As you have found out, investing usually follows trends, many of which we are experiencing right now. If something is hot or seems to be working, why not follow it?

- Delivery of everything

- Pre-packaged food (delivered also)

- Transportation (Uber/Lyft etc)

- Bitcoin (blockchain really)

- Internet of Things

- Retail/online shopping

- Sharing economy

We now have 229 (what day is it?) unicorns that have been funded with over $175 billion in investment, which have a combined value (private) of over $1.3 trillion! A lot of that money is coming from large VCs and now hedge funds, private equity and even sovereign nations. Why? Because they have other people’s money they need to spend and venture capital seems like the best asset class to pursue for the biggest (with special safe(r) deal terms) returns.

They hope to get their clients upwards of a 15 percent return on their money over a few years and lately have been trying to invest pre-IPO to double their money (2x) even faster. Very few other financial instruments can give you a potential return like that, which is also why it’s so risky and why our current climate is so hot right now. There are only so many deals at that level too, so you gotta take what you can get if you can’t get into others.

The same mentality can be applied to the startup world — there can only be a few winners. You would think that the more money you have, the better your chances are but that doesn’t happen over night. Money can just buy you time but does not equate to success.

Combined, the biggest VC firms manage billions of dollars and invest in more than 90 unicorns because they understand how the games works and the risk involved. They know that most of their investments will not work out but if one or more hit, it will make up for all losses and hopefully more. Even the leading equity crowding funding platform AngelList tells you that you should “Expect to lose your money.”

So what’s the point of saying all of this that isn’t entirely positive sounding? That you need to understand that what is going on right now, while we can’t call it “normal,” it is kind of expected. It is definitely unfortunate timing that the stock market is a bear, recent tech IPOs are not fairing so well and M&As are down, but our job (as investors) is to figure it out and help our investments do the same. The upside though is that we know we don’t expect a liquidity event when we invest for at the very minimum 5 years on most investments. A strategic “early exit” would be about 2-3 years.

I’m not trying to paint a pig here as we’re definitely in some funky and interesting times, but the companies that survive will be the real businesses. Think of this as natural pruning or a “correction” in the marketplace (not a bubble!) when lots of companies will go out of business, take a down round or get acquired for a fraction of their valuation. Please please please don’t call them cockroaches, uni-corpses or any other labels, as that will make the situation worse and more ego- driven. These are real people trying to create real businesses, real jobs, real value and real money and they are changing the way we do certain things, hopefully improving our lives.

With everything going on right now, I do expect the later stage “unicorn” rounds to slow down a little but not significantly. As already reported, seed investing won’t slow down so there won’t be any shortage of startups continually looking for a Series A but it will get a little harder to secure those rounds without the proper metrics in place. Once all of the major industry companies are done restructuring, laying off workers and figuring out how to survive in the current climate, M&A will pick up again and there will be more liquidation in the market.

Just to reiterate, there is no such thing as an overnight success — when you invest in a startup, don’t expect your money back for years, if you get any at all.

Please feel free to email me your deck and terms to t@nyvp.com with “invest opp — company name” in the subject line. We don’t invest in notes, only priced preferred equity and about 3 percent of the companies we meet with.

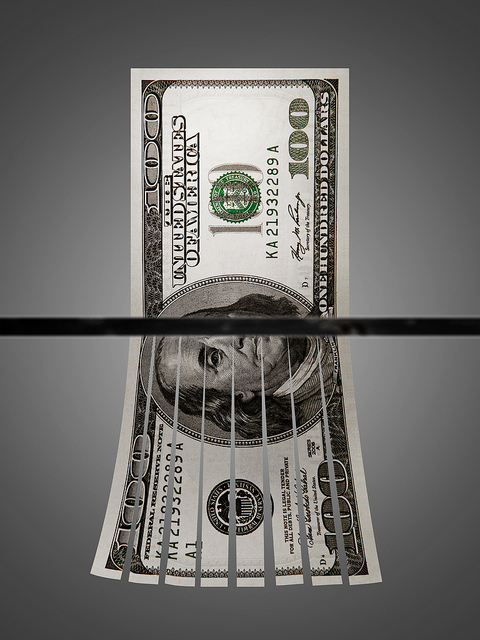

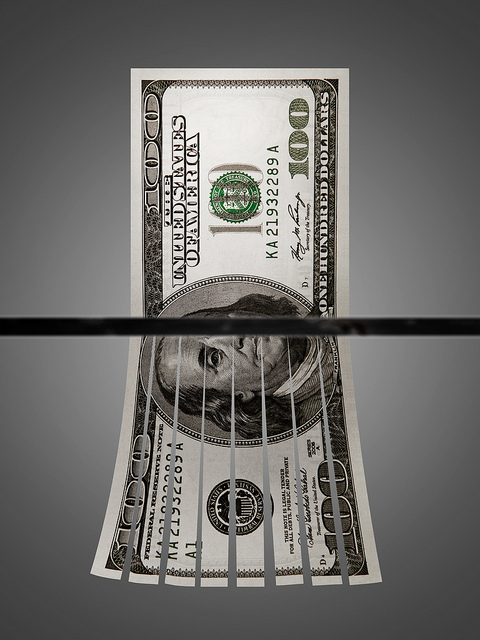

Image Credit: CC by Tax Credits