There has been chatter over the years about fund economics — specifically whether carry should be calculated on a fund level, or on a deal-by-deal basis. With the rise of Syndicates and SPVs — and the rise of Angelist as a platform for both — I believe it merits revisiting. My major concern is that all players involved (syndicate leads, investors, funds, even founders) do not understand what it actually all means. This is especially relevant for LPs/Investors trying to understand what investing in single-deal SPVs can do to their bottom-line returns.

For those unfamiliar, here is how the 2 differentiate in calculations:

Fund Level — the more traditional method, calculated by first subtracting all losses, and taking carry (assume 20 percent) on the net.

Deal-by-Deal — carry is calculated on each deal independently. So full carry on positive deals, none on the negative/even deals, without netting against one another.

The Math:

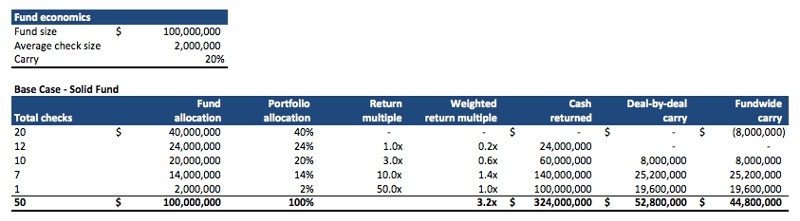

Assuming 50 investments, totaling $100M.

This is a somewhat standard fund distribution: 2-thirds of the fund return no capital, or capital invested. Another third return between 3-to-10 times, and one “home-run” out of the 50 returns the fund, 50 percent. Not including management fees, this leads to a 3.2x multiple, or $324M returned on $100M investment.

So you will realize, with traditional, fund-level carry, the GPs will earn $44.8M in carry from their LPs, lowering that $224M profit to $179.2M; a nice investment for the LPs.

Now imagine instead of investing in this hypothetical fund, you auto-backed this GPs syndicates, which made the exact same 50 investments, and the same $324M was returned to the syndicates in aggregate. But because each investment/syndicate has its own carry, the losses are not netted from the gains. You will realize the $44.8M in carry increases to $52.8M, and drops profit from $179.2M to $171.2M, transferring an extra $8M from LP pockets to GP pockets.

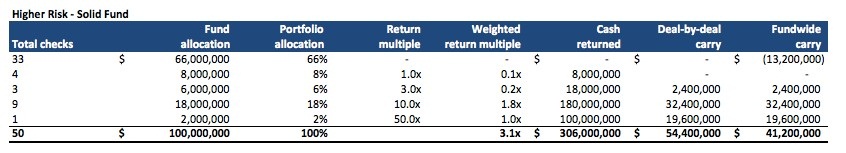

While I can end my argument there, that LPs are worse off financially with deal-by-deal carry, my bigger concern is around misaligned incentives. In theory, GP and LP should be perfectly aligned — the more money the GP makes, the LP should do the same. But with deal-by-deal carry, since “losses do not matter,” GPs may be incentivized to take additional risk (even more than the already-high risk customary in venture). Here is how it can play out:

What do I mean by additional risk? Higher variance — or more binary outcomes. So here, it means 2 more 10x winners, at the expense of a lot more losers. Was this the proper strategy? No, the fund returned $306M v. the $324M in original model. Given those numbers, if using fund-level carry, the GP would have earned just 41.2M carry versus the original 52.8M. But here is the kicker — when using deal-by-deal carry, even though the fund performed less, the GP performs better, earning 54.4M carry. Just to carry out the math — while the GP earns additional $1.6M in carry, LPs receive back net $151.6M ($206M-to-$54.4M), compared to the original $179.2M. Starts to get pretty significant, right?

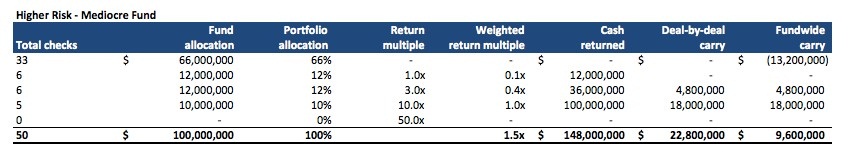

But most funds do not return even the lower 3.1x return. Imagine a scenario, not so unlikely when taking a “moonshot” approach, where there are no big wins, and fund performance is poor:

Hey, at least the fund had a positive IRR (not always the case). But now, the fund missed out on any 50x, and had 4 less 10x investments. This lowers portfolio-wide fund returns to 1.5X ($148M returned on $100M). Traditional carry would have only netted GPs $9.6M, but because we are using deal-by-deal, the GPs now earn $22.8M. This comes from a meager $48M profit, leaving the LPs with just $25.2M.

Let’s not even run through the scenario where the fund loses money, yet the GPs still earn carry.

I have not written this to make any definite suggestions. Maybe single-deal SPVs/Syndicates should be done at a lower carry? Maybe a new, waterfall-type structure is appropriate. My hope is for transparency and for open dialogue — at the end of the day the entire ecosystem will benefit.

Image credit: CC by Terry Johnston