Recently, Amazon reported a record fourth-quarter earnings with a profit of $749 million on $43.7 billion of revenue. Amazon is in so many businesses beyond books and e-commerce, from shipping & logistics (and eventually drones) to cloud hosting services. In the spirit of our upcoming event on The Societal Impact of Robotics on March 2nd, I would like to analyze its newest endeavor, a humanless brick & mortar supermarket, called Amazon Go.

Jeff Bezos’ latest venture comes on the heels of a dismal holiday season for department stores. While shoppers spent close to $100 billion online, department stores suffered a 5% decline from 2015. This new reality has led to massive store closures and layoffs. Macy’s, the largest department store chain in the U.S., announced over 10,000 employee layoffs and 68 store closures, followed by Kohls, Sears, Kmart, and The Limited (which closed all of its 250 stores). Amazon in turn had its best Holiday season ever.

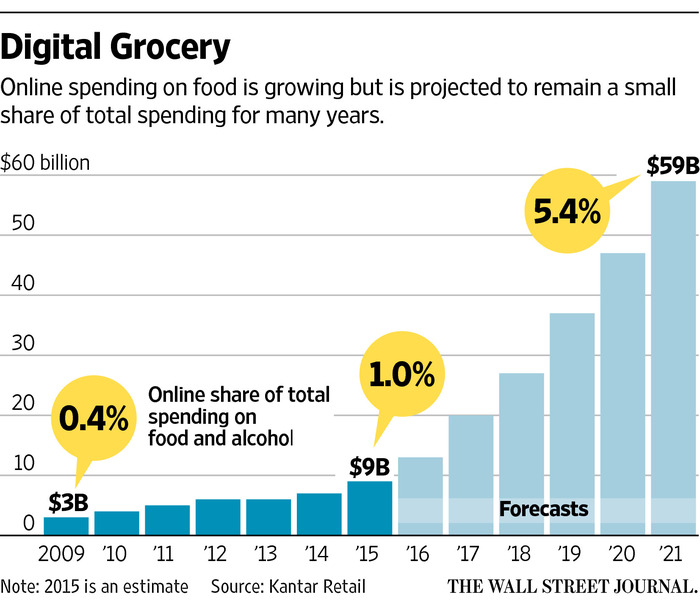

Amazon has won the online war and is now taking its battle to the streets with the launch of its first brick & mortar store. Last month, at the same time retailers were giving out pink slips, Amazon released the above video outlining its new digital shopping experience in a physical store. Amazon Go eliminates checkouts and cashiers. Instead, it tracks grocery items automatically through a combination of computer vision and deep learning technologies. It is currently only available to Amazon employees in Seattle but the store is set to open to the public in early 2017. The company is looking to expand to more store formats that could even be bigger than the Go store by offering drive-through pickup options.

According to Bill Bishop, Chief Architect of Brick Meets Click Consultancy, “Amazon’s secret sauce will be grocery pickups in terms of all of the different ways in which they can engage the customer in bringing the product to them. Everyone is looking at grocery because of frequency. Frequency guarantees that you have density.”

Amazon was not the first humanless store experience; a similar approach was launched last year in Sweden by entrepreneur Robert Ilijason. Like Amazon Go, Ilijason’s customers just need his mobile app to unlock the doors and scan items for purchase. Ilijason hopes that his staff-free concept will help bring small stores back to Sweden’s villages, which have gradually died off over the past decade as large big box retailers have opened in larger neighboring cities. “My ambition is to spread this idea to other villages and small towns. It is incredible that no one has thought of this before.” said Ilijason.

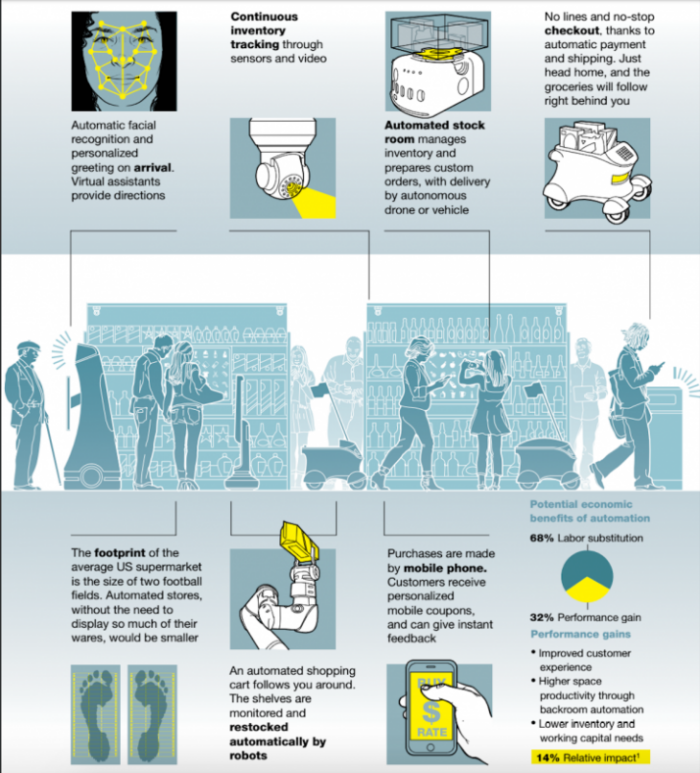

When breaking it down, the robotic-store utilizes a series of sensors connected to a cloud based network. Customers are greeted by an automatic facial recognition system at the entrance and virtual assistant-like screen kiosks, or Pepper working today at PizzaHut, can direct people to different aisles along with artificial-intelligence sensors. Prices are continuously updated and added to the customer’s mobile shopping cart, which is finalized through a cellphone order that pushes customized coupons/advertisements. The entire process from browsing to checkout is accomplished in a fraction of the time, especially without checkout lines. Behind the scenes, the automatic stock room will manage the inventory and send signals for robots to restock vacant shelves that are connected to the cloud (see Wiseye). Similar to today’s online grocery shopping experience, advanced technology can also prepare custom orders and deliver the items via drones or terrestrial carts like Starship.

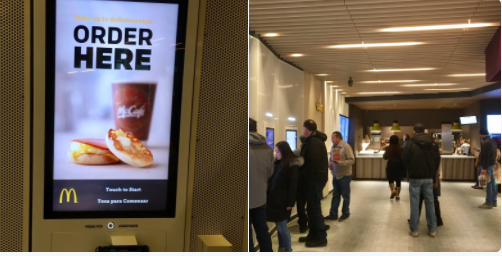

One doesn’t have to travel to Sweden or Seattle to experience cashierless convenience, I witnessed it myself yesterday at the opening of a new McDonald’s concept in New York City. As I left, I wondered what what will happen to the entry-level hourly job? According to McKinsey, human engagement with machinery is still a mission critical component of the experience. Amazon staff members are on call to assist the computer vision system; Ilijason’s store still requires him to personally restocks the inventory; and McDonald’s needs a fry cooker (unless they start using automated kitchen systems)

At a recent talk titled,“Will Robots Eat Your Job?” MIT professor Erik Brynjolfsson said ‘robots and artificial intelligence software could eventually render human workers obsolete in virtually every industry, but that shift will likely take at least 30 to 50 years to play out.’ In the meantime, he stresses the importance of focusing on properly preparing people for the jobs that will be available over the next decade or so, and finding a way for everyone to be able to benefit from the gains in economic productivity and wealth generation spurred by technological advances.

This sentiment was echoed last month at the National Retail Federation show. While it was obvious that the big headlines from the show were the changes on the horizon from artificial intelligence and store robotics, the big question was the Return On Investment (ROI). For a number of years, a few major retailers have been giving robots a test run. Best Buy implemented a customer-facing robotic arm, Chloe, in a Manhattan store to collect movies, music, games, headphones, chargers and phone cases for consumers. In April 2016, Target conducted a one-week trial of the Tally robot from Simbe Robotics in a San Francisco store. Tally works in concert with retail associates, arming them with information to ensure the store’s shelves are always stocked in the right place and displaying the correct price tag. But neither retailer has expanded on these limited pilots, lending credence to the idea that these technologies haven’t yet generated sufficient ROI.

“The costs out of the gate for these robots are high, especially to run many of the tests,” said Bill Lewis, VP of Consumer Products for Capgemini Consulting. “The use cases are still being understood and I think right now most retailers are trying to focus on their e-Commerce integration with stores. When you talk about something as advanced as robots that have high costs attached, such as Pepper, you need to ensure that there’s a disciplined approach and a rigorous way to measure the ROI.”

Traditional retailers are typically very slow when embracing change, compared to innovation companies like Amazon or Google. The most famous case was in 2008 when the CEO of Blockbuster, Jim Keyes, said “neither RedBox nor Netflix are even on the radar screen in terms of competition.” In reflecting on this new reality, Lewis updated his predication to three years when Main Street customers will experience robotic and AI-infused stores. Until then, Amazon will Go Go Go…