It happens to everyone. You go to the doctor and miss a payment and you keep getting calls from strange numbers trying to remind you to pay, but you just ignore the calls. Why should it be so difficult to pay your medical bills? Well this is most likely a problem of the past. With MedPilot your unpaid balance notification is sent to you via one of your devices, easily.

Today, CEO Jordan Brown, sits down with us to tell us more about the company ahead of Blueprint’s Demo day.

Tell us about the product or service.

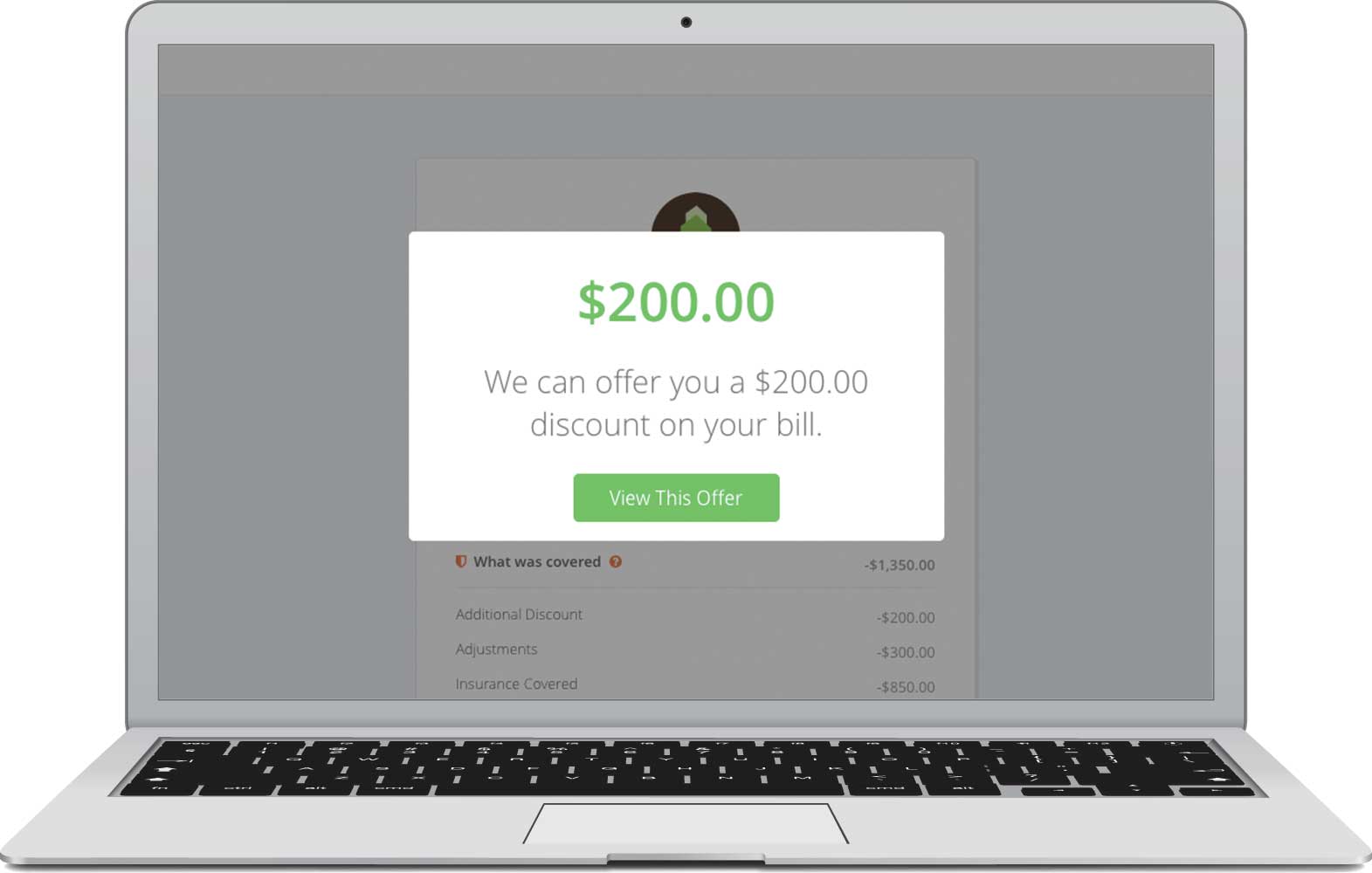

MedPilot enables healthcare providers to resolve late payments with patients, online, in minutes. Our technology gives patients the ability to negotiate a discounted financial settlement and customize a payment plan based on their individual needs from any device, at any time.

How is it different?

The de-facto solution for healthcare providers to recover late payments is the medical debt collections industry. Debt collectors robo-dial patients over and over again to recover money and yet only collect an average of 7 cents on the dollar, of which they keep a significant cut. It’s a flawed solution that is ineffective and harms the patient/provider relationship. This is an extremely underserved and growing part of the revenue cycle that we’re tackling.

We take an entirely different approach by putting the power back in the patient’s’ hands with earlier intervention. We present patients with a menu of options to resolve their bills and keep them out of debt collections—increasing revenue for hospitals and other providers, while decreasing administrative costs, and preserving customer relationships.

What market are you attacking and how big is it?

Hospitals and physicians practices are writing off over $120 billion in uncompensated care every year, leading to higher bills for everyone and pricing distortions throughout the healthcare industry. We’re attacking the accounts receivables management/healthcare payments market with a niche technology solution. With hospitals alone, this is a $1.5 billion market—not including surgery centers or physicians practices.

What is the business model?

We facilitate payments directly between patients and healthcare providers and take a percentage of every successful transaction.

Tell us about the experience participating in Blueprint Health…

Blueprint Health has been a tremendous experience that enabled us to take our business to the next level. Their mentorship helped us optimize our business development efforts, navigate complex enterprise sales cycles and hone our team’s operations and market positioning. Blueprint’s mentor network of healthcare executives has expanded our access to customers, capital and expertise in a way that we never imagined. I highly recommend the program to any promising digital health startup.

What are the milestones that you plan to achieve within six months?

We are focused heavily on growing our customer base. Our goal is to be up and running with three hospitals and outsourced billing companies in the next two fiscal quarters.

If you could be put in touch with one investor in the New York community who would it be and why?

David Hauser, because he’s a proven winner in the fin-tech and SaaS world. I have tremendous respect for entrepreneurs who have sold companies who then go on to invest in promising startups.

Why did you launch in New York?

Our team was living in New York when we started the company. It’s the perfect place, as it’s one of the healthcare and fin-tech capitals of the world.

Where is your favorite place to visit in the area in the fall?

Central Park.