In late 2013, Aileen Lee wrote a seminal article in TechCrunch where she coined the term “Unicorn” as a “U.S. based software company”. It began in 2003 and was valued at over $1 billion by public and private investors. In the article, it was noted that only 39 Unicorns had been created in those 10+ years. In 2015, 26 Unicorns were created through April, expanding Unicorns to include companies outside of the U.S. This means that we are on pace to create 78 Unicorns this year alone. A pace that is more than 20 times faster than the period from 2003–2013.

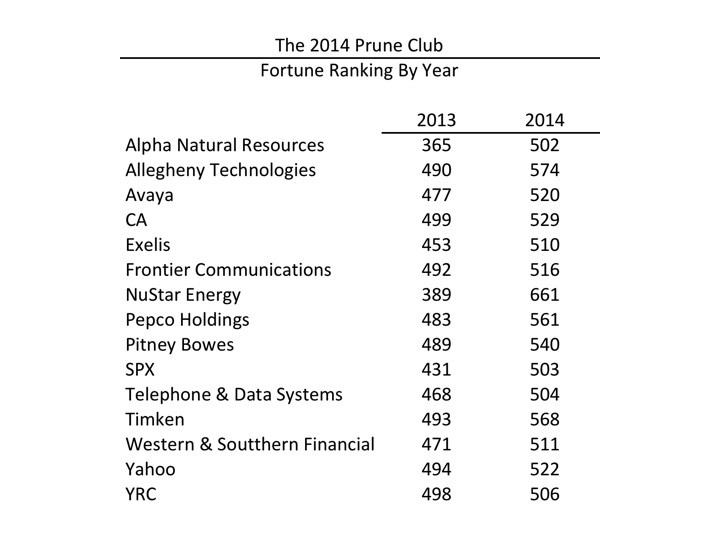

Yet for all that has been written about the rise of the Unicorns, there has been much less written on the flip side of Unicorn creation—the companies being disrupted by Unicorns. When Facebook created $200+ billion in shareholder value, some of that value creation was new and was created to make the world more efficient. However, much of that value is taken from the shareholders of other companies. In Facebook’s case, one big loser, in terms of total value lost to Facebook’s better advertising platform, is Yahoo. The value of Yahoo’s business has been falling for years. For instance, an indication of Yahoo’s demise was when it fell out of the Fortune 500 last year (falling from 494 to 522 on the list), while Facebook’s ranking rose dramatically (from 482 to 341). I refer to companies like Yahoo that fall out of the Fortune 500 as “Prunes”, because, largely due to lack of innovation, they are literally shriveling before our eyes.

But Yahoo was far from the only “Prune” created in 2014. In total, there were 30 companies that fell off the list in 2014 from the list in 2013. Half of those companies fell out because they were acquired, or had some other financial machination. The other half fell out because they lacked the ability to innovate and keep pace with the Unicorns or other more innovative companies.

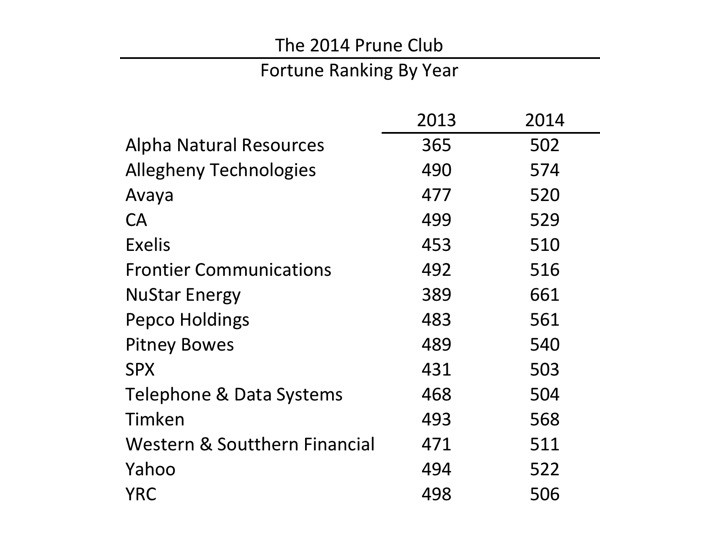

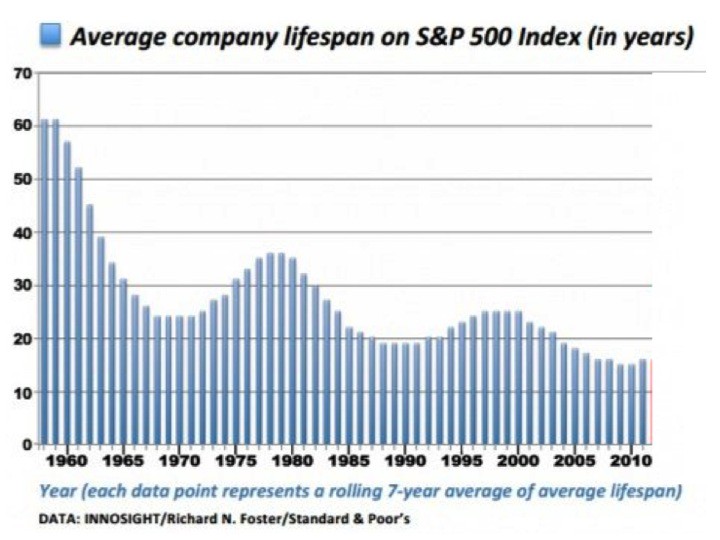

Just as the pace of Unicorn creation, the pace of “Prune” creation has been rising for a long time. The table below shows that there were 30% fewer companies remaining in the Fortune 500 from the class of 1995 15 years later. They were still around from the class of 1965 15 years after:

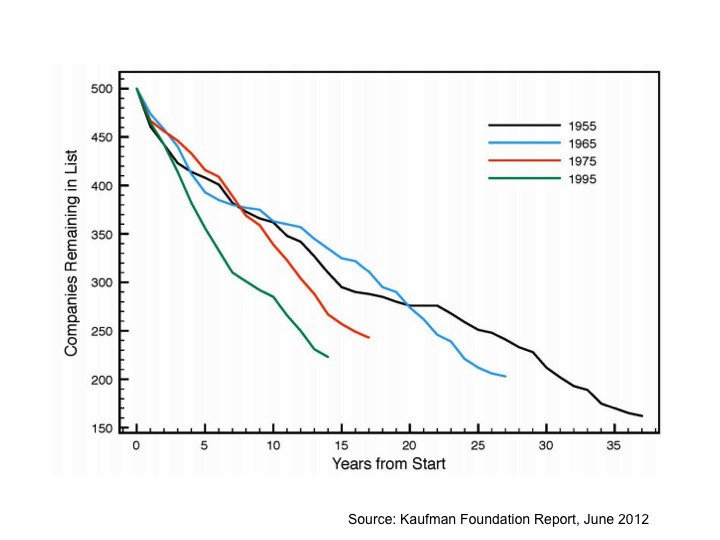

The same phenomenon is true for the S&P 500, which has seen the average lifespan drop by over 70% over the last 50 years:

Now if you looked at the amount of money spent on driving innovation, it seems that the largest companies have had a massive advantage over the disruptors:

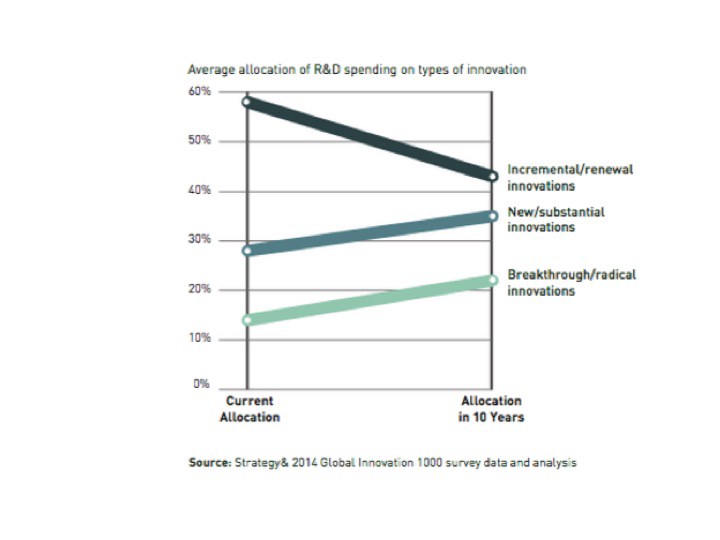

But as we know, money spent does not equate to innovation. Most notably, the majority of R&D is spent on driving incremental innovation. This makes existing products a little better, not driving the kind of breakthrough innovation that drives disruption:

In the graph above, it is interesting to see that corporations are aware of the need to shift the allocation of R&D dollars to more breakthrough innovation. But the amount they see allocated in the future is still a small minority of the R&D spend. This shift will happen over ten years, during which many Fortune 500 companies from the class of 2015 will already have achieved “Prune” status.

As earlier noted, money spent on acquisitions is the second biggest bucket of dollars spent driving innovation. But as Clayton Christenson, the author of The Innovators Dilemma, wrote in a 2011 Harvard Business Review article, “…study after study puts the failure rate of mergers and acquisitions somewhere between 70% and 90%.” So M&A struggles to drive the needed innovation to avoid becoming a “Prune”.

Corporate VC is growing rapidly, much as it did leading up to the bubble in 2000. However, as HBS Professor Josh Lerner wrote in another HBR article in 2013, “The median life span of corporate venturing programs has traditionally hovered around one year.” So Corporate VC struggles to drive the desired level of innovation needed to avoid becoming a “Prune”.

An area that appears to hold promise to drive corporate innovation is Corporate Accelerators and Incubators. While most corporations choose to run their own Accelerators, a growing number of corporations are hiring organizations like Techstars and StartUp Bootcamp to run their Accelerators. I recently gave a TEDx talk on Corporate Accelerators, and highlighted seven things that corporations should do to maximize the innovation impact of the programs.

Corporations need to take advice from Mike Tyson who famously said before a fight with Larry Holmes: “Everyone has a plan, until they get punched in the mouth”. Running an accelerator program is tough. You will get punched in the mouth. many times. So you have to enter with a long-term plan, iterate it, and never give up. Turner started Media Camp with much fan fare in March of 2012, only to shut it down last December. It got punched in the mouth and folded.

Another obvious thought, if you want to be more like a start-up, is to get help from an outside organization to run the accelerator. Get buy in and participation from the CEO, as well as line managers. Have KPIs for the programs like any other part of the organization. House the incubator close by, so it can be easily visited by the organization. But do not house it within the organization, or the startups will become more like the organization instead of the other way around.

The last thought on running a successful accelerator program uses donuts as an analogy to make a point. If you were given a box of donuts, like the one pictured above, and asked to pick one, you would feel pretty sure you were in for a treat. But what if I gave you a second box that looked like the one above, and told you that half the donuts were 30 days old. You would feel much less confident about getting a tasty treat. In fact, you would want to touch the donuts first if you could before you had to choose. Well, choosing startups to participate in an accelerator program is like picking a donut from that second box. A lot of startups look good from the outside until you take a bite. Thus the curation of companies for the accelerator is key to the accelerators success. So choose wisely and creatively. One good example is 9MileLabs, which takes 18 startups in each class, and then Windows 9 after two weeks.

Yet even if the corporation follows the best available advice for driving disruptive innovation, many will fail, and the pace of “Prune” creation will continue to increase. This is because most Fortune 500 corporations were simply not set up with disruptive innovation as a core competency. It was not necessary for the successful evolution of corporations. But the world is changing at ever faster speeds. Unfortunately for the “Prunes”, most can not keep pace. But they will continue to spend trillions of dollars trying.

Image credit: