Investing your own money can be intimidating without the knowledge and guidance of how to invest properly. So rather than just throwing you in to the deep end of the pool, Trigger Finance is providing you with a platform to establish ‘rules’ of when to pull the trigger. With if/then rules attached to a myriad of potential situations, the platform informs when things are statistically on your side. Sound investment advice combined with early investment is this latest entrant’s mantra in the personal financial management space..

AlleyWatch spoke with Rachel Mayer about her startup which brings back discipline to investing and its future.

Tell us about the product or service.

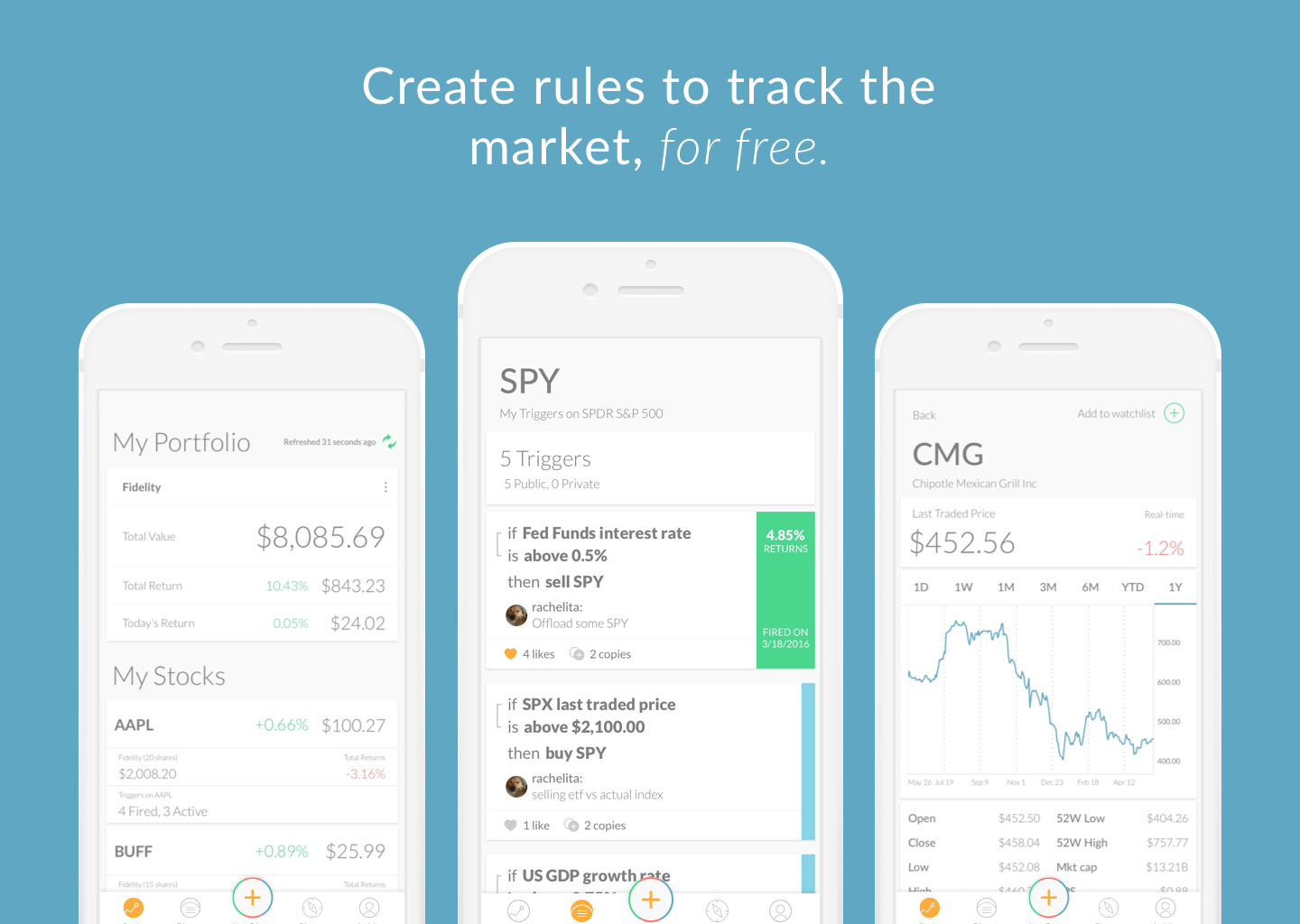

Trigger is the next generation investing platform that encourages investing through rules. We believe that triggers are the best way to remove emotion from investing, and we will motivate all investors to invest conditionally, and teach them the basics to become a more sophisticated investor through triggers. A ‘trigger’ monitors any type of financial data and delivers the result in real time. For example, if the Fed raises interest rates, then sell SPY, or IF oil trades below $20, buy Exxon. Our goal is to build the next generation brokerage business for individual investors, starting with a mobile first solution.

How is it different?

Conditional orders have always existed in brokerages – even the commonly used limit order is a conditional order. However, triggering on events that are not necessarily price based has not been done before on brokerage platforms, let alone on mobile.

Moreover, using an IF THIS THEN THAT natural sentence format for expressing complex orders hasn’t been done before at a mass retail level. This is especially true for triggering on events such as your own portfolio, economic events, corporate earnings, market movements, weather, insider events and so much more. No one has given the ability to trigger alerts and orders on the data sets that we integrate with. Traditionally these tools have only been available to the big Wall Street firms, or managed by an expensive trader watching the market 12 hours a day.

What market are you attacking and how big is it?

This is an entirely new product, and our goal is to bring triggers to everyone in the financial services sector. We are attacking the retail investing market, specifically those who are DIY investors. According to the SEC there are over 100M retail investing accounts, and we could potentially target triggers to all of them, but we are starting with a higher value, niche audience that is a sophisticated retail investor, and then expanding to different types of accounts and investor profiles with appropriate triggers as we grow as a company.

What is the business model?

We are exploring different paths of monetization, including licensing our trigger technology to businesses as well as becoming a broker dealer to offer triggers in a more holistic capacity to investors.

What inspired the business?

We were inspired to give individual investors the tools and knowledge they need to make better decisions when it comes to personal investing. Rachel spent almost 5 years on Wall Street as a trader, and it was not until she went on sabbatical in graduate school where she met Adrian and Zafrir, that they quickly realized their was both a product and knowledge gap between the institutional and retail investor. We were very much inspired by the simplicity of the product IFTTT for automating your life, we wanted that simplicity for automating investments based on key events.

What’s it like to be a female founder building a business in NYC? What resources have you found most helpful

I believe there is no better city to be a female founder when building a business. New York is such a diverse mix of people and industries that it spurs unique combinations of teams and big ideas across different markets. I definitely enjoy being a part a couple of awesome mailing lists, like 2XinTech, which was born out of Grand Central Tech. There is also a great community of female focused investors, like Female Founders Fund and Astia Angels that hold lovely community events where you get to meet other inspiring women founders.

What are the milestones that you plan to achieve within six months?

We plan to continue to offer new trigger types to our users, and we hope to expand the trigger bank to include even more unique triggers like insider events, weather, sentiment and so much more. We are also introducing a referral program, and launching an API that other businesses can leverage to introduce triggers to their audiences.

What is the one piece of startup advice that you never got?

It always takes more time, money and effort that you think!

If you could be put in touch with anyone in the New York community who would it be and why?

I would love to have coffee with Sallie Krawcheck of Ellevest. Her impressive career on Wall Street and now focus on a financial advisor tailored towards women is filling such a big need in the market. As a former female trader on Wall Street who transitioned to fintech, I’m sure she’d have plenty of learnings to share that I’d love to hear and learn from!

Why did you launch in New York?

The Trigger team came out of Cornell Tech’s Master’s of Engineering program, which is big on students engaging with New York’s tech and academic communities. The three of us were all very much set on staying in New York and being part of the thriving startup ecosystem. We love that New York isn’t just about tech, but finance, media, advertising, fashion, health, art and so much more. If we get tired of programming all day we can go to the theatre or hit a comedy show to unwind!

What’s your favorite rooftop bar in NYC to unwind?

I’m a big fan of bar backyards, I love Riviera Drive and Huckleberry Bar in Williamsburg! Sometimes you can sneak your dog in too 🙂