Upon news of WeWork’s latest fundraise at the $10 billion level, I immediately got déjà vu that I was experiencing the Internet bubble again. Didn’t we experience a colocation correction in 2002 that saw the likes of Exodus, the $30 billion market darling, go bankrupt? Isn’t WeWork an almost eerie analogy just substituting people for servers?

Let me start out by saying I was a WeWork member for the past 9 months and it was not a bad experience. Although it did remind me more of a college’s library-scene where students congregate in common areas to do anything but study. Most of the people I encountered were operating startups I had never heard of – despite the fact that I’m an active early stage investor.

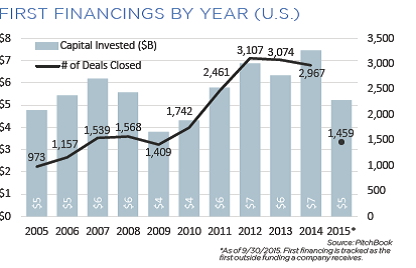

WeWork has brilliantly capitalized on the Amazon Web Services (AWS) fueled “seed surge” as coined by First Round. AWS has made starting a company almost effortless, all it takes is a credit card and you have servers and storage provisioned. As a result, first financings have roughly doubled to 3,000-3,100 over the last few years (Pitchbook data). These early stage companies, flush with outside capital, are ready to move out of Starbucks and into a coworking facility – enter WeWork.

WeWork caters to the new entrepreneurs offering them free coffee/beer, common space, and cool furnishings. The monthly commitment is incredibly flexible. When our firm, Sand Hill East, decided to exit our lease all we had to do was inform WeWork via an email and we were out within 30 days.

The Comparison to Regus is More Appropriate than Most Think.

The monthly WeWork commitment differs greatly from the 1 year minimum that Regus mandates. But even so, when the Internet bubble burst, Regus’ occupancy dropped precipitously causing them to declare Chapter 11 bankruptcy in 2003.

Regus has taken pro-active steps emerging from bankruptcy a much leaner and more pro-active company in managing fixed expenses. To prepare for the next downturn, Regus has moved the majority of their leases to “flexible” defined as “either terminable within 6 months and or located in or assignable to a standalone legal entity, which is not fully cross guaranteed (by Regus parent company)”. As of 2014 year end, 92% of Regus’ total leases are “flexible”.

Massive Expansion Planned

Conversely, WeWork has not learned from the prior crises that impacted Regus, likely because WeWork founders were not operating businesses then. WeWork is expanding voraciously, adding new buildings in prime time locations. Based on BuzzFeed’ s article, WeWork plans to increase their available desks at a 100% CAGR from 2014 level of 18,337 to 282,638 by 2018. The reason they can procure such capacity at these great locations is by entering predominantly long term leases.

WeWork is excellent for the early startups ranging in headcount from 1 to 10. Unfortunately, beyond 10 people WeWork offers larger spaces but the quantities are low and often times when companies get to this size they want their own space regardless. Consequently, WeWork’s best clients leave once they become successful.

Asset Light is a Misnomer

According to CompStak, of WeWork’s 21 NY City leases 80% run 15 years or longer including 5 signed this past year. Asset light is a misnomer when the vast majority of your leases are 15 years, more than double the lifespan of even the most successful startups.

There has certainly been a litany of warnings by luminaries that the VC market is overheating; however, it takes time before the funding spigot slows or shuts down effecting privately funded companies. But the canaries have begun to sing…..

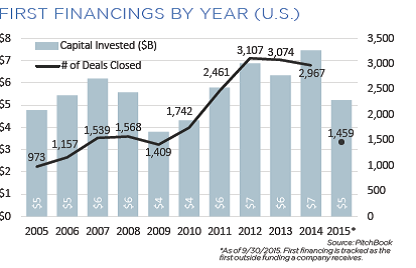

According to Pitchbook, the number of early stage deals decreased 20% sequentially in Q3, hitting the lowest quarterly level in five years. We Work will argue that they have diversification far beyond “startups”; however, private companies of all stages (Early to mature) will also been effected when private market funding slows.

Regus’ blue chip customer base, including Oracle, Starbucks, Red Hat, IBM, didn’t prevent them from seeing a precipitous decline in occupancy during the Internet bubble and to a lesser extent the 2008 financial crisis.

In addition to the long term nature of their existing leases, which has the potential to squeeze WeWork should many of its tenants decide to exercise their monthly option to not renew; WeWork is also dramatically understating their expenses.

Not surprisingly, WeWork successfully negotiated various concessions with landlords when it signs long term leases. Oftentimes, the concession includes lower/free first year rent and/or capital toward facility improvements. Rather than amortizing the full cost of the rent over the life of the loan (i.e. GAAP standards), WeWork has taken the aggressive stance of recognizing the lower costs all upfront, dramatically overstating near term profitability. Note WeWork is private so is not bound by GAAP. Regardless, their accounting dramatically deludes reality.

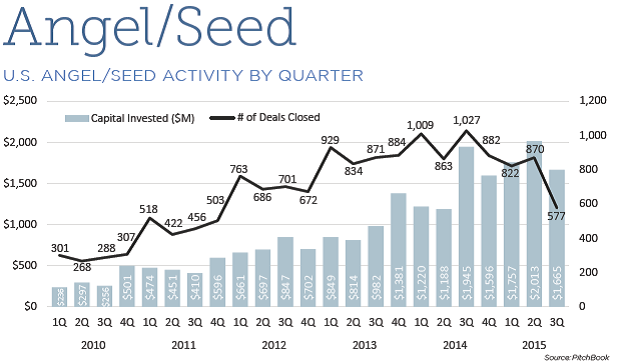

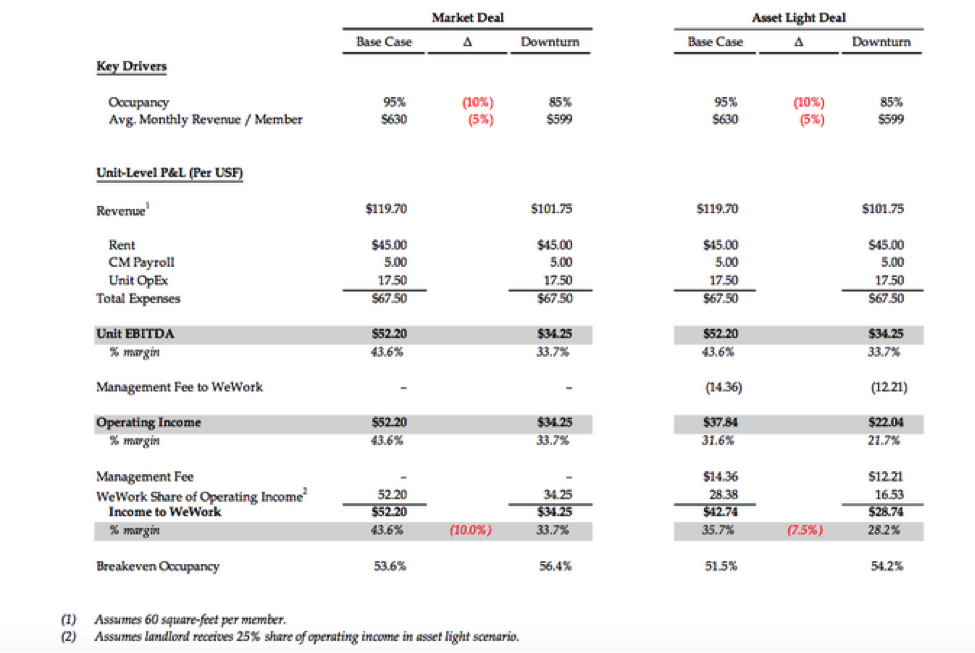

Over Optimistic Downside Scenarios

According to recent BuzzFeed article, WeWork projects 85% occupancy in a downturn which is rather Pollyannaish in light of Regus history and the composition of clientele. Regus saw a precipitous decline to 60% occupancy in 2002, despite having a total US workstation installed base of 24,000. That is roughly half the level that We Work anticipates at year end 2015 (i.e. 45, 352).

One thing I learned from being a professional investor for the last 15 years is that when things turn bad, as they inevitably do, things play out dramatically worse than the “worst case scenarios” signed off by company management. I regard WeWork’s rosy projection akin to those who thought the mortgage crisis of 2008 would result in a short downturn for residential property prices.

A “downturn” where their occupancy declines a mere 10% to 85% would make Pollyanna blush! Regus runs mid-high 80% occupancy in strong years.

Screengrab from WeWork’s company overview/ BuzzFeed

According to Regus:

It became clear early in 2002 that Regus had over expanded in some markets, most notably in the US

The overarching theme around millennials moving to flexible employment is not lost on me. I believe we will see an ever increasing amount of 1099 employees, whether it be Uber drivers, freelance marketing professionals or computer programmers. In addition, the emergence of AWS has never made it easier for startups to form real businesses overnight.

Unfortunately, the reality of venture capital is that the vast majority of startups will fail, most estimates are anywhere from 70-90%. Some will fail in 2 years, others in 4-5 years but the grim reality is that starting a successful business and scaling it is extraordinarily hard. Look at the recent announcements from Quirky (raised $170M, filed for bankruptcy), Zirtual (raised $5.2M and went out of business), Gigaom (raised $23M and went out of business), Secret (raised $35M and shutdown), PostRocket (raised $15M total funding before shutting down) and of course fab where I was a seed investor who raised $300 million.

The bottom line is that history is repeating itself as entrepreneurs extrapolate prior experience with the future expecting it to play out linearly. That is why bubbles are formed time and time again.

A company that seems more in-line with WeWork in capitalizing on a technology boon is Exodus and the colocation industry. Exodus was to data center co-location what WeWork is to coworking. I will leave you with a quote from the Exodus director who took over when the CEO resigned in the wake of Exodos bankruptcy.

“We sacrificed profitability in exchange for growth and market share, over-expanding in some areas in advance of demand, not anticipating the decline as the dot-com bubble burst and the economy weakened,” Exodus Director L. William Krause said. (September 27, 2001)