In this post we are talking to Christine Carrillo, co-founder and CEO of Impact health, Techstars ’15 company from Los Angeles.

1. What is Impact Health in 140 characters?

Impact Health helps consumers select and buy optimal health insurance.

2. Why did you start the company?

A friend of ours came to us for help, trying to understand why his family’s costly plan did not cover his medications or doctors. Since we had been in healthcare for 14yrs helping health plans and the government with large initiatives, he thought we could easily figure this out. Actually, we also thought it would be easy to figure out.

Were we wrong. It took us hours to do the research and data analysis to do a thorough comparison. Once we finished our assessment, we had to break the bad news to him that his plan was not going to ever cover his medications or doctors, and we suggested a lower cost plan that would do that immediately. We saved him $9000 by switching plans. This led us to starting Impact Health.

3.What does your product do?

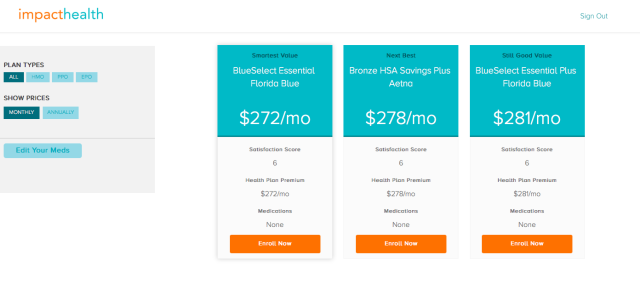

Our vision is to make buying health insurance online simple and transparent. We basically do all of the research and data analysis for you, removing the stress of choosing a plan.

Realizing that no one health insurance fits all, we take a personalized approach to finding consumers the best plan. In a few simple steps, a consumer enters in their healthcare usage, and Impact health scans all of the Health Exchange (Obamacare) plans and Private insurance plan options to recommend the best health insurance plan with the biggest value.

We’ve reduced buying health insurance from hours of research to just 5 minutes.

4. What is the technology behind Impact Health?

We’ve developed an algorithm that takes customer data points, such as medications they take, and number of doctor visits, to provide consumers transparent costs and help them choose the right plan. The more we learn from our customers, the smarter our algorithm is getting.

5. Why would a customer buy from your vs. a competitor?

We decided early on that we did not want to be biased like a traditional broker or other web portals by only offering a few plans. We offer every plan choice that is available to you.

Our data analysis also takes into consideration other data points that our competitors do not, such as your specific medications. In addition to finding plans that cover these medications, we can analyze which health plan pays the most for those medications. Lastly, we are as simple to use as it gets!

6. What are your key KPIs and how did you choose them?

Our focus is on number of customers that buy health insurance, and MRR. These two metrics help us continuously measure and improve on simplifying the health insurance experience for our customers.

7. What is your long-term vision for the company?

Health insurance is such a huge purchase with millions of people having to purchase it directly online each year. We want to bring more transparency to that purchase by including forecasted costs of conditions, and bridging the gap between providers and health plans. We want to empower each consumer to know exactly what they are buying, and why.

8. What is your advice to other founders?

Competition can be tough to ignore. If you’re going to obsess about something, only obsess about what you’re doing, not what your competitors are doing.

I find this to be one of the hardest things to do, but it helps us to stay focused on building a better product for our customers and staying on track with our mission, rather than constantly looking in the rear view mirror at what everyone else is doing.

As a brilliant mentor of ours, Alex White, told us – “No one really knows what they’re doing. The best thing you can do is to stay focused on what you’re doing, and not try to be what everyone else is trying to be.”