-closing process on behalf of selling shareholders in private M&A transactions. MeltingPointSolutions is an online market for secondaries in alternative assets.

The most visible evidence of the trend towards automation is an increasing number of engineers working at venture capital and private equity funds. Over the past few years, ff Venture Capital hired two full-time engineers to build out its internal technology stack, called Totem. Totem is an operating system that makes investors smarter by helping them leverage their knowledge, relationships & insights. ffVC Partners kept going into meetings and showing other VCs the app on their phone, and hearing, “I could really use that—that’s like having an Analyst in your pocket.” As of the beginning of 2017, ffVC spun out Totem into a separate business.

Stereotypically, venture capitalists are viewed as less numerically focused than private equity investors. With regard to analyzing a given company’s financial model, that is a reasonable stereotype, given that VCs do not typically use financial leverage and financial forecasts of early-stage companies have a very high uncertainty rate. That said, I’d suggest the VC industry is more advanced than private equity in using technology in many other steps in the overall investing process, given the technology savvy of VCs, the transparency of many companies in the technology industry, and the relative receptivity of our limited partners to trying new ideas.

In private equity, the investors most proactively trying to use quantitative techniques are primarily sector specialists. According to one study, sector specialists regularly outperform generalist funds, returning an aggregate 2.2x Multiple on Invested Capital versus 1.9x MOIC. Sector specialists have always subconsciously correlated certain factors as drivers for future growth, but this knowledge is now being distilled into quantitative analysis.

Mariya Osadchaya-Isa, Principal, Speedinvest, who worked previously at a sector-focused private equity fund, observes, “Sector funds, because of their ability to mine sufficiently targeted data, are working backwards to identify key correlations between different KPIs — including more unusual ones like positive PR releases to more basic fundamental analysis — that drive value at exit. This information is used to automate screening during origination. Automated screening ensures a higher quality deal pipeline that isn’t as prone to performance drags like mission creep and personal bias. Sector funds lend themselves well to doing this because it’s easier to quantify the characteristics which drive value on a sector basis, e.g., if you focus on SaaS companies you can identify annual change of >10% in recurring revenues as an indicator of future stability of revenues. This kind of ability to build a multivariate analysis suitable to be deployed on a company by company basis is not suited for generalist funds, unless they have sector strategies nestled underneath a generalist umbrella.”

Quantitative analysis by private equity funds is still largely restricted to early stage screening during the origination process. However, there is an increasing interest in adding more refined quantitative analysis to other stages of the investment process. For example, some private equity funds are quantifying their exit strategy in a concerted way. They are tracking information available on Pitchbook, Bloomberg M&A, and other similar sources to conduct factor analysis in order to identify a series of factors that would kick-off the exit process. According to Ms. Osadchaya-Isa, one fund she has a relationship with, “tracks the available private company data for same sector companies and the relevant exit data and use basic correlation analysis to identify moments of the largest possible multiple expansion. This process is very similar to what a growing number of PE houses are doing during origination, so I feel it’s a natural extension of their capabilities to do this in order to more effectively time the exit. This also can be a valuable tool for increasing fund transparency and communicating with LPs.”

One global institutional investor is investigating setting up a large-scale co-investment vehicle, similar to Correlation Ventures, but focused on private equity transactions. They are looking at doing this as an exclusive partnership with one of the leaders in the private company analytics and investing space. Their intent is to enable any private company investor leading a transaction to click a button, see a short list of criteria, and then quickly obtain additional co-investment capital to close the transaction.

At HOF Capital, our long-term vision is to build an end-to-end technology platform which automates every possible step that can reasonably be automated. We have a long way to go!

Please fill out our survey of the tech stacks of VC firms here.

I have embedded below the deck from a recent Nexchange event on how PE and VC investors are using fintech in their investing process, co-organized with PEVCTech.com and some other partners.

* ff Venture Capital portfolio company

Special thanks for their comments to Blue Future Partners, Karim Fattal, Steven Greenberg; Clay Hunt, Andrew Kangpan; David Levine; Mariya Osadchaya-Isa; Sebastian Soler; Andrew Sudol; Jim Tousignant, CEO, FinTech Studios; Franklin Tsung; various anonymous friends; and to Farah I. of ffVC portfolio company AskWonder.