Customer On-Boarding data should be easy to take advantage of. It should be simple to monitor what works and what doesn’t. And now it is. With Alloy, you can easily analyze the data with a simple click of a button. Recently accepted into the Barclay Accelerator program in NYC which specializes in fintech, this promising company seeks to make big strides in the fintech world. Cofounder, Laura Spiekerman takes us through her new company and what sets it apart from the rest.

Tell us about the decision to apply for Barclays Accelerator.

Because our product is designed for financial services companies, an accelerator with the reputation of Techstars with the built-in relationship with a bank like Barclays was perfect for us. As a startup, it’s really hard to get banks to talk with you, so this was an ideal inroad.

Tell us about your product or service.

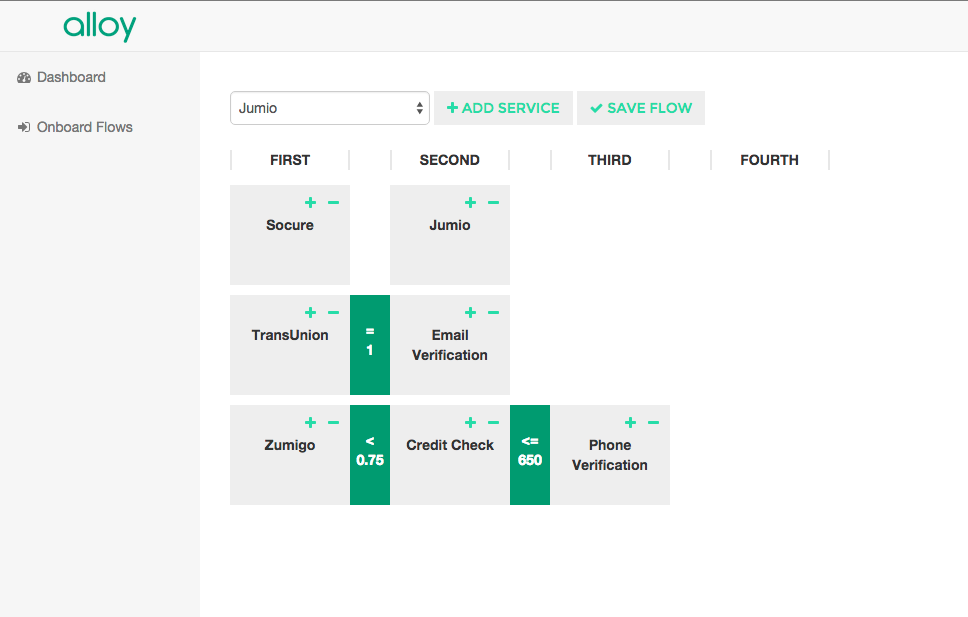

Alloy builds APIs for fintech, starting with a customer on-boarding/KYC API to help fintech companies access various aggregated data sources (e.g. credit bureaus, identification databases, government watch lists, financial transaction data, etc.), while providing a dashboard through which to organize and analyze customer on-boarding data to improve conversion while reducing risk & fraud.

How is it different?

Unlike “black-box” decision-ing engines, Alloy gives full control over which data sources are used and how they are applied so that companies can customize and optimize customer on-boarding. Adding, subtracting, or changing rules about how data sources are used is as simple as the click of a button, and what works or not is clearly analyzed and visualized at all times.

What market are you attacking and how big is it?

We’re going after the hundreds of billions of dollars in financial services. To start, that means the thousands of growth-stage financial services companies in lending, payments, banking, and brokerage.

What is the business model?

We charge a monthly fee as well as a per-customer-onboard fee.

What inspired you to start the company?

We previously worked at an ACH payments processing company where we integrated with lots of financial services companies who struggled to figure out the best practices for KYC and customer onboarding while maintaining frictionless experiences for their users.

What are the milestones that you plan to achieve within six months?

We’ll have integrated our first few customers across a few different verticals to demonstrate demand and higher customer conversion.

What is the one piece of business advice that you never got?

That being a hustler is more important than a pedigreed education or professional experience.

If you could be put in touch with one investor in the New York community who would it be and why?

Fred Wilson: we’ve been reading his blog since forever, and he has some portfolio companies that could be great customers for us.