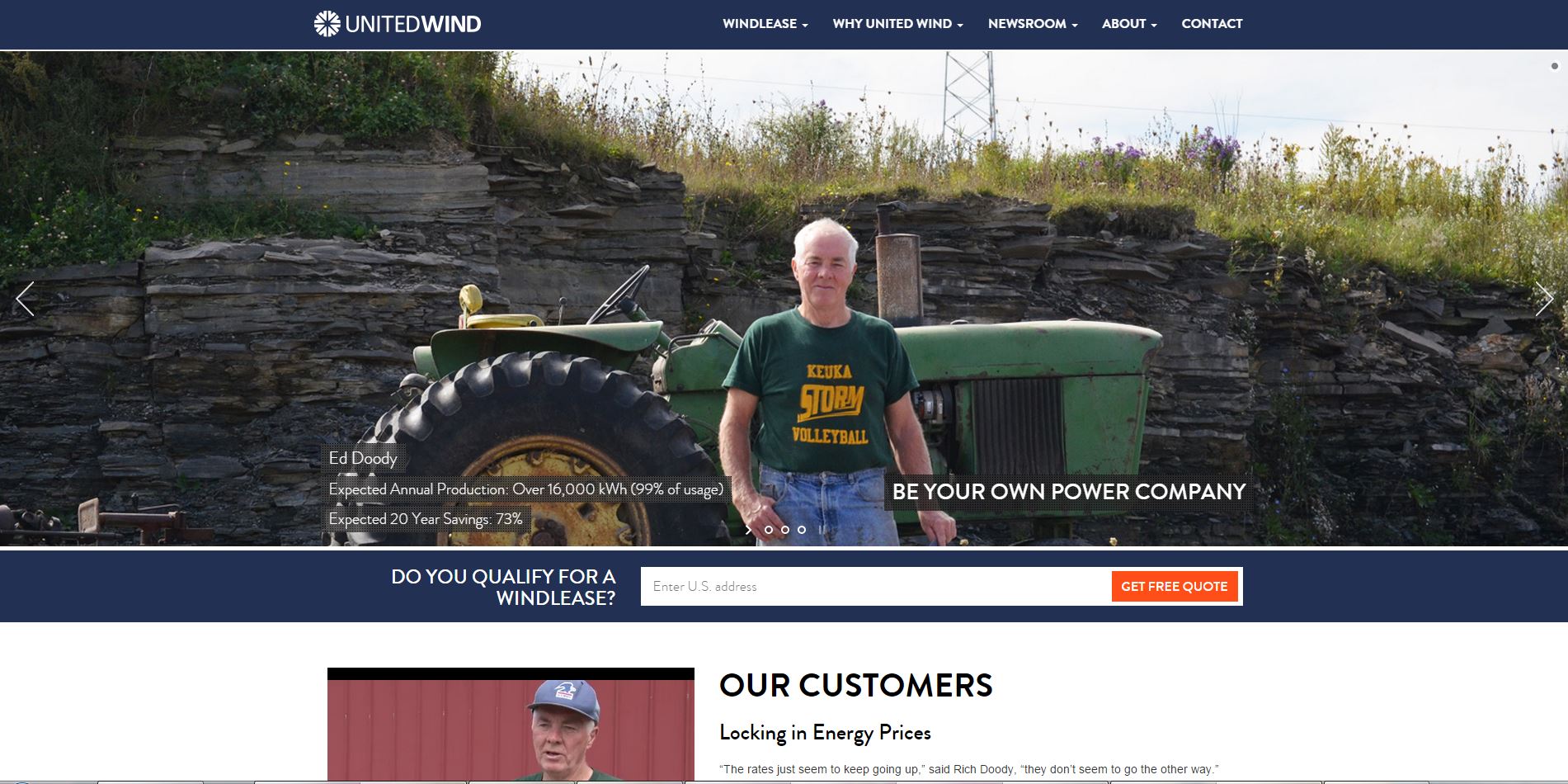

Regardless of your political leanings, everyone can admit that a renewable energy source that can power everything to our homes would greatly benefit this country. Solar energy is well known but what are our other options? United Wind, the company that is capturing wind energy is turning into a legitimate alternative. With the ability to save 30%+ on energy and help out our ecosystem it Kurt Schmitt, a happy NY customer, put it plainly that, “It’s always windy here so we decided we might as well harness that power instead of complaining about it all the time.”

We spoke with CEO and founder Russell Tencer and got the inside scoop on his newest funding round and how he is pioneering a new and fruitful industry.

Who were your investors and how much did you raise?

This was a Series B funding of $8 million. Our primary investors in this round are Statoil Energy Ventures, the renewables-focused corporate venture unit of Statoil ASA, Norway’s largest energy provider, and Forum Equity Partners, an alternative investment management and development firm focused on energy and renewables, infrastructure and real estate. We’ve also recently announced two other project capital investments, $200 million from Forum Equity Partners, and $13.5 million from U.S. Bank and New York Green Bank.

Tell us about your product or service.

United Wind is the U.S.’s only one-stop-shop for leasing a small wind turbine, providing rural markets with a low-cost renewable, distributed generation energy option.With our twenty-year WindLease, our customers can lock in savings of 30% or more on their electric bills, without having to worry about the hassles of putting up and maintaining a wind energy system.Additionally, we are able to offer many of our customers a $0 down option, and also guarantee the production of all our turbines, so our customers don’t have to take on any financial risk.

What inspired you to start the company?

I started a company called Wind Analytics, which provided low-cost wind analysis for small wind projects. It was through this company that I realized a major gap in the marketplace – that rural communities could really benefit from having a small wind turbine leasing option. Before, the only other way these people could get into renewables was through buying a turbine outright (and taking on the financial risks associated with that) or going with solar, which tends to be a less effective option for their particular needs. If you have the land, the wind resources, and the energy usage rates, wind really is the way to go – United Wind makes it a financially feasible option.

What market you are targeting and how big is it?

We target rural, windy markets with high electric costs. The potential market is huge – we’re just now tapping into the Midwest market, after refining our business model (and taking advantage of state grants) in New York.

What’s your business model?

Our local sales reps sign customers, and United Wind handles the project through installation and handle any issues that may arise during the lease term. Our investors provide project capital, meaning they buy groups of projects from us, and receive those projects’ lease payments.

Is your home wind powered? Do you notice the difference?

As I live in the Bronx, wind power is unfortunately not an option for my home! We usually need a customer’s property to have at least 5 acres to make a deal work. However, I can say that our customers don’t notice any difference between wind power and regular grid energy – both sources are integrated into a seamless system.

What was the funding process like?

We’ve been lucky enough to say that we’ve raised some significant capital in the last six months, and we’ve found that each round has gotten a little easier. We’re anticipating questions better, and have built a strong case for our product. Working with partners like Forum and Statoil makes a big difference – it’s great to work with people with experience in the renewables market, who know what the issues we face are and can help provide valuable feedback.

What are the biggest challenges that you faced while raising capital?

Being first in the industry means we had a lot to prove. Investors were passing on us every day. But once we started proving our model and hitting milestones, we were able to spark some interest. Suddenly we became appealing to the investment community, and now I’m receiving emails from interested investors almost daily. It’s a great position to finally be in.

What factors about your business led your investors to write the check?

We’re the only ones offering what we do. We’ve got the partners in place – installation experts, tower and turbine manufacturers. We also have a proven business model, with over 20 turbines up and spinning in New York State. Our investors can see that what we do works.

What are the milestones you plan to achieve in the next six months?

We plan to have installed, or started installation, on over 100 turbines. We also are expanding our sales team, looking to add about 10 more representatives across the Midwest.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

It’s all about having the right team. Bring on passionate people who are willing tostick it out, because they see the long-term possibility of what the company is trying to do.Our mission is to offer more people low-cost renewable energy, and my team believes that what we’re doing isgoing to bean important part of this country’s energy future.

Where do you see the company going now over the near term?

Right now we’re focusing on expanding across the United States, especially the wind-rich Midwest. We’re also looking to develop our own installation teams and as well as enhance our corporate structure.

Where is your favorite bar in the city for an after work drink?

Our office is located in DUMBO, and our favorite hangout is right down the street, at Olympia Wine Bar. $5 Moscow Mules during Happy Hour – you can’t go wrong!