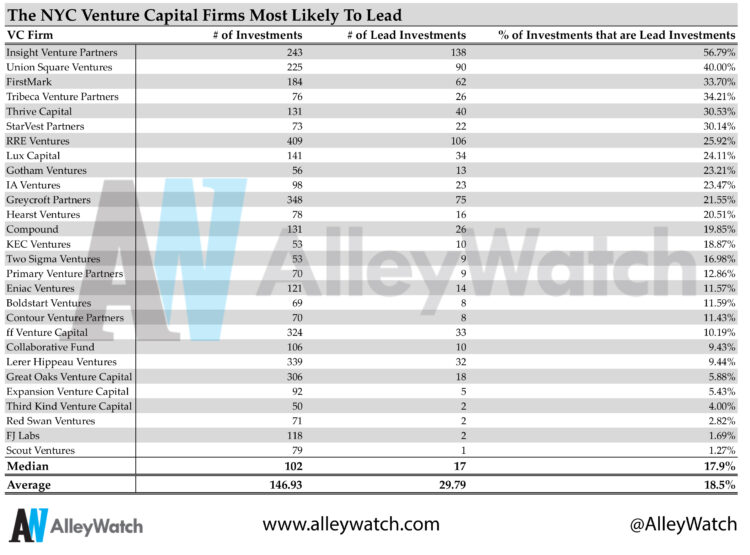

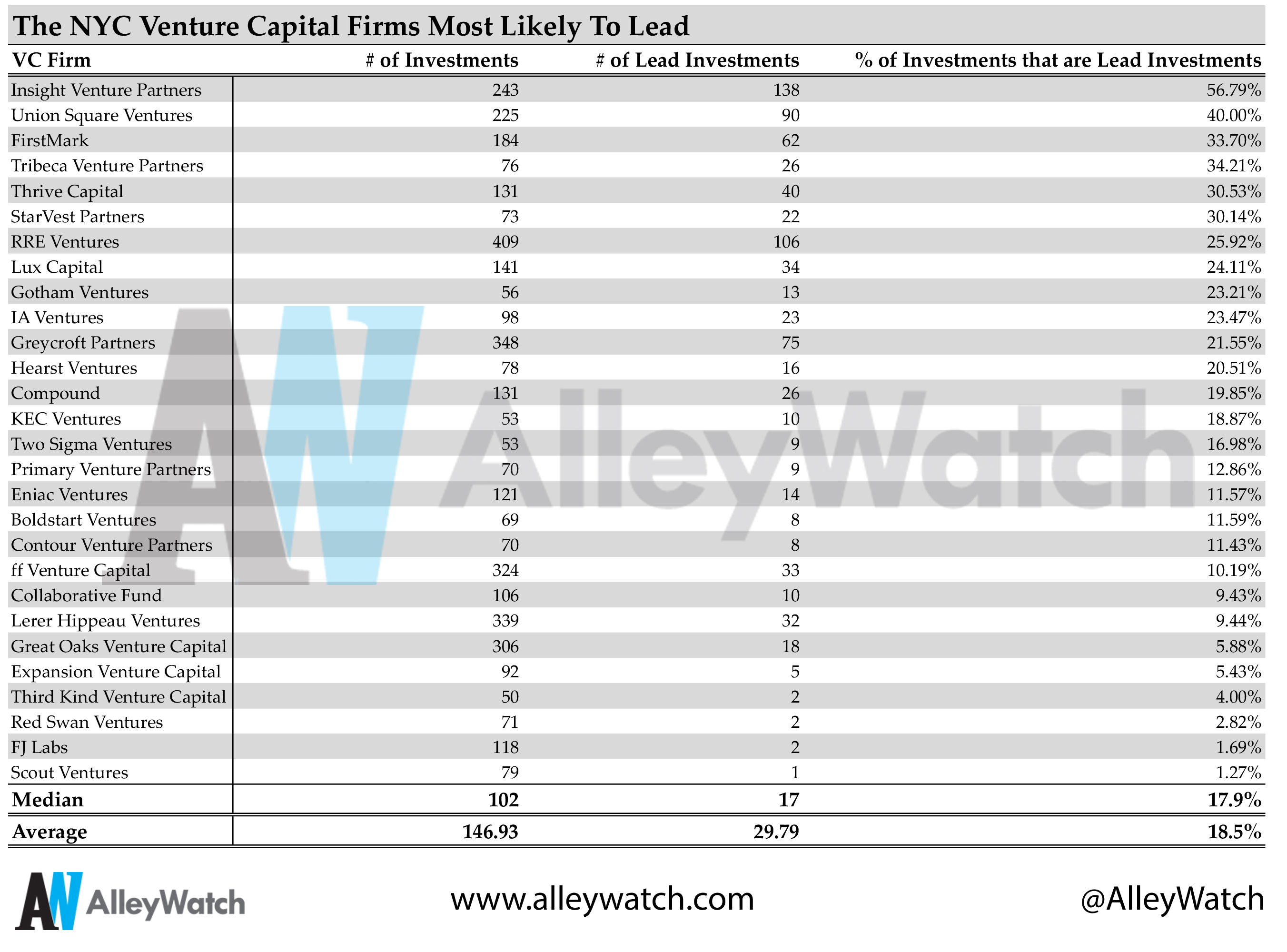

Entrepreneurs seeking funding are able to tilt their chances for funding in their favor when they are able to attract a good caliber lead investor. This signals validation to other potential investors and can introduce a sense of urgency. Today, I take a look at the rate at which a number of New York-based venture capital firms lead funding rounds using some data from our friends at Crunchbase.

While examining the data, it is important to keep the following in mind as these factors do have an impact on the data:.

- Only venture capital firms that are headquartered in NYC were considered.

- This data does not include angel nor accelerator investments.

- Only venture firms that have made 50+ investments were considered.

- Not all investments are reported; similarly not all lead investments are reported.

- The data does not take into account the stage preferences for the venture firms.

- To maintain a focus on tech-enabled startups, energy and healthcare-focused venture funds were not considered. Growth capital and private equity firms are also excluded.

- Only venture firms that are active were considered; meaning that the venture firm has made at least one investment in 2017.

- The data is current of 7/16/17.