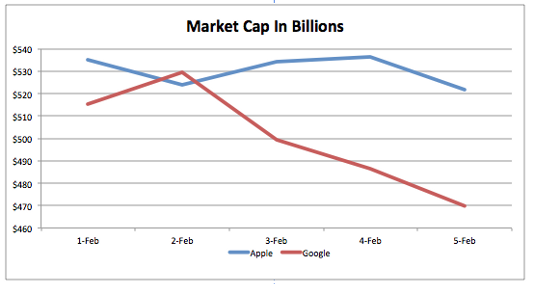

On Monday February 1st, after the market closed. Google reported blow out earnings. In after hours trading Google’s shares immediately rose by more than 8%, giving the company a market cap of $560 billion, almost 5% above the $535 billion dollar market cap sported by Apple at the time. After a four-and-a half year reign by Apple as the world’s most valuable company, which started when Apple surpassed Exxon on August 11th, 2011, Google was n0w the world’s most valuable publicly traded company in the world.

However, by 10a.m. on February 3rd, a mere 42 hours after Google’s reign began, the market was turning south, taking Google’s shares with it. As Apples shares were falling at a slower pace, Apple regained it’s place as the world’s most valuable company. By the end of the week, as the market rout continued, Apple’s market cap was 10% bigger than Google’s.

Let’s Focus On Tech Companies

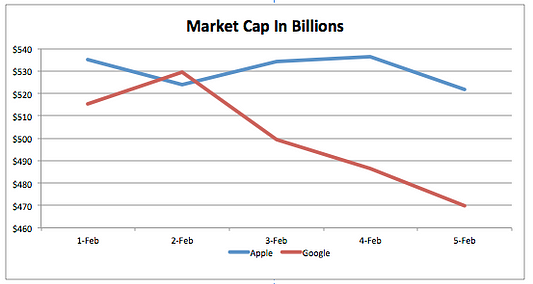

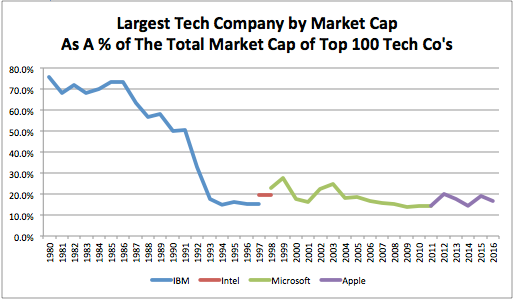

While tracking the largest market cap company is interesting, as a VC, I’m most interested in tracking market cap of tech companies. To that end, my favorite graph of the last year is this brilliant interactive graph published in The Economist. The graph takes the total market cap of the top 100 tech companies, and then calculates the share of that total market cap of of each of the those top 100 tech companies. In the graph below, in 1980, IBM accounts for an incredible 75% of the total market cap of the top 100 tech companies. As the picture below is static, I highly recommend clicking onthe link and playing with the graph.

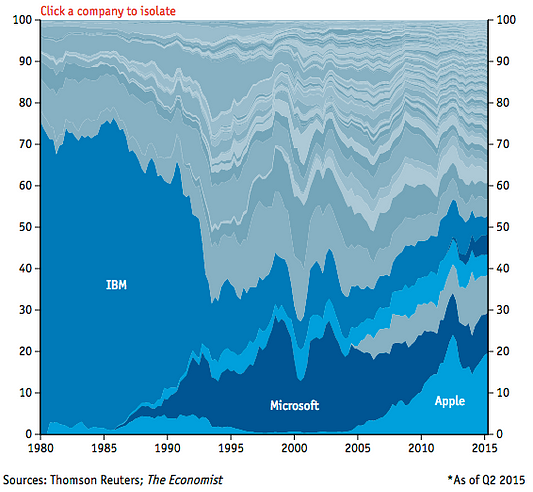

IBM’s remarkable 75% share of total market cap in 1980 was the peak percentage of the total market cap that IBM, or any other company, ever achieved. While Microsoft went public in 1986 at #11 out of the top 100, IBM continued to hold the #1 position until it was toppled by Microsoft in Q2 ’96. However, Microsoft held the top position for only two quarters, before it was surpassed by Intel. Intel held the mantel of top tech company by market cap for only two quarters, before ceding the top spot back to Microsoft. Microsoft then held the #1 spot for the next 13 years before Apple surpassed Microsoft in Q3 ’10 to achieve it’s place as the most valuable tech company in the world. Apple held that spot for over five years before Google passed it for 42 hours.

In the chart below, I simply isolated the data from The Economist chart to highlight just the #1 tech company by market cap over time, as a % of the total market cap of the top 100 tech companies.

Lessons Learned

Cogitating over the data mostly confirmed lessons I had already learned, that at this point, are really cliches. But there were some new insights.

Lesson #1: The first cliche confirmed the notion that there is nothing constant but change (a quote credited to the Greek philosopher Heraclitusaround 500 BC). IBM held the top spot for many years before the chart started in 1980. In 1960 IBM was the 5th largest company by market cap in the U.S.. No other tech company was close. Then we changed from the mainframe era to the PC era, and the baton of largest tech company was passed from IBM to Microsoft. When we moved from the PC era to the mobile era, the baton was passed again, from Microsoft to Apple.

The cliche that nothing is constant but change runs counter to a thoughtfulrecent article in the NYT that argued that the Top 5 tech companies by market cap (Apple, Google, Microsoft, Amazon and Facebook, which are also all in the top 10 companies by market cap in the U.S.), are poised to “continuing to win”. The writer, Farhad Manjoo, makes some great points, but I bet it often looks like the incumbents are well positioned. Maybe things are different this time. Maybe Heraclitus’ reign of change only lasted 2,500 years.

Lesson #2: The second cliche is that leaders from one era do not lead the next. IBM had a great run, and then let Bill Gates own the operating system of the PC (doh!). Balmer totally wiffed on mobile. If the next platform is AR/VR, Google, Facebook, and Apple are all trying be players and not miss it like their predecessors have.

Lesson #3: The third cliche is that change is happening at an ever increasing rate. IBM held the spot for more than 50 years. Microsoft held the top spot for 13 uninterrupted years. Apple held it uninterrupted for 5 1/2 years.

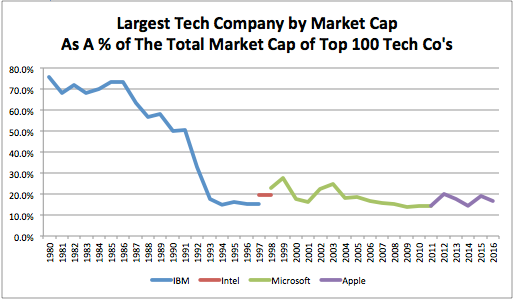

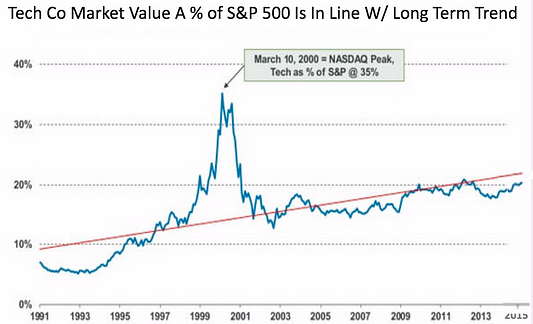

Lesson #4: This was the surprising one. We all know that technology is an ever increasing part of the economy. The best graph I’ve seen representing that (which I’ve referenced in my “Are We In A Bubble” decks) came from Mary Meeker’s annual blessing to the tech community of her insights in to internet trends:

The graph highlights how tech companies grew from less than 10% of the S&P market cap to over 20% in the last 25 years. Yet if we look again at the this graph…

…we can see that while the while IBM accounted for 75% of the tech market cap in 1980, and Microsoft accounted for 25% as late as 2003, in 2004 Microsoft’s share dropped to 18.2%. Over the subsequent 13 years, the percentage of total market cap controlled by the largest company has been range bound, between 13.8% in 2009 and 19.8% in 2012. I estimate that Apple’s #1 share now stands at 16.6%, barely changed from the 18.2% share controlled by then #1 Microsoft in 2004. So while the total tech market cap has grown dramatically over the last 13 years (the last few months not withstanding), the share of that growing market cap controlled by the largest company is staying pretty steady. So while individual verticals are often winner take all, it turns out there are lots of big winners. While the bigger winner is winning more in terms of market cap, their share of the total market cap pie, is pretty steady.

How Much Longer Will Apple Reign?

I wrote a post in August, “Google’s Alphabet Soup”, about Google’s major overhaul of it’s corporate structure to make it “cleaner and more accountable”. I think all corporations have to think about the antiquated ways they’re organized if they want to compete in this world of increasingly rapid innovation and disruption. Google’s new structure was implemented to improve the odds of success in its numerous moonshots (self driving cars, robots, AI….). Facebook is also innovating at a pace and a scale never before seen. How long will Apple reign? Who would I put my money on to replace Apple? My guess is that in five years, Apple’s reign will be long over. In other words, my money is with Heraclitus.