Today, I take a look at the 15 companies that have raised the largest FinTech startup funding rounds in the US in 2016 using some data from our friends at Crunchbase. In addition to dollar amount, I have included type of round, investors, and total dollar amount raised by the startup to further the analysis.

CLICK HERE TO SEE THE 15 US FINANCE COMPANIES THAT RAISED THE LARGEST ROUNDS IN 2016

The AlleyWatch audience is driving progress and innovation at a global scale. Reaching more individuals in a single month than every other tech-focused organization in NYC combined, AlleyWatch is the highway for technology and entrepreneurship in New York. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this. Find out more here.

The analysis in this report is presented by Coworkrs:

Coworkrs offers 24/7 headache-free access to all the office services and amenities you need to focus on your business. From beautiful open lounge spaces, to shared desks and private office suites, we provide our members with everything they need to focus on their work. Our collaborative and comfortable environment welcomes all. Move your company to Coworkrs today!

NOW ON TO THE 2016 TOP 15 US FINTECH FUNDING ROUNDS

- Varo Money $27M

Round: Venture

Investors in the Round:

Warburg Pincus

Total Capital raised:

$59.73M

- Lend Street Financial $28M

Round: Venture

Investors in the Round:

Flock Specialty Finance

Total Capital raised:

$28M

- Acorns $30M

Round: Series D

Investors in the Round:

Point72 Ventures, e.ventures, PayPal, MATH Venture Partners

Total Capital raised:

$61.96M

- AlphaSense $33M

Round: Venture

Investors in the Round:

Tribeca Venture Partners (lead), Quantum Strategic Partners (lead)l, First Fellow Partners, Tom Glocer, Triangle Peak Partners

Total Capital raised:

$35M

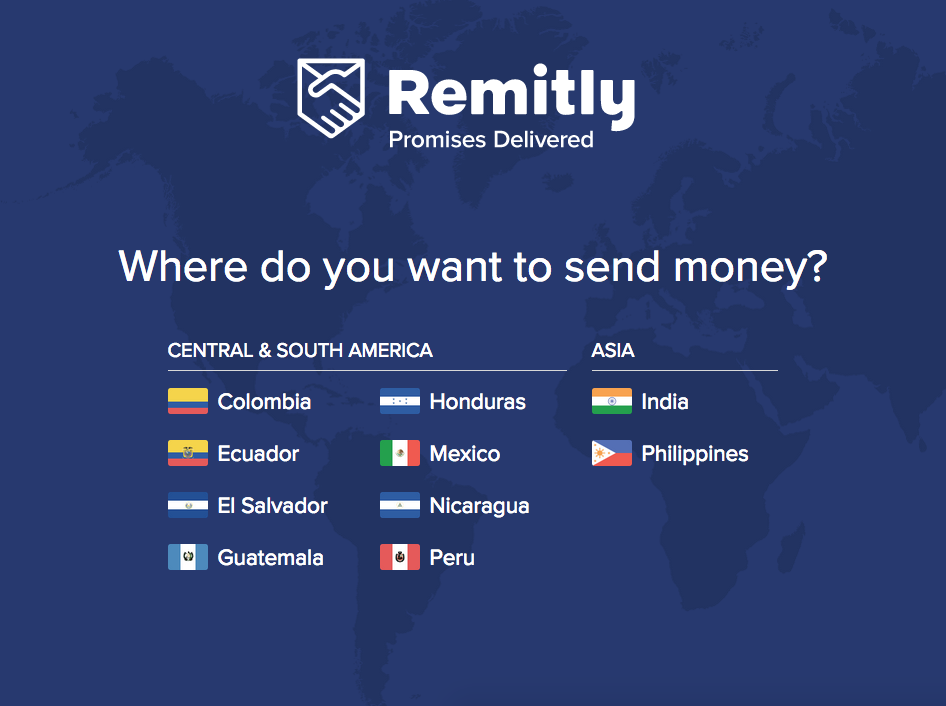

- Remitly $38.5M

Round: Series D

Investors in the Round:

Silicon Valley Bank, International Finance Corporation

Total Capital raised:

$100M

- Open Lending $40M

Round: Venture

Investors in the Round:

Bregal Sagemount

Total Capital raised:

$50M

- BlueVine $40M

Round: Series C

Investors in the Round:

Menlo Ventures, Rakuten, 83North, Lightspeed

Total Capital raised:

$113M

- Plaid $44M

Round: Series B

Investors in the Round:

Goldman Sachs, New Enterprise Associates, Spark Capital, BoxGroup, GV

Total Capital raised:

$59.3M

- LendUp $47.5M

Round: Series C

Investors in the Round:

Y Combinator (lead), Radicle Impact, SV Angel, Bronze Investments, Susa Ventures, Data Collective, QED Investors, Thomvest Ventures, GV

Total Capital raised:

$111.5M

- BlueVine $49M

Round: Series D

Investors in the Round:

Silicon Valley Bank, Rakuten FinTech Fund, Citi Ventures, 83North, Menlo Ventures, Lightspeed Venture Partners

Total Capital raised:

$113M

- LendUp $50M

Round: Series B

Investors in the Round:

Data Collective (lead), Susa Ventures (lead), Kapor Capital, SV Angel, Radicle Impact, Bronze Investments, GV, Yuri Milner

Total Capital raised:

$111.5

- InstaMed $50M

Round: Venture

Investors in the Round:

Carrick Capital Partners

Total Capital raised:

$125.63M

- Ripple $55M

Round: Series B

Investors in the Round:

SBI Investment (lead), Blockchain Capital, Abstract Ventures, Accenture, Venture51, Seagate Technology LLC, CME Ventures, Santander InnoVentures, SCB Digital Ventures, Standard Chartered Bank

Total Capital raised:

$93.6M

- Fantex $18M

Round: Series B

Investors in the Round:

Boston Millennia Partners

Total Capital raised:

$21.76M

- Tradeshift $75M

Round: Series D

Investors in the Round:

Data Collective

Total Capital raised:

$190.68M

- Personal Capital $75M

Round: Series E

Investors in the Round:

IGM Financial

Total Capital raised:

$225.3M

- Affirm $100M

Round: Series D

Investors in the Round:

Morgan Stanley

Total Capital raised:

$520M

- Payoneer $180M

Round: Series E

Investors in the Round:

Susquehanna Growth Equity, TCV

Total Capital raised:

$270M