In March 2015, I joined Flight VC as manager of the Israeli Founders Syndicate, the 15th syndicate in the stable of Flight VC’s federation of AngelList syndicates headed by Gil Penchina and Shawn Merani. By September, I was so impressed by what the team was building that I wrote a post “The Rise of Flight VC” where I detailed the statistics behind the dramatic growth of Flight VC.

Now, one year later, AngelList continues to grow, in part driven by the $400 million committed by China’s CSC, which AngelList’s Naval Ravikant recently suggested “ … could become a tsunami.” Flight VC has also experienced significant growth and success, including 2 of the first 3 unicorn exits in AngelList history.

A Brief History of Flight

Flight VC got its humble beginning in July of 2013 when Naval Ravikant, the founder of AngelList, launched the Syndicate model. The idea was to incentivize highly followed angels on AngelList to be more active by giving them carry in deals they “syndicated” on AngelList.

AngelList investors could “back” a syndicate, and indicate an amount they would invest if they liked a deal. The backing isn’t a commitment, just an indication of interest. It is analogous to a YouTube subscriber, in that backers, like subscribers, are made aware of a new offering, and they can decide to watch/invest, or not. In fact, YouTube is a great analogy for AngelList in many ways (e.g. it evolved in to the largest video platform in the world).

Naval asked Gil Penchina to be one of the first Syndicates. It was an inauspicious beginning for Gil, with just 18 investors, totaling $104,500, backing the Gil Penchina Syndicate in the first month in October 2013.

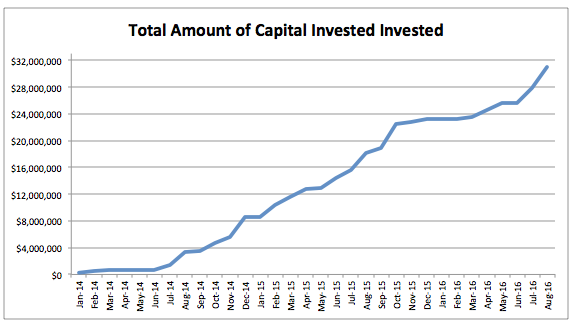

Gil launched his first syndicated deal on AngelList in November 2013 for UXPin, a design platform for product teams. With other backers of UXPin including Andreessen Horowitz, the Gil Penchina Syndicate closed on $258,970 for UXPin, in January of 2014, and Flight VC was on its way.

Alt School, which is reimagining education, was Gil’s second deal, launched in January 2014. After his third syndicated deal, Orion, Gil launched the SaaS syndicate (in partnership with Nathan Creswell and Kyle York), in May 2014.

The plan is to have Flight VC grow to be the Fidelity Investments of crowdfunding. Started in 1946, Fidelity has an all-star group of fund managers managing a diverse group of 462 Mutual Funds for 25 million customers.

Flight VC by the Numbers

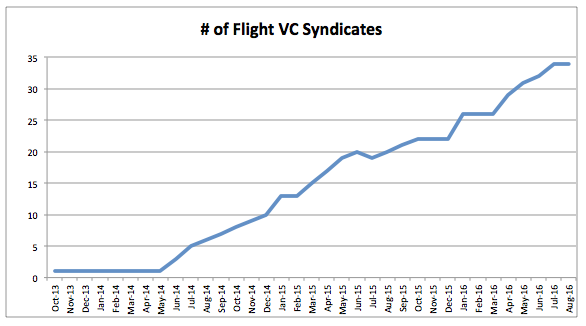

Now, less than three years after Flight’s first Syndicate was launched, Flight VC has 34 Syndicates. We’re confident that Flight has more relevant industry knowledge, networks, and connections than most traditional VCs.

Syndicate managers include ex CEOs, CMOs, CFOs, CROs and VPs of engineering. We are confident that Flight has more relevant industry knowledge, networks and connections than most traditional VCs. When we pitch startup CEOs, we talk a lot about this group of syndicate leads that can offer specialized expertise.

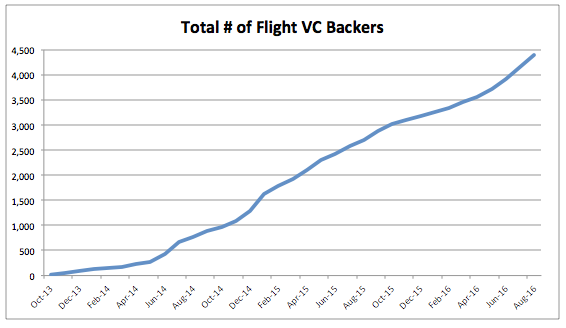

Syndicates are only as strong as the people backing them. Flight now has over 4,400 backers across the 34 Syndicates, an increase of 63 percent in the last year. About half are in the US, so it is a global investor base.

Flight built AngelMob.co to enable our companies to request help from our vast and growing backer network. Requests can be as simple as sharing something on Twitter or Facebook, to helping with key hires or introductions. In return, backers can get early access to our hottest deals. Backers can join Flight’s advisor/mentor network and become more deeply engaged with Flight portfolio companies and receive advisory shares.

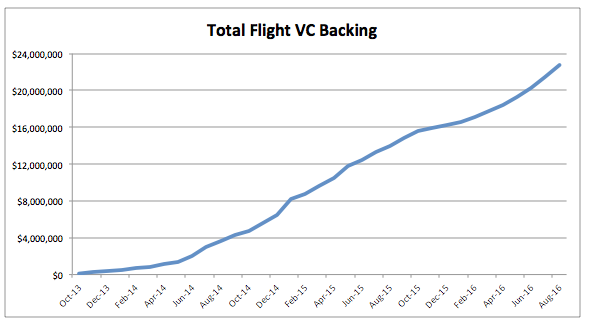

While many backers invest only $1,000 per deal, the average backer has indicated an interest of investing over $5,000, Total backing from active syndicates stands at $22.7 million, year-over-year growth of 63 percent.

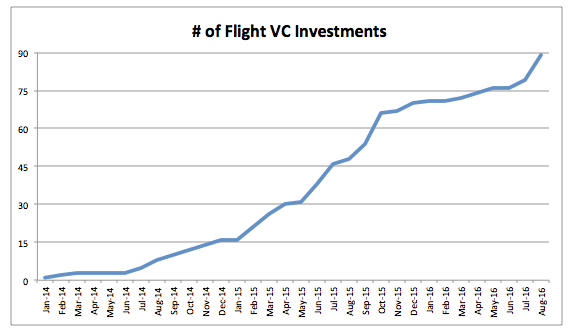

Flight is stage agnostic, investing in seed, bridge, A, B, C and common. In the last year, Flight made 41 investments, or about 3.4 deals a month, up 2 percent from the 40 investments made in the prior year.

Flight’s modest growth in transactions compares favorably to the 19 percent decrease in total North American VC deal activity through the first two quarters of 2016 per CB Insights.

Over the last 12 months, flight has invested $12.8 million, a 13 percent decrease from the $14.8 million invested in the 12 months prior, due to one large investment the prior year. The average investment over the last year was over $300,000.

Unicorns Come to AngelList

The first Unicorn exit in AngelList history was Cruise, a provider of autonomous car technology acquired by GM in May, 2016, less than 9 month after Flight’s Zach Coelius syndicate invested in its Series A.

The second AngelList Unicorn exit happened in June, when Twilio went public. In June 2015, Twilio acquired Authy, an AngelList backed company.

The third Unicorn exit in AngelList history will be Dollar Shave Club, when its acquisition by Unilever closes later this year. The deal was announced on July 20 2016, less than a year after the Gil Penchina Syndicate invested in a post-Series B transaction.

While the reputation, and the quality of deal flow, of Flight VC has been growing, our participation in two Unicorn transactions so soon in our history, has further enhanced our ability to get in the deals we want to be in, which is the key to being a successful VC.

The Future of Flight VC

In my Flight post last year, I made 3 predictions.

The first prediction was that “The Lines Will Blur Between Syndicates and Traditional VCs”, and that is undoubtedly happening. In fact, some of our new Syndicate partners are more traditional investors including Amplify and Maven Ventures. In this recent post by MIT Sloan student Louis Coppey, his research finds that AngelList syndicates are becoming an important source of funding “ … but they are more of a complement than a substitute to traditional VC firms.”

The second prediction was that “AngelMob will evolve into a powerful advocate for Flight VC companies.” Well, AngelMob is still a work-in-process. Coupled with our new Advisor/Mentor Network discussed above, I continue to believe that Flight has the opportunity to evolve in to one of the most value added VCs on the planet.

My third prediction was that “AngelList will emerge as the largest VC in the world, in terms of # of companies backed and total dollars raised”. While the jury is still out, AngelList continued to make great strides in the last year. In fact, AngelList estimates that “15 percent of investments in early stage startups happen on its platform.” To date, more than 950 startups have raised capital on the AngelList platform.

As I look out over the next year, I am even more confident in AngelList’s ability to continue to grow and evolve in to a powerful force in the VC community, and for Flight VC to grow and evolve too. In a recent AngelList blog post , Gil Penchina said “ … you can view AngelList like AWS. It is a set of infrastructure and tools that are constantly evolving to help you build your business faster. From that perspective, much like AWS, AngelList is great and allows you to move faster and get more things done. It is also always evolving, which can be a real headache sometimes. But it beats buying and booting up your own server.”

Image credit: CC by Avariel Falcon