In following yesterday’s piece on the 13 Unicorns in NYC, today I take a deeper dive into the composition of these startups as well as some trends in the NYC unicorn universe. We break down our data to a few key segments that include funding, industry, capital efficiency, valuation, and team.

This list was compiled from data retrieved on 1/20/16 from our friends at CrunchBase and does not include companies that underwent liquidity events (acquisitions or IPOs). Educational data was extrapolated from publicly available sources including LinkedIn and Wikipedia.To keep the focus on traditional tech-enabled startups, real estate companies were excluded from this analysis

CLICK HERE TO SEE EVERYTHING YOU EVER WANTED TO KNOW ABOUT BUILDING A NYC UNICORN

Summary of the Analysis

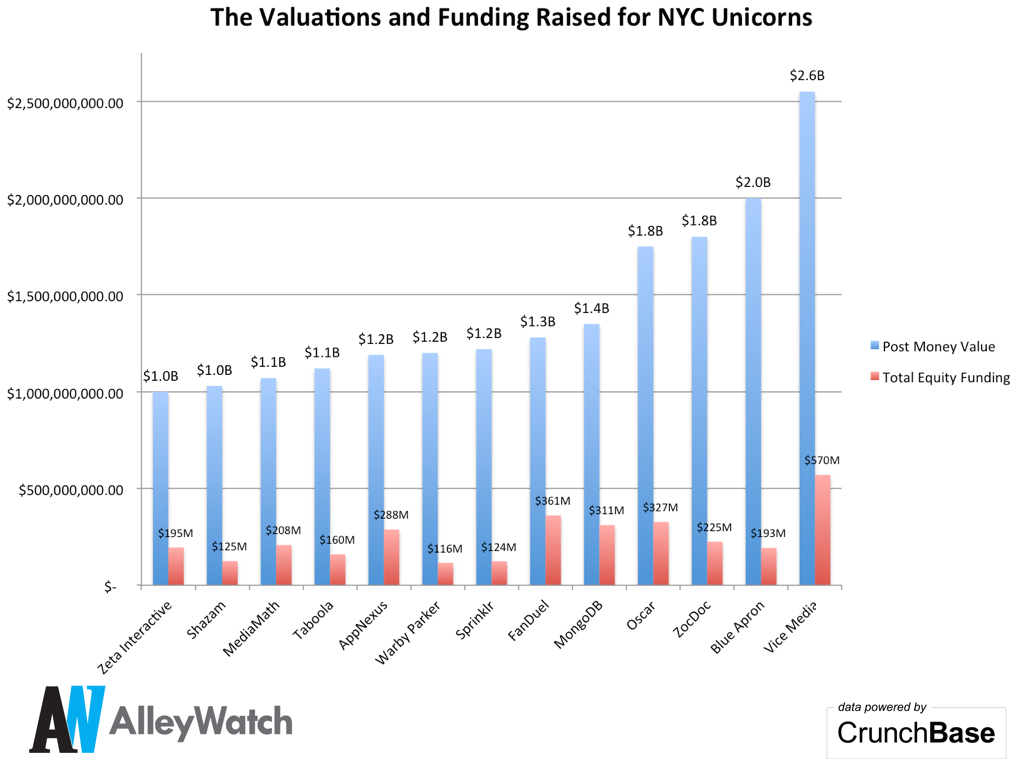

There are 13 active unicorns in NYC that have post-money valuations exceeding $1B as of the last raise TWEET THIS

The total post money valuation of these companies was $18.6B TWEET THIS

The oldest unicorn in this set was founded in 2002

The median post money valuation of these companies was $1.22B TWEET THIS

The average post money valuation of these companies was $1.4B TWEET THIS

The unicorns in NYC have raised a total of $3.2B in equity funding TWEET THIS

The unicorns in NYC have raised an average of $246.4M each TWEET THIS

46% of unicorns in NYC were started in 2007 TWEET THIS

The average age of a NYC unicorn is 8 years TWEET THIS

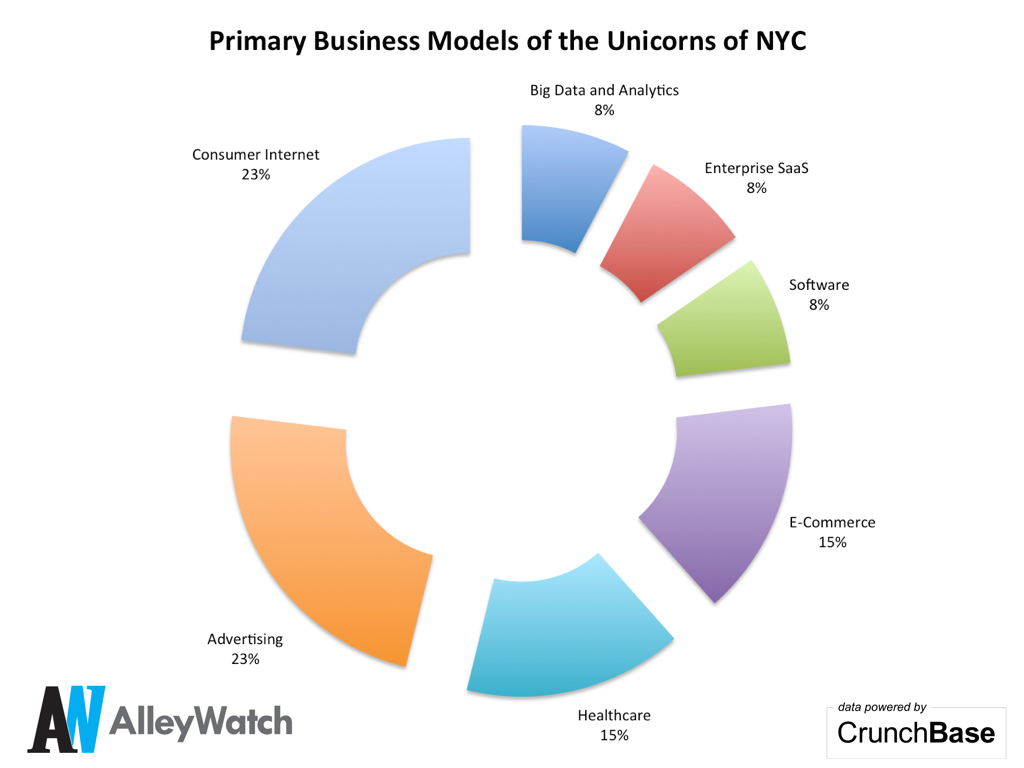

Industry

Consumer internet and adtech companies comprised the largest number of unicorns in NYC; followed by healthcare and ecommerce.

23% of the unicorns in NYC are focused on consumer internet TWEET THIS

23% of the unicorns in NYC are focused on adtech TWEET THIS

15% of the unicorns in NYC are focused on healthcare TWEET THIS

15% of the unicorns in NYC are focused on ecommerce TWEET THIS

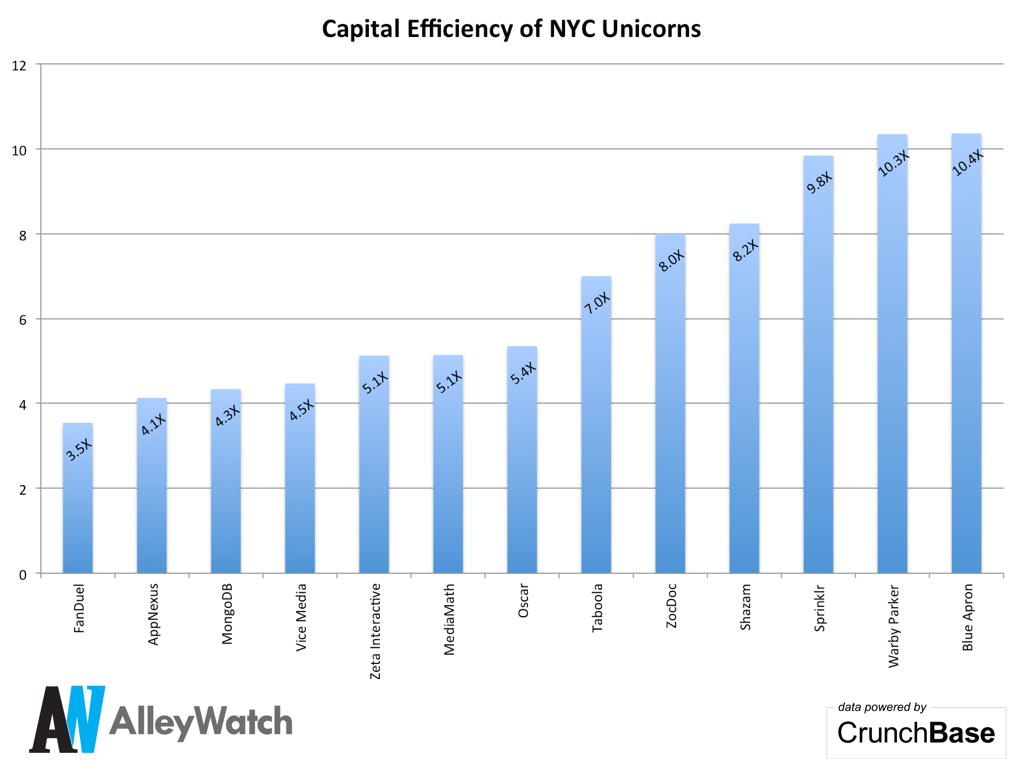

Capital Efficiency

Ecommerce companies are the most capital efficient startups in our set and adtech companies were the least efficient. The average capital efficiency in this set was 6.18x. Capital efficiency is measured by total post money valuation divided by the total equity funding raised.

Ecommerce unicorns deliver the highest multiple (10.35x average) of valuation over capital raised. TWEET THIS

Adtech companies deliver the lowest multiple (5.42x) of valuation over capital raised in instances where there were multiple unicorns in an industry classification. TWEET THIS

Blue Apron was the most capital efficient unicorn on the list (10.36x) TWEET THIS

FanDuel was the least capital efficient unicorn on the list (3.55x)

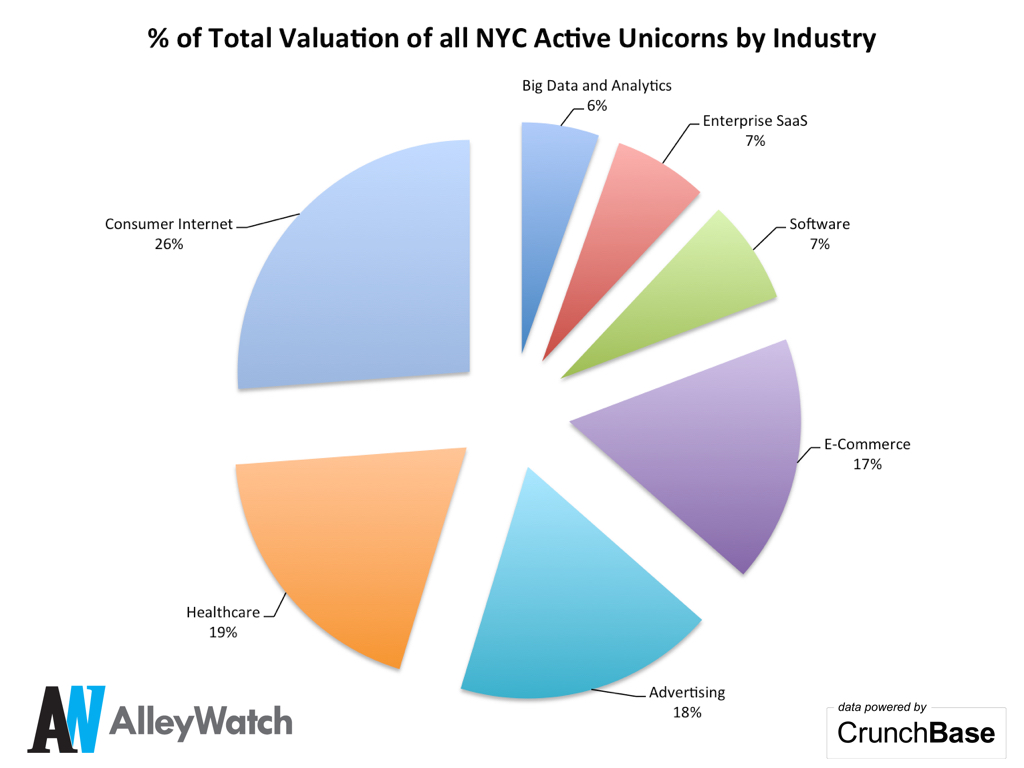

Valuation

The total post money valuation of these companies was $18.6B. Of that aggregate amount, consumer internet drives the most value; followed by healthcare, advertising, and then ecommerce.

26% of the valuation of the unicorns in NYC is derived from consumer internet startups TWEET THIS

19% of the total valuation of the unicorns in NYC is derived from healthcare startups TWEET THIS

18% of the total valuation of the unicorns in NYC is derived from adtech startups TWEET THIS

17% of the total valuation of the unicorns in NYC is derived from ecommerce startups TWEET THIS

Team

Education and the quality of that education played an important role in the development of our data set with a majority of founding teams having an Ivy League educated founder and an MBA on the founding team. Gender diversity remains an issue.

Only 1 unicorn in NYC was founded with a solo founder. TWEET THIS

54% of unicorns in NYC have at least one Ivy League educated founder on the team. TWEET THIS

69% of unicorns in NYC have at least one MBA on the founding team. TWEET THIS

Only 1 unicorn in NYC has a woman on the founding team. TWEET THIS

Only 1 unicorn in NYC has a founder who dropped out of college. TWEET THIS

Image credit: CC by Dawn (Willis) Manser