For millennials, investing is scary. All they hear about is the economic recession of 2008 and how fragile the market is. What they need is a little bit of confidence before confronting this monster. Stash is helping this become a reality. With just $5 you can start investing, and if you ask nice enough they may just give you some real in-person advice. Furthermore, the fact that both CNN and Fox have featured Stash (and actually agreed on something) is a great indicator of the company’s continual growth.

Chatting with CEO David Ronick, we uncovered the details about the company as well as how they are using their new funds.

Who were your investors and how much did you raise?

Stash has raised $3M in seed funding, led by Silicon Valley-based Goodwater Capital, which specializes in early-stage consumer technology companies. Two leading fintech investors also participated in the round: New York-based Valar Ventures, and London-based Entrée Capital; as did previous investors in the company.

Tell us about your product or service.

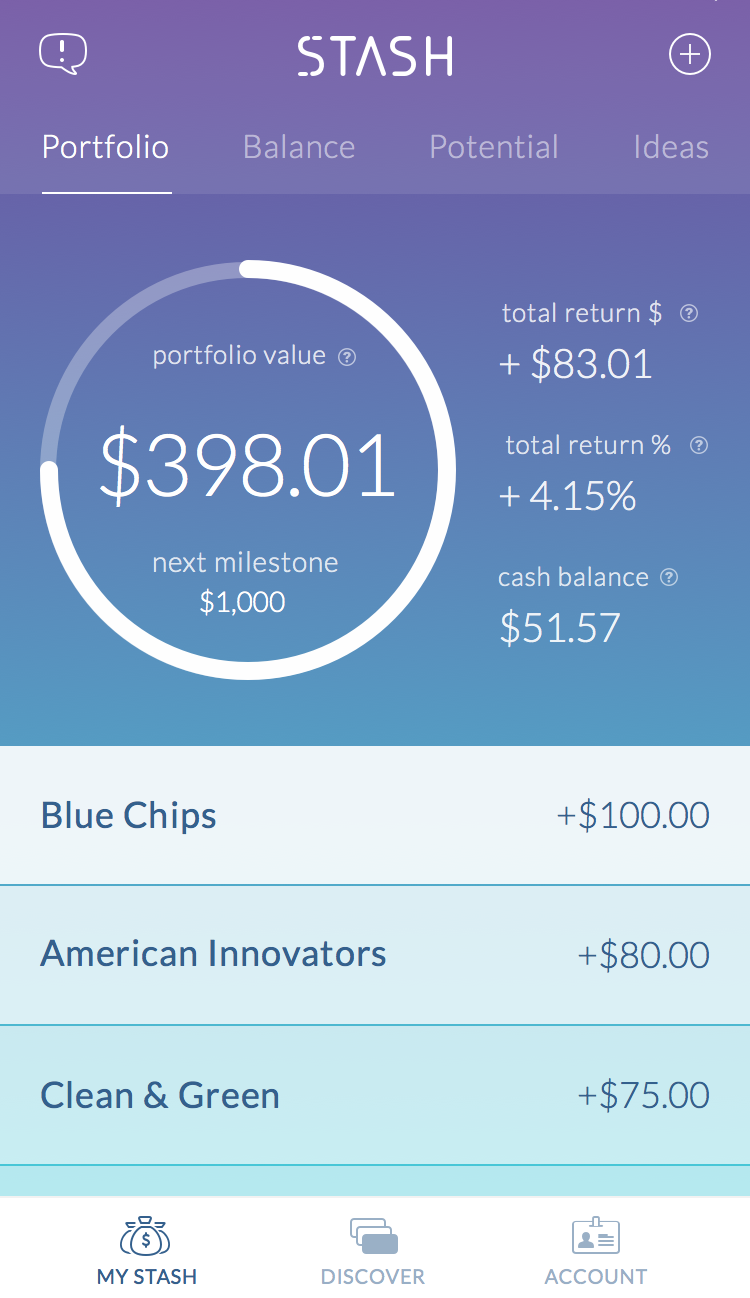

Stash is a fast-growing investment app for millennial’s. Stash helps people start investing with as little as $5, gain investing confidence gradually, and build smart financial habits for the long-term.

With Stash, you can choose investments from over 30 themes, mostly Exchange Traded Funds (ETFs). Investments are described in relatable ways, such as “Internet Titans,” (online tech giants), and “Clean and Green” (renewable energy companies). We help people start small, with as little as $5, by offering fractional shares. And we provide ongoing guidance via notifications and emails.

Stash doesn’t charge commissions for buying or selling investments and has a transparent monthly subscription fee of $1 per month for accounts under $5,000, with the first three months free; and 0.25 percent a year for balances over $5,000.

What inspired you to start the company?

Last year, we interviewed over 100 people under the age of 30 about why they don’t invest; and heard over and over that “I know I should save and invest, but don’t because I don’t know how to do it; and I don’t have enough money to get started.” We also heard that they trust technology (e.g. Venmo) more than big banks. It became clear that most people who don’t invest find it confusing, expensive and unrelatable. We realized that we were on to something and that there was a big need that wasn’t being met.

How is it different?

Unlike traditional financial advisors, we don’t require a big account balance to start investing. With Stash, you can invest with as little as $5; we do that by offering fractional shares of stocks and funds. We also have low, transparent fees, and do not charge any commissions.

While many online brokerages have lower minimums than traditional brokers, they don’t provide much in the way of advice. This isn’t ideal for inexperienced investors who don’t have enough knowledge of the market to pick their own investments. Stash has not only named and organized investments in ways that are more relatable; we also provide guidance to help you understand what you’re investing in.

Unlike “robo advisors”, Stash helps you become an investor, and make your own, informed choices about what to invest in; you’re not handing your money over to a black box.

What market you are targeting and how big is it?

There are over 80 million millennials (18-34). Studies show that 74 percent don’t invest at all. It’s also a big opportunity because millennials are set to inherit $30 trillion.

What’s your business model?

We charge a subscription fee of $1 per month, which is waived for the first 3 months. Once your account balance reaches $5,000, we switch to 0.25% per year.

You raised a round fairly recently in August, what brought on the need for additional capital at this point?

Our first round funded critical early activities, like getting registered with the SEC, designing and development our fully-functioning investment service, and attracting a solid base of early customers.

What was the funding process like for this round?

We had solid early traction, and we’re in FinTech – a space that’s getting a lot of attention, so connecting with the right investors was pretty straightforward. Goodwater Capital had developed a thesis around our market, and called us to get acquainted late last year. As we dug in together, it became very clear that we shared a vision for the opportunity and how to approach it.

What are the biggest challenges that you faced while raising capital?

It was pretty efficient for a capital raise, but the process always takes a lot of management time and attention, so it becomes hard to juggle that and focus on the business.

What factors about your business led your investors to write the check?

We’ve taken a unique angle toward helping millennials save and invest their money – including a very easy and affordable way to get started, choosing your investment themes, and providing education and advice. That, and our initial traction helped a great deal.

What are the milestones you plan to achieve in the next six months?

We’re excited to continue the growth and development of the app, including new product features and expansion to the Android platform.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Pick a big, growing market, focus on solving an important problem for your customers, run experiments quickly and constantly, and when you find the right formulas, sprint like hell to get results.

Where do you see the company going now over the near term?

We’re excited to bring on top talent, to continue learning about the needs of our customers, and to improve and expand our offerings.

Where is your favorite bar in the city for an after work drink?

The Hideaway in Tribeca.