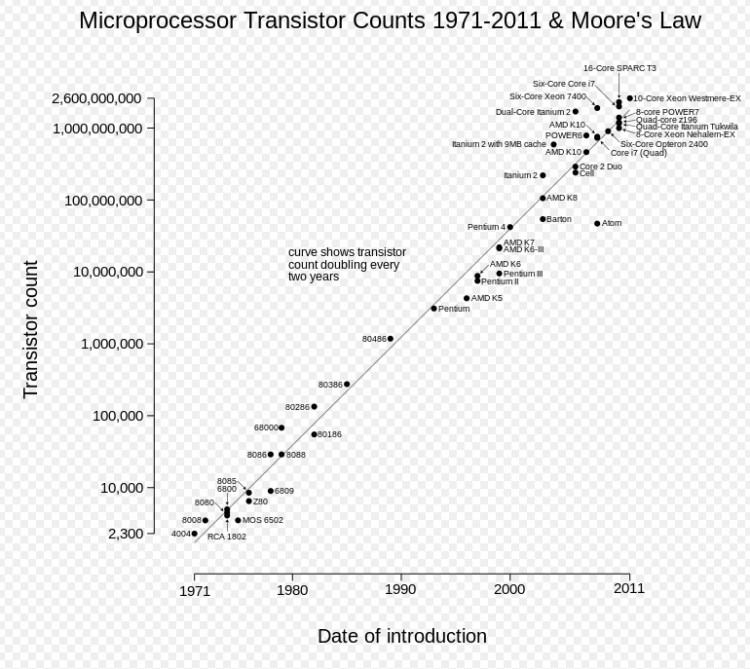

For more than 50 years, Moore’s Law has been the major way people give context to the advancement of technology. Gordon Moore’s 1965 prediction that the number of transistors man would be able to squeeze on to an integrated circuit would double every two years was remarkably prescient.

A plot of CPU transistor counts against dates of introduction

In 1983, the concept of “singularity” first appeared in a story in Omni magazine written by Vernon Vinge: “We will soon create intelligences greater than our own. When this happens, human history will have reached a kind of singularity, an intellectual transition as impenetrable as the knotted space-time at the center of a black hole, and the world will pass far beyond our understanding.”

Ray Kurzweil took over the mantel as the leading voice on singularity, with his 2006 book “The Singularity Is Near: When Humans Transcend Biology”, where he predicted the date of singularity as 2045. He also made predictions of other milestones along the way (e.g. computers that can pass the Turing test by 2029.). That book was preceded by Kurzwiel’s 2001 essay “The Law of Accelerating Returns”, where he postulated that: “An analysis of the history of technology shows that technological change is exponential, contrary to the common-sense “intuitive linear” view. So we won’t experience 100 years of progress in the 21st century — it will be more like 20,000 years of progress (at today’s rate).”

As an investor, as we live through this time of accelerating technology change, it’s fascinating to see the winners and losers play out in terms of market cap gains and losses. This awesome chart published in The Economist in 2015, maps out, over time, the shifting % of total market cap of each of the top 100 tech companies:

You can see how market cap market share domination transitioned from IBM, to Microsoft, to Apple as the dominant computing platform changed from mainframe, to desktop, to mobile.

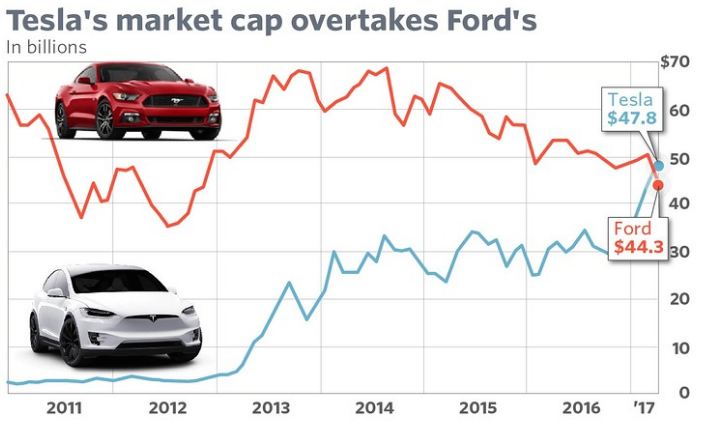

Another milestone happened on April 4, when the market cap of Tesla surpassed the market cap of Ford, highlighting the market’s belief that we are transitioning to a world of electric autonomous cars from a world of gas guzzling human driven vehicles:

Often times, as a result of Amara’s Law, the markets get ahead of themselves, and it can take years before the actual impact of the technological shift begins to dominate.

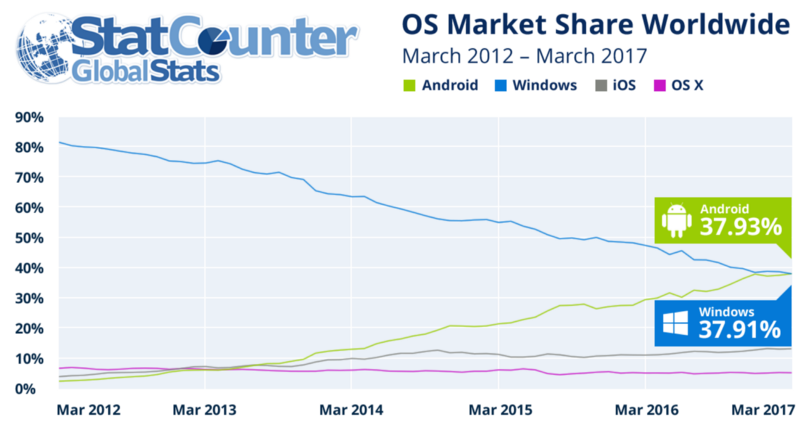

This can be seen in another seminal moment that was announced , on April 3, when StatCounter issued a press release to announce that Android OS (finally) passed Windows OS as the dominant OS in the world:

This moment happened almost 12 years after Google bought Android in what has been called Google’s “best deal ever”.

There’s something life affirming for me when these data driven seminal moments happen. They give me comfort that the technology sea change I think is happening, is actually happening.

More often than not, the seminal moments are not even known as seminal moments at the time.

For a long time now, I’ve viewed Facebook’s introduction of the news feed on September 5, 2006, as the beginning of social media, a truly seminal moment. However, many users were outraged out the time, let alone realizing it as the seminal moment it was.

Sometimes seminal moments happen by luck, as when the Andy Samberg SNL video “Lazy Sunday” was uploaded to YouTube in December 2005, which quickly made YouTube the fastest growing website in history.

Fasten your seat belts, to paraphrase Ray Kurzweil; the pace of seminal tech moments is accelerating, and that’s a great thing for the tech ecosystem and the world!