Life is short, and it’s often not worth taking a chance on missing life’s most precious moments. If you are looking to safeguard these important moments, then SURE is for you. SURE, the company that has created episodic insurance, introduces instant mobile insurance that helps you insure a much needed vacation, your wedding, or just time with your pets. With insurtech quickly expanding, our ideas of what can be insured are growing as well, and SURE is in the front lines of changing how we insure. The company has partnered with Nationwide, CHUBB and MetLife to protect your memories and hopes to help you go through life with a few less worries on your mind.

AlleyWatch chatted with Wayne Slavin about the company and the process of securing their most recent round of funding.

Who were your investors and how much did you raise?

Our latest round was a Series A of $8 million. IA Capital led the round (arguably the smarted investors in insurtech). Menlo Ventures, FF Venture Capital, Nationwide Ventures, AmTrust, and Assurant participated as well.

Tell us about your product or service.

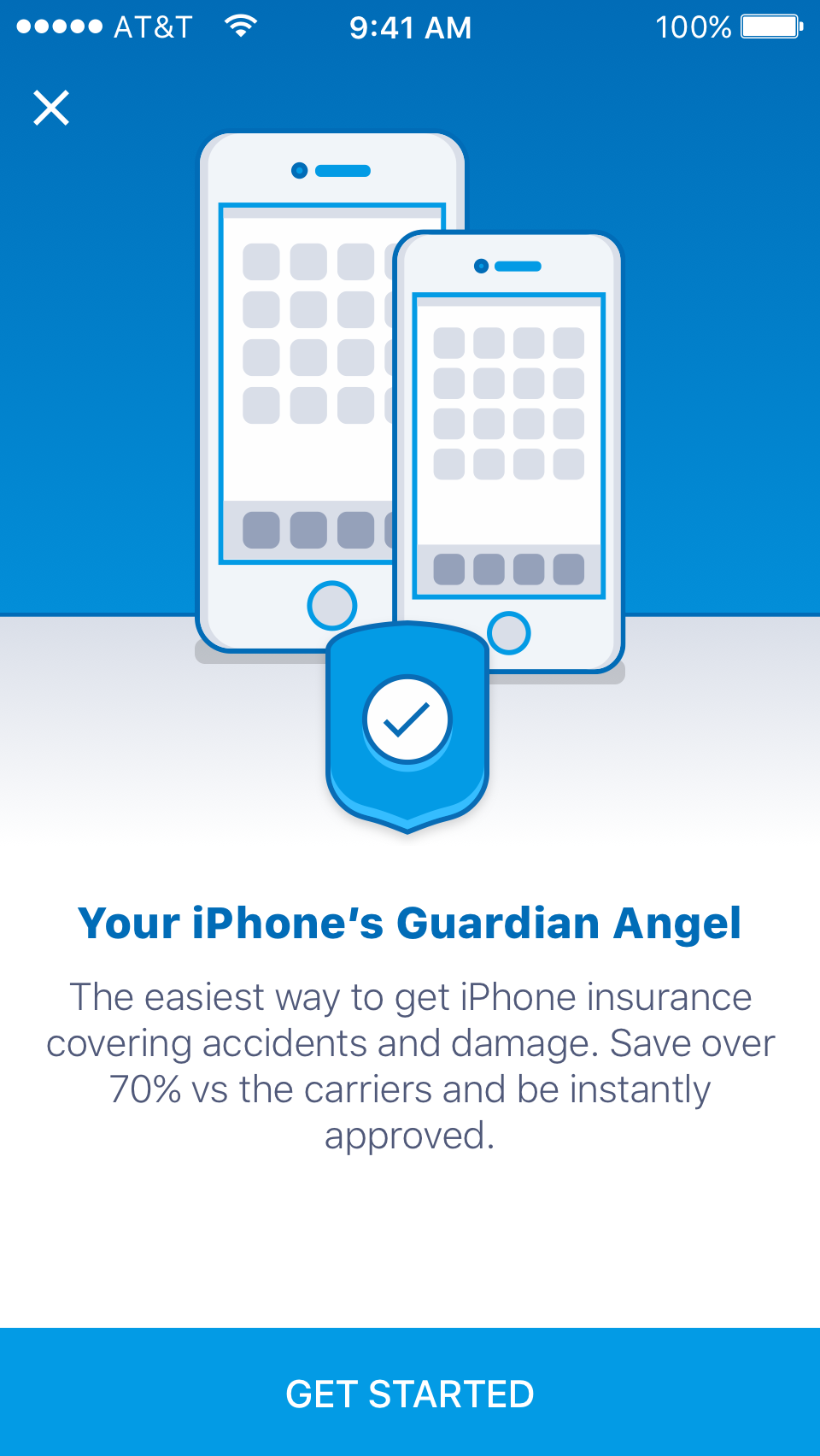

SURE is an insurtech platform that provides insurance to consumers when they need it most. We’re unlike most other disruptors in the space, we are modernizing the $5 trillion insurance industry by partnering with the world’s top insurance companies such as Nationwide and CHUBB to offer top-brand insurance policies to our customers and better technology to their customers.

Consumers are demanding faster and easier digital insurance options – from purchase through to claims. We make the insurance industry digital and ultimately stronger through using mobile tech, AI, and advanced data analytics.

What inspired you to start the company?

Our main inspiration was looking at one of the largest pain points in the insurance market: how insurance is distributed. The current system is one that has not seen much innovation. For example, the insurance broker network will soon see significant changes with 400K brokers expected to retire in the next five years. How will people purchase the right insurance for them when there are significantly less brokers in the market? Also, who wants to go to an insurance office anyway? We decided to build technology that partners with large insurance companies. We are taking a different approach to disrupting the industry, one that enabled the insurance industry. We are offering policies from trusted insurance companies with the customer experience that would be expected of a startup.

How is it different?

We differ from other insurtech providers by offering a variety of personal insurance options and by partnering with trusted insurance carriers like Nationwide. We currently offer six different types of personal insurance categories: flight, baggage, renters, pet, wedding and smartphone. We want to be a one-stop-shop for all insurance needs and cover a person throughout their lifetime…from renting an apartment to celebrating a wedding to purchasing life insurance after a child. Many of our competitors only offer one or two categories and do not offer the policies directly from trusted insurance providers instead they create their own and often times leave coverage gaps that are included with our insurance carriers.

What market you are targeting and how big is it?

We are targeting the $5 trillion dollar insurance industry via a new distribution method so that consumers have easier access to quality insurance.

What’s your business model?

We partner with insurance companies that are in need of a new, mobile-friendly distribution method in the form of an easy-to-use app and when a customer purchases from us we’re compensated.

Would you mind telling us about the experience building an insurance tech company in NYC?

We love the energy and talent pool within New York City. For an insurtech startup, New York is the perfect city because the major insurance companies are headquartered here (and they are our partners), and we fit into the “Silicon Alley” scene too. We are leading the change in the industry and inspired by the innovation around us.

What was the funding process like?

We had strong interest from a variety of VC firms and many insurance companies. Our investors have become allies in our business and we’re grateful for their wisdom, patience, and support.

What are the biggest challenges that you faced while raising capital?

We have investors around the table that understand our industry and who can add value – we’re fortunate to have found both in our investors.

What factors about your business led your investors to write the check?

Our incredible traction in the market, both with customers and insurance companies.

What are the milestones you plan to achieve in the next six months?

The Series A funding will enable the company to continue product development, drive user acquisition, boost marketing initiatives and bolster the team with new hires.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

There are so many companies small and large who need solutions for legacy problems. These are great opportunities that, with some simple technology solutions, can become great companies without having to hire dozens of people or have an impressive office.

Where do you see the company going now over the near term?

In the near term we’re focused on creating a place where consumers can come and buy any type of insurance and expanding our insurance partnerships to include more companies. Our goal is to have users rely on us throughout their life whenever they need insurance, starting from when they need renters insurance for their first apartment, jewelry insurance for when they get engaged, pet insurance for their first pet and everything in between.

What’s your favorite restaurant in the city?

I have a soft spot for Café Mogador on Saint Marks.