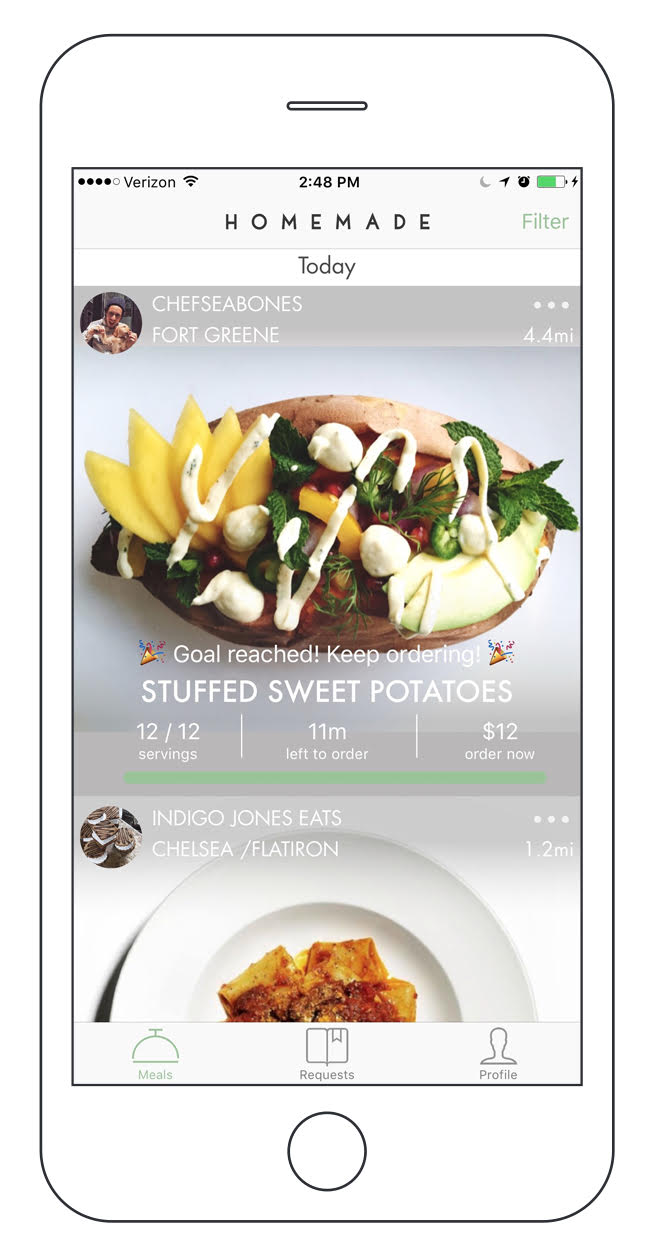

You know that friend who is really good at cooking, and when people tell them to pursue it they just shrug their shoulders humbly and give a bad excuse? Granted it’s not so simple to just start selling food but it just got a whole lot easier thanks to Homemade. The platform that allows you to seamlessly buy and sell gourmet food in your neighborhood is a win-win and may even be what gets you out to finally meet your neighbors.

We spoke with CEO and cofounder Nick Devane about his newest round of funding and chatted about how local cooks can start taking advantage of the food market.

Who were your investors and how much did you raise?

We raised a $2.3M series seed round of funding, including: Techstars Star Powers, Slow Ventures, Maveron, Third Kind Venture Capital (Shana Fisher), Maven Ventures, Scrum Ventures, Dan Rose Family Fund (Facebook), Kevin Hartz (Founder of Eventbrite),Wayne Chang (Director of product strategy at Twitter), Ken Keller (founder of IGN), Greg, Martin (founder of Jask), Huck Finn Fund, Rostrum Capital, Suren Markosian (Founder of Epic), Tom Williams (Founder of Better Company), XG Ventures, and Third Kind Venture Capital (Shana Fisher).

Tell us about your product or service.

Homemade, is a suite of software tools enabling cooks to sell food from home. Their product runs over SMS, iOS, and mobile web. It makes it easy to run your own business out of your kitchen. Scheduling, pick up times, payment processing, controlling ordering, and marketing are all things people trying to run a business need to think about. Homemade helps cooks leverage their existing networks using a combination of marketplace, marketing, and CRM toolsets.

Homemade lets people take advantage of a core competency in an extremely disenfranchising space. The average income for a cook in the US is $23,700, which makes opening a restaurant or food truck prohibitively expensive. Homemade’s mission is to empower cooks to build a personal brand and create community through food. They provide wholesome and healthy food options while fostering local community when folks interact with one another. The initial spark was my own grandmother’s cooking.

How is it different?

Our SaaS and CRM approach to marketplace liquidity separate us.

What market you are targeting and how big is it?

Initially, the restaurant takeout market, which is $70 billion.

What’s your business model?

We charge a 9% platform fee on top of every cook’s meals.

What was the funding process like?

It was long and difficult, particularly in New York. We definitely struggled with fundraising initially. The only money we we’re able to raise was from Alex Iskold via Techstars NYC, which really kept our company afloat. We presented at Demo Day to little interest from investors. The team had spent a lot of time experimenting and continuing to iterate on our strategy, execution, and product. We were learning more about the business and the intricacies of how to make our particular marketplace work. Our numbers started to jump in January, but a month later we had still only raised one smaller angel check. I went out to SF on a whim when I received an email from Naval of Angel List expressing interest in our space, but thinking I lived in the area. I jumped on a flight to meet him, and while Naval did not end up doing our deal, I reconnected with Jim Scheinman of Maven Ventures during the trip. We met Jim previously, and he quickly agreed to lead our round. We then connected with a number of amazing firms and angels that understood the value in our software first approach. I hope they are also equally excited about our vision and ability to execute.

What are the biggest challenges that you faced while raising capital?

Creating momentum and getting the first institutional check.

What factors about your business led your investors to write the check?

Traction, product, strategic approach, and vision.

What are the milestones you plan to achieve in the next six months?

Launch several new products we are pretty hyped about and some serious growth.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Keep pushing forward and building stuff people want. Raising capital is hard, but it does come when real value is created. If I were to do it over, I would’ve waited longer to try to fundraise and condense initial meetings into a tighter time frame.

Where do you see the company going now over the near term?

We’re building up our community, operations, and product teams currently. We have really big goals for the next six months, so we’re setting up an amazing team to manage the output and recent growth. We will look to create more offerings across the cooking spectrum (pop-ups, cooking lessons, office lunch catering, etc.)