For the landlords and brokers working in the CRE sector, fragmentation in respect to information is still a problem, like in most traditional industries that haven’t fully subscribed to technological advancement. VTS, a leader in leasing and asset management space provides a streamlined workflow, market intelligence, portfolio analytics, and real time tracking of deals. They just raised the largest round in the history of commercial real estate technology.

Today, we sit down with CEO and Founder Nick Romito to discuss this mega round, where the real estate tech market is going, and where VTS fits in.

Who were your investors and how much did you raise?

Our series C funding round was led by Insight Venture Partners with support from previous investors, OpenView and Trinity Ventures. We raised a total of $55 million, which is the largest venture funding round in the history of commercial real estate technology. To date, we’ve raised a total of $84 million.

Tell us about your product or service.

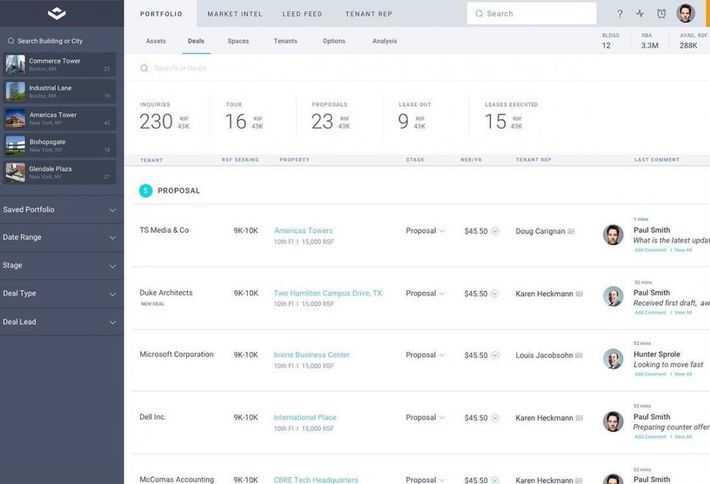

VTS is a commercial leasing and asset management platform built specifically for landlords and brokers. Put simply, VTS’s platform allows landlords and brokers to track deal activity, streamline workflow and access market insights. Over 2.7 billion square feet are under management on our platform, and 8 of the world’s top 10 investment managers use the platform to inform critical business decisions.

What inspired you to start the company?

VTS co-founder Ryan Masiello and I met when we were just 10 years old at a surfing competition. Coincidentally, we both spent nine years working in commercial real estate and soon discovered a major opportunity to improve workflow and increase access to data for smarter decision making across the real estate spectrum. We saw an industry that relied on enormous amounts of manual labor to compile data and reports that were becoming old by the time they were delivered. We knew that access to real-time data and reporting on a single platform would drive the industry forward — that’s what drove us to develop VTS.

How is it different?

VTS was built by industry experts for the industry. Our platform leads the way in terms of security, usability and technology. That’s because we brought industry expertise and a team of engineers together to create a solution that solves real problems that brokers and landlords encounter daily. What’s more, VTS is leading the charge in market intelligence for commercial real estate. Our platform integrates with data resources like Argus, MRI, S&P Capital IQ, CompStak and iPreo, which provide real-time market analysis to users.

What market are you targeting and how big is it?

VTS was built for the commercial real estate market, which is valued at $15 Trillion (the size of the US stock market) and is the world’s second largest asset class.

How does the strategic shift of the company change now given this funding?

We’ll use the funding to expand into more key markets abroad, specifically EMEA and APAC markets, starting with Germany, the Netherlands and Sydney, Australia. Product development is also another big priority for us, so we’ll dedicate a big portion of the funding there. Our goal is to build for commercial real estate what Bloomberg built for financial services: the one platform for benchmarking and communicating as an industry. We’ve already become the standard for brokers and landlords on the deal management and portfolio management side. With the funding, we’ll build more benchmarking and forecasting products, so our clients can understand how they’re doing compared to the rest of the market.

What was the funding process like?

We weren’t in the market for funding, but when Jeff Horing, co-founder of Insight Venture Partners approached us, we were blown away by how well he understood our vision. He recognized that we’re in a winner takes all market and saw VTS as the clear leader. Our numbers supported this. We have a strong history of revenue growth and market penetration. When an opportunity like that presents itself you have to move on it.

What are the biggest challenges that you faced while raising capital?

As I mentioned, we weren’t actively raising capital when Insight Venture Partners approached us. We’ve heard it’s a hard market for fundraising right now, but we were lucky to have the revenue growth and market penetration that investors are looking for at the series C stage.

What factors about your business led your investors to write the check?

VTS has proven market penetration — 8 of the top 10 management firms in the world use VTS to power their businesses, including LaSalle Investment Management; RXR Realty; Angelo, Gordon & Co. and more. Their diligence on our market share, user acquisition and growth tell the story. It’s all about the data and your growth quarter over quarter.

What are the milestones you plan to achieve in the next six months?

Our goal is to double our headcount year over year. We’re at 150 people right now, so in the next six months, we should be well over 200 people. In the next two quarters, we plan to add new benchmarking products and make headway in capturing more market share among global real estate investors, landlords and brokers. Investing in our customer base is how we’ve reached our current milestones and it’s something we’ll continue to do.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

We started with no funding. We poured our life savings into VTS just to build a prototype we could bring “door-to-door” to show people our vision. As an entrepreneur, it’s not about the money you raise, it’s about how bad you want it and how strong your vision is. When both those things are in sync you can do some very special things, most importantly build a great product that people want to pay for. After that, raising money is a lot less painful.

Where do you see the company going now over the near term?

Over the past few years, we’ve focused on building the central platform that brokers and landlords use to track deals, manage their portfolios and communicate within the industry. Our metrics in the first quarter of this year show that we’ve accomplished this. Today, 2.7 billion square feet of real estate are under management on our platform, and 80 percent of the top 10 global investment managers use VTS. With our market share, we now generate enormous amounts of data that our clients use to improve their performance. In the near term, our focus will be to marry our software with this powerful data, so our customers have the insights they need to make smart, data-driven business decisions.

What’s your favorite rooftop bar in NYC to unwind?

SoHo House is always fun, but if you’re in midtown Refinery is also great.