This may surprise you, but attacks on oil and gas manufacturers are becoming increasingly common and while a new cybersecurity company is coming out daily, few are protecting the data of industrial applications the way that Bayshore Networks is. Their protection solution covers energy, industrial, enterprise, and public services applications. The startup just raised a new round to strengthen these industries by keeping them safe.

Recently named a SINET 16 Innovator for 2015, today we chat with Evan Birkhead about the recent funding as well as the company’s novel applications for the industrial Internet of Things.

Who were your investors and how much did you raise?

Bayshore Networks raised a $6.6M Series A round from Trident Capital Cybersecurity and our existing angel investors.

Tell us about your product or service.

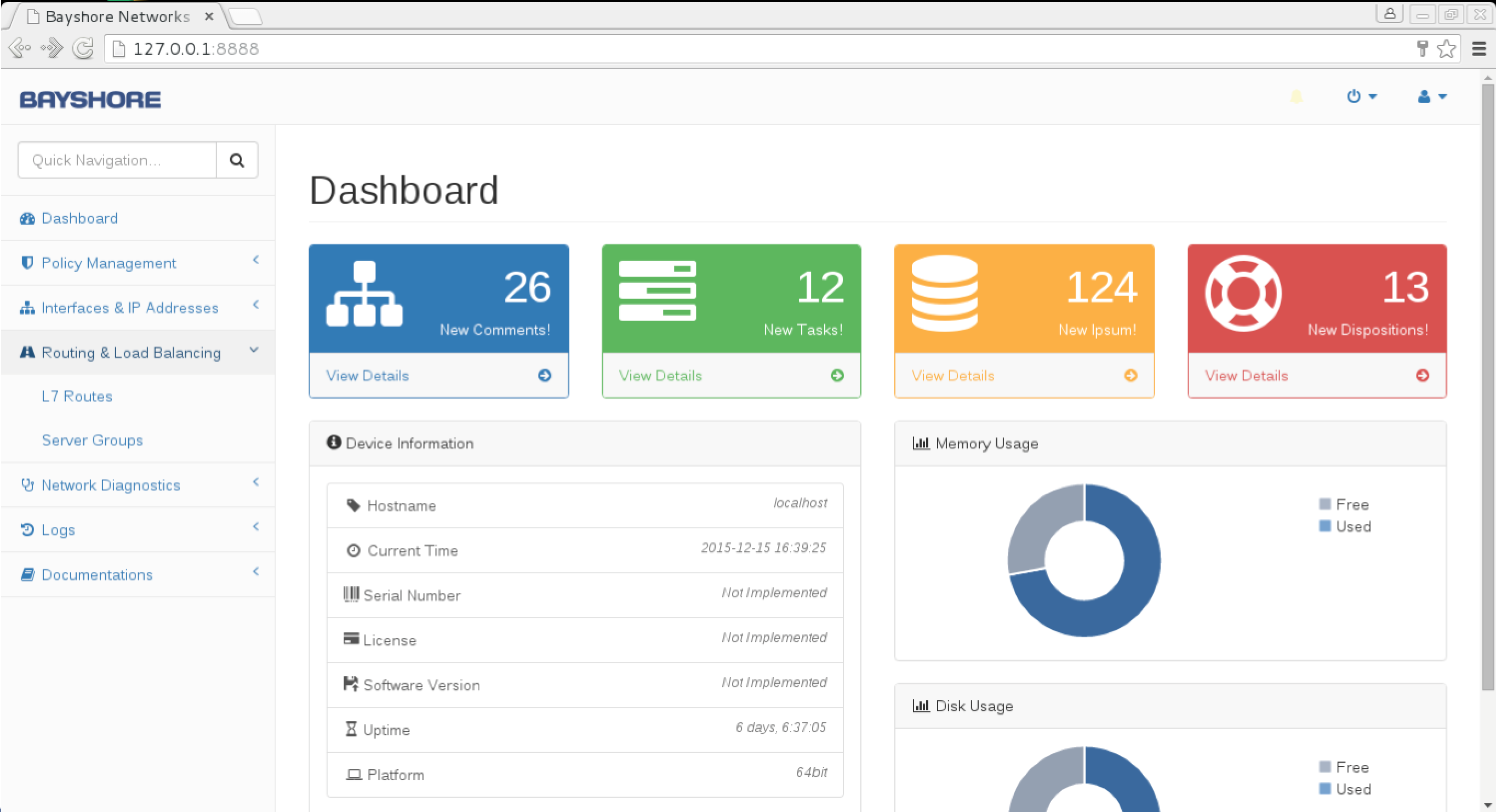

Our product is cybersecurity software for the Industrial Internet of Things. It’s designed to protect industrial machines and workers in industries such as discrete and process manufacturing, utilities, oil and gas, and smart cities.

What inspired you to start the company?

We originally developed the foundation for the security software — which eventually evolved into today’s product — for one of the leading U.S. defense contractors. They continue to be a customer today and we help them and their customers protect their critical infrastructure.

How is it different?

Industrial enterprises require a new approach to cybersecurity. Our industrial software has three primary differentiators: 1) It deploys from the cloud, 2) It is policy-based, meaning users can quickly build rules for safe and secure operations that customize to their industrial environment, and 3) It offers extremely deep inspection and filtration of network content, down to the machine transaction level. That means the software can tell when someone is trying to change the temperature, voltage, pressure, or other operations of a machine.

What market you are targeting and how big is it?

We are targeting the market for Industrial Internet cybersecurity. The term “Industrial Internet” refers to the convergence of networked applications and sensors with industrial machinery and processes. IDC projects overall revenues for Internet of Things security products will exceed $20B by 2020 at a CAGR of 16.5%.

What’s your business model?

Bayshore sells direct to Fortune 1000 end customers and via strategic alliances with some of the world’s most prominent Industrial Internet companies.

Why another cybersecurity platform?

Bayshore cloud-based solution complements existing perimeter-based and premises-based platforms. Designed for IT perimeter security, firewalls look for IP addresses and ports, which means they block attacks according to standard Internet parameters. Because industrial cyber attacks are typically based on granular machine instructions that alter sensor values, our technology is well positioned to detect industrial attacks that are often overlooked by other security technologies.

What was the funding process like?

The funding process was very complicated but very rewarding. We met many interested investors in the tech industry that we will stay in touch with.

What are the biggest challenges that you faced while raising capital?

The challenge was to grow to a certain point where we could approach VCs. Once we identified those companies that invested in cybersecurity in early rounds, we were able to focus on getting meetings and closing the round.

What factors about your business led your investors to write the check?

Trident was impressed with the presence we gained in the market with limited resources. Alberto Yépez, the managing director of Trident Capital Cybersecurity, said they were impressed with our cutting-edge cloud-based technology, our team’s ability to grow its customer base across the Fortune 100, and our track record of developing strategic alliances with world-class players.

What are the milestones you plan to achieve in the next six months?

We have set internal targets for revenues and for hiring of engineers and sales people.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Continue to work hard and focus on what you do best!

Where do you see the company going now over the near term?

Our goal is to expand our base of customers in our core verticals – manufacturing, electric, oil and gas and smart cities.

Where is your favorite bar in the city for an after work drink?

Live Bait, 23rd and Broadway. Try the Plantation Gumbo.