Finances are important for everyone and if you are smart enough to think ahead, you need to think about retirement. The only problem is that an easy to use retirement calculator that is also flexible is hard to come by. With OnTrajectory you have your answer. Their platform sets out a viable financial plan to follow to be financially stable in unstable times. With their simple platform you’ll be putting money away like it’s no ones business!

Founder and CEO Tyson Koska speaks with AlleyWatch about the path to stability as well as what makes their product a serious contender in a larger market.

Tell us about the product or service.

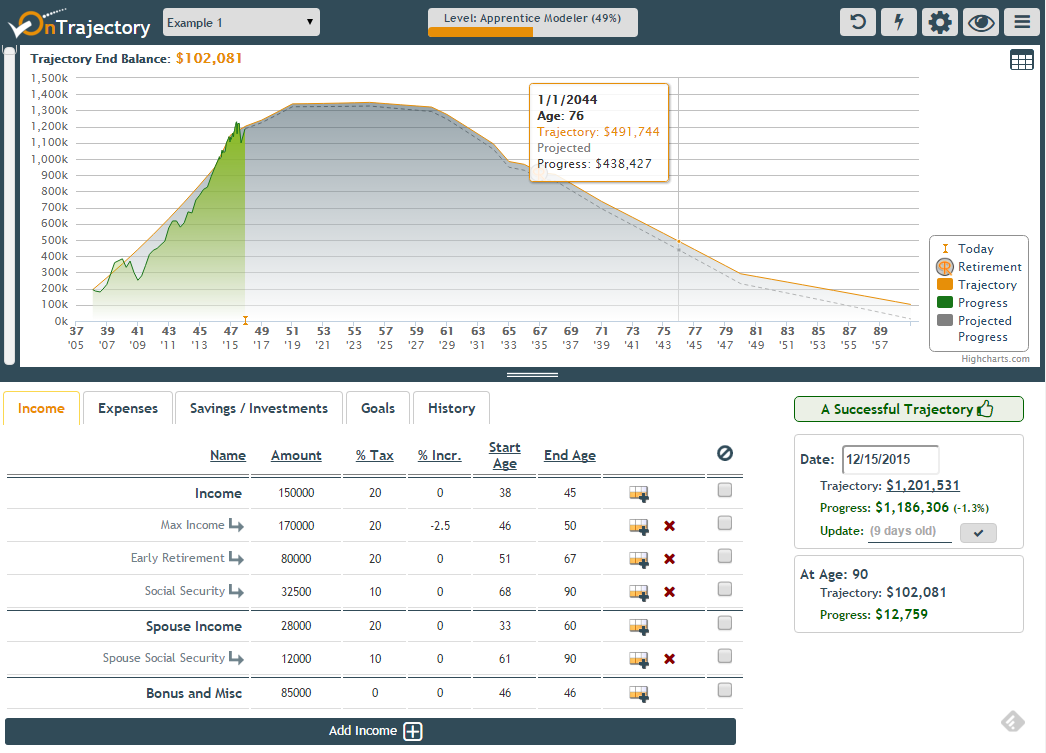

OnTrajectory serves as your personal ‘Financial GPS’ — it reveals the path your income, expenses & assets are taking you, and it gives you the ability to guide your finances towards a fiscally-healthy future. OnTrajectory functions as financial cash-flow tool, retirement planner, 401k/IRA and 529 planner all-in-one. Our software is great for financial pros and beginners alike.

Users can sign up for OnTrajectory for free and begin molding their financial future right away. We also have an active blog, Facebook, Twitter, and Google + pages to promote ways to improve users’ lives financially and to encourage folks to interact with us on social media.

How is it different?

Unlike other products that require the entry of dozens of technical financial elements, OnTrajectory displays results after just 4 questions. Users are subsequently rewarded for adding detail about their financial situation, which produces more accurate and realistic results in turn. Also, OnTrajectory does not focus on narrow questions like: “What number do I need to retire?” or “How much will my kids need for college?” – we address the central concern: “Where is my money taking me?”

What market are you attacking and how big is it?

In the United States, approximately 96 million people are between the ages of 30 and 49. Of that population, about 23% use the Internet not only for Banking, but also for other Financial Services such as account ‘aggregation’ and budgeting. This 20 million population is our target market. This group includes those who are just beginning families to those in their prime earning years who are beginning to focus on retirement, or potentially early-retirement. These are individuals comfortable with technology, yet old enough to have assets and responsibilities that require adequate financial planning.

What is the business model?

We are pursuing three monetization channels:

Paid Subscriptions — A monthly or annual fee to unlock our “PowerPlan”. This plan allows users to tailor their financial details more granularly than free users.

Targeted Ads & Offers — Free users will be presented various ads/offers as they pertain to them.

Licensing — OnTrajectory will be the “Google Maps” of the financial services world. Partners can ‘plug-in’ an individual’s data to show them a map of their future.

What inspired the business?

Our Founder & CEO, Tyson Koska, was looking for a financial retirement calculator that was both easy-to-use and maximally flexible. He was unable to find anything that suited his needs — and so, as a software engineer himself, he decided to build one. Two years later and with the help of several partners, OnTrajectory is building on that vision to help people more easily plan their financial future.

Could this not just be a feature set in an offering for a larger company?

The complexity of the problem requires a highly sophisticated tool to deliver correct results. Although some larger financial institutions do have offerings in this space, since it is outside their core business, the tools are too rudimentary to provide the value that OnTrajectory provides.

What are the milestones that you plan to achieve within six months?

To reach 10,000 active free users and 100 paid users.

What is the one piece of startup advice that you never got?

I think just about all the advice that can be given has been given, but what I would say is the most important piece of advice I received, and which I should’ve taken more to heart is that to be successful you need patience.

If you could be put in touch with anyone in the New York community who would it be and why?

Probably Fred Wilson from Union Square Ventures. He’s an icon of success and would love to tap his mind for advice and information… and perhaps to seek some funding as well! USV has successfully funded so many huge websites and services that are part of our everyday lives — we would like to be one of them.

Why did you launch in New York?

New York is where the majority of our teammates live and we also operate here because of the value that NYC brings with its many VC firms, angel investors, co-working spaces, and even accelerators.

Where is your favorite fall destination in the city?

Central Park is probably my favorite in New York City because the foliage and landscape are beautiful, especially as the leaves turn from green to reds, yellows, oranges, and browns.