As a Silicon Valley venture capitalist and founder of Social Capital, Chamath Palihapitiya chooses to bet on technology companies that are focused on solving the world’s hardest problems; healthcare, financial services, education, mobile, and enterprise software. Social Capital is a partnership of philanthropists, technologists, and capitalists utilizing venture capital as a force to create value and change on a global scale.

By 2045, Chamath aspires to have impacted 25% of the world’s population, employed 10 million people, and earned a trillion dollars. A quick glance at their portfolio explains why Social Capital is one of the fastest growing venture funds in Silicon Valley history. In 2015, Social Capital raised $500 million in their third and largest venture capital fund.

Palihapitiya began his career as an investment banker at BMO Nesbitt Burns. Soon after, he joined AOL where he ran Instant Messenger. He later joined Facebook as a senior member of the management team and served in various roles at the company, including Vice President of user growth, mobile and international. Chamath is also a co-owner of the Golden State Warriors.

Recently, Chamath Palihapitiya and Pimm Fox, cohost of “Taking Stock” on Bloomberg Radio, packed a room at Bloomberg’s NYC headquarters with the first in series conversation. This conversation revolved around Social Capital’s unconventional portfolio company traits and how they tie into the social commentary of the day. Fundamentally, the focus is on redistribution and reallocation of power and resources to fuel social progress and create an equitable world.

| Portfolio Company Traits | Social Commentary |

| High integrity to live authentically, driven by inside out (intrinsic) values vs. outside in (extrinsic) values | For individuals, inside out values stem from personal experience and the desire to live life to the fullest. Usually coupled with the inherent ability to overcome conditions that hinder the self-actualized human, such as economics, politics, health, and education.

For organizations, inside out values reflect the true value of all aspects of the business, in terms of tangible and intangible factors. Money is but a lagging indicator of progress, change, and value. |

| Intellectual curiosity and firm belief that technology can enable society to function effectively | The digital age is a shift from the traditional industrial industry to an economy based on information computerization. The goal is to unlock the potential of everyone and enable a new form of human expression.

When great people, get easier access to capital, networks, healthcare, and education, new things will exist. |

| A strong sense of purpose to disrupt for the future by changing existing business models | Disruption is deterministic and is intended to change the way we think, behave, do business, and go about our daily activities. There is no magic formula to disrupt in a democratic way.

Since it is both destructive and creative, we expect that entrepreneurism will create the next class of businesses and job classes. We must avoid myopic overreaction and embrace the future. |

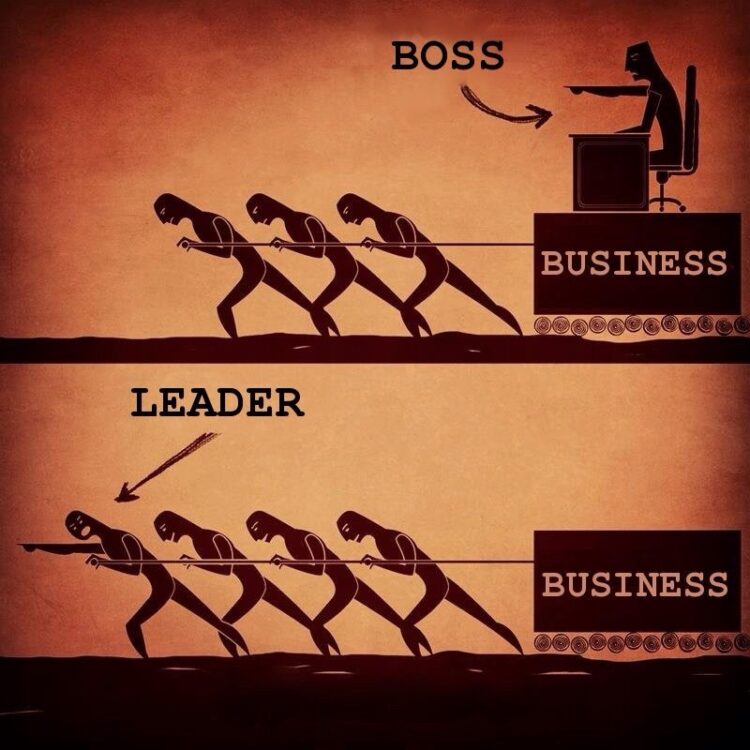

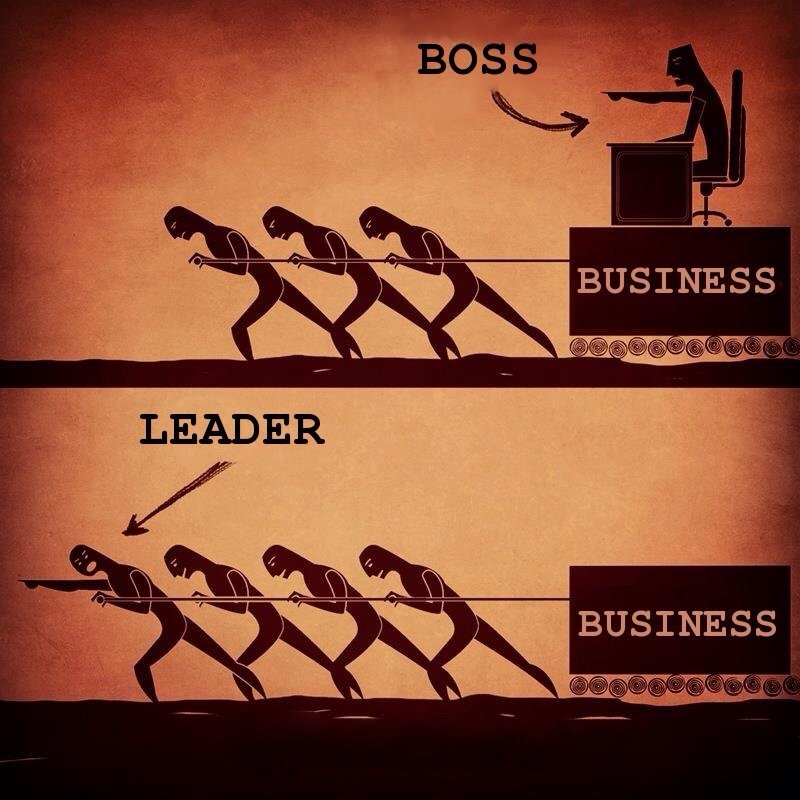

| Self-directed, complementary mix of eclectic personalities who don’t take themselves too seriously | Culture and leadership are both important. Build atop a foundation of an apolitical, candid, and transparent culture. Then experiment with the edges and push boundaries.

Use both data and intuition to make decisions. This takes courage. |

| Focused on the job at hand with distractions abstracted away; learning from mistakes while focusing on success | Society undervalues things that do not work. Attempts to disrupt will not always be successful, but leaders need to take risks to be aggressive and competitive.

Embrace change and know when to adapt vs. pivot. Growth starts when you can see room for improvement. |

Image Credit: CC by David Sanabria