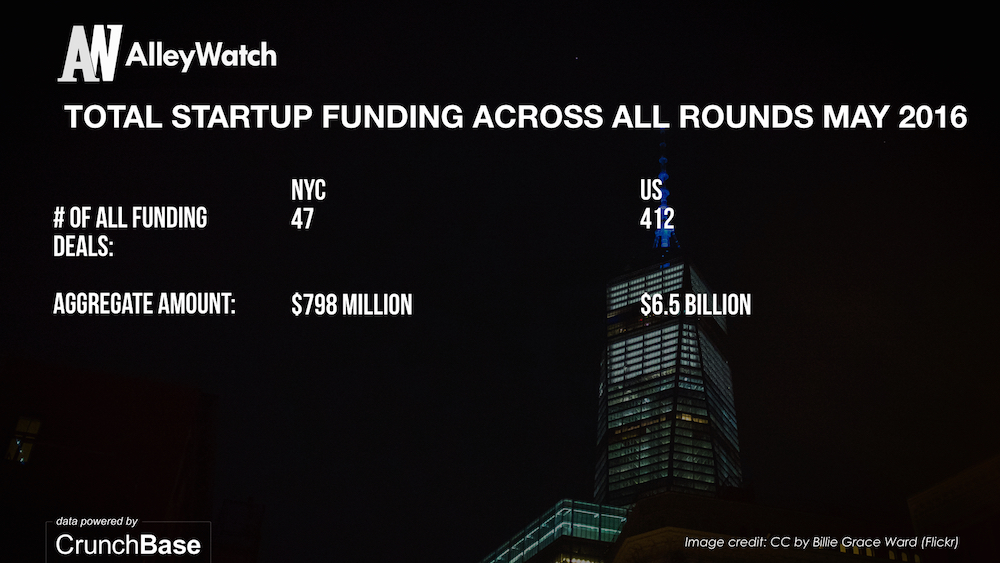

Today, I take a look at the state of venture capital and angel funding during the all of May, both in New York and nationally. Analyzing some data from our friends at CrunchBase, I break down the national aggregate statistics for all funding deals by stage of funding (Angel/Seed, Series A, Series B, and Series C+, as well as non-specified venture rounds <$10M).

CLICK HERE TO SEE THE FULL REPORT

Quick analysis:

In New York, it was a very robust month for NYC startup funding, as the aggregate funding for the month approached $800M. This figure is largely affected by two funding rounds in the transportation sector that comprised more than half the total – Gett and Via. Both of these rounds and the growth in funding is attributable to later stage rounds (Series C+). Following a slow April, for Series A activity, May did not prove better with only a total of 6 announced fundings.

Nationally, it was also a very active month with aggregate funding approaching $6.5B, which is the largest we have seen over the last 12 months. Similar to NYC, the driver for growth in national funding was the latter stages rounds, where founding more than doubled to approach $5B. Of note, is the Snapchat funding totaling $1.8B, which comprises >25% of the total.

For your tweeting convenience:

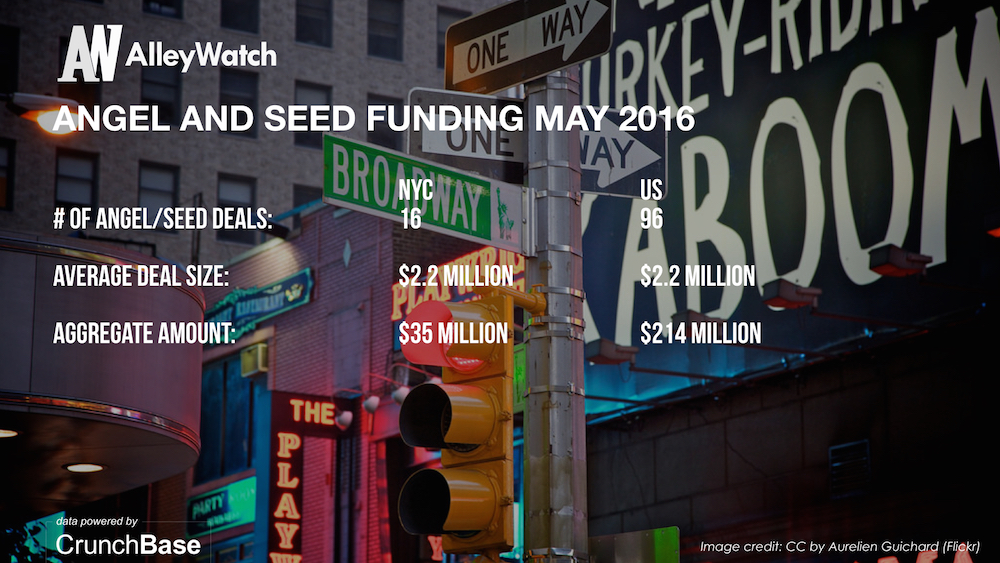

Average Angel/Seed round in NYC for May was $2.2M Tweet this

$35.1M was invested across early stages rounds in NYC in May Tweet this

Average Angel/Seed round in the US for May was $2.2M Tweet this

$214M was invested across early stages rounds in the US in May Tweet this

16.4% of early stage funding nationally went to startups in NYC in May Tweet this

For your tweeting convenience:

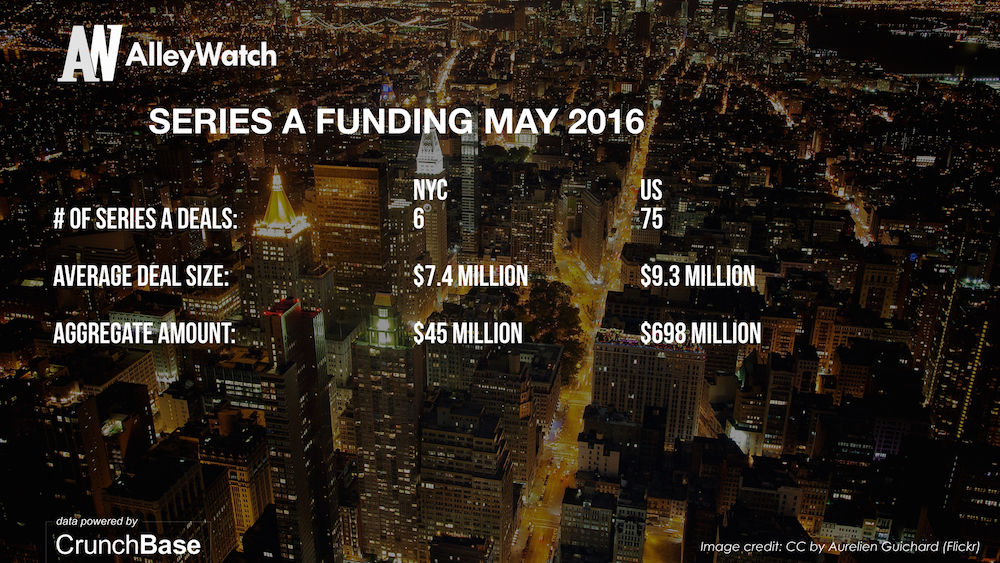

Average Series A round in NYC for May was $7.4M Tweet this

$44.4M was invested across Series A rounds in NYC in May Tweet this

Average Series A round in the US for May was $9.3M Tweet this

$698M was invested across Series A rounds in the US in May Tweet this

6.4% of Series A funding nationally went to startups in NYC in May Tweet this

For your tweeting convenience:

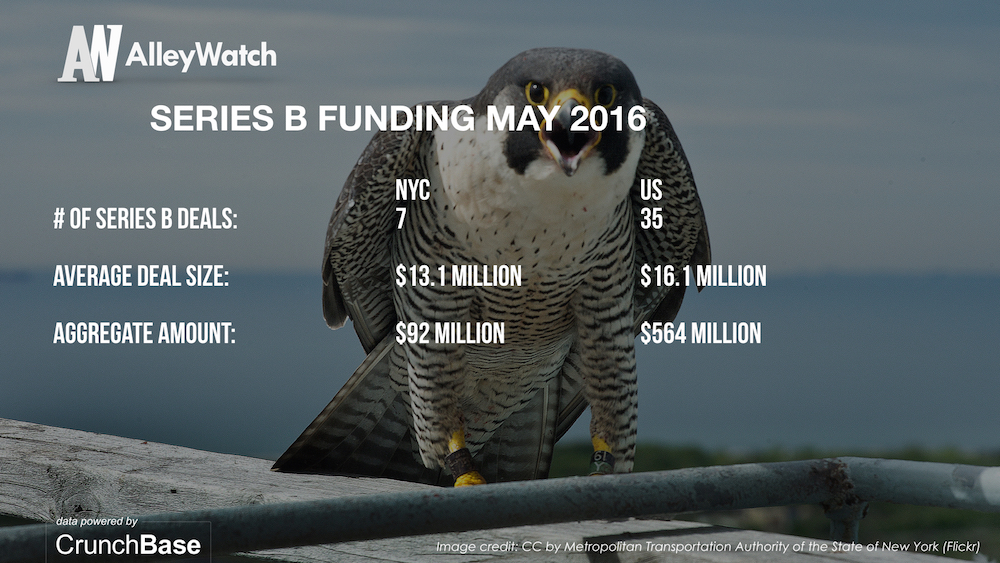

Average Series B round in NYC for May was $13.1M Tweet this

$91.5M was invested across Series B rounds in NYC in May Tweet this

Average Series B round in the US for May was $16.1M Tweet this

$564M was invested across Series B rounds in the US in May Tweet this

16.22% of Series B funding nationally went to startups in NYC in May Tweet this

For your tweeting convenience:

Average Series C+ round in NYC for May was $93M Tweet this

$557.5M was invested across Series C+ rounds in NYC in May Tweet this

Average Series C+ round in the US for May was $69.8M Tweet this

$4.7B was invested across Series C+ rounds in the US in May Tweet this

11.92% of Series C+ funding nationally went to startups in NYC in May Tweet this

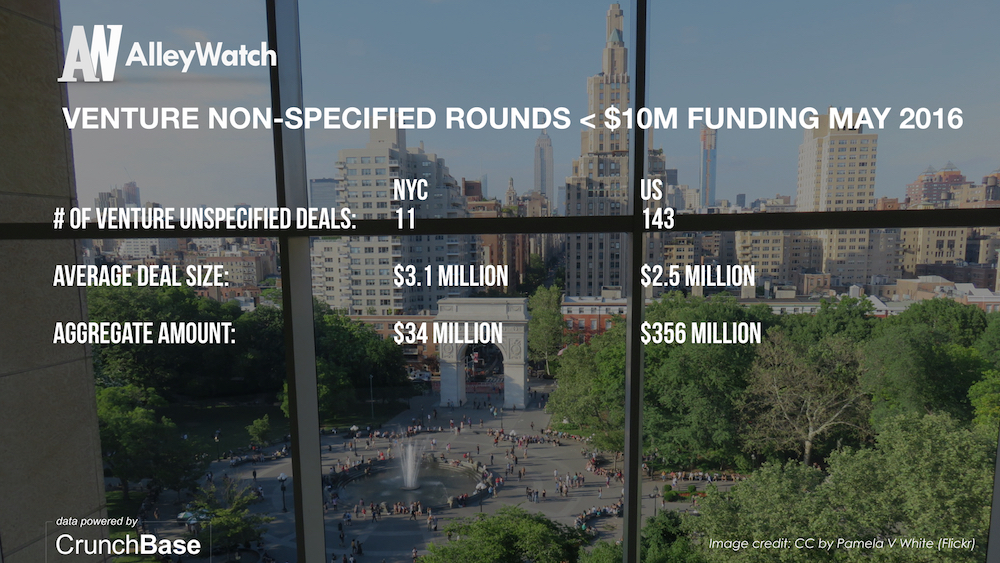

These rounds comprise funding that is classified as venture but not specified as a specific round and includes a number of bridge financings.

For your tweeting convenience:

$798M was invested in angel and venture financing for #startups in May in NYC across 47 deals Tweet this

$6.5B was invested in angel and venture financing for #startups in May in the US across 412 deals Tweet this

12.33% of startup funding nationally went to startups in NYC in May Tweet this