While businesses have utilized technology to its advantage, paperwork has managed to stay around. Yes, sometimes it is unavoidable, but why not rid of it when possible? Liveoak, a virtual conference room is innovating how we do long distance business allowing for seamless collaboration, shared data space, as well as electronic sign in/out forms. This new innovative company has also been accepted to Barclays Accelerator program which is designed to take fintech businesses further.

Today, we chat with the founding team about their technology, the accelerator program, and the future.

Tell us about the decision to apply for Barclays Accelerator.

Alex Iskold and Alex Tarhini of Techstars discovered us at SXSW and encouraged us to apply. We are grateful and truly indebted to them.

Tell us about your product or service.

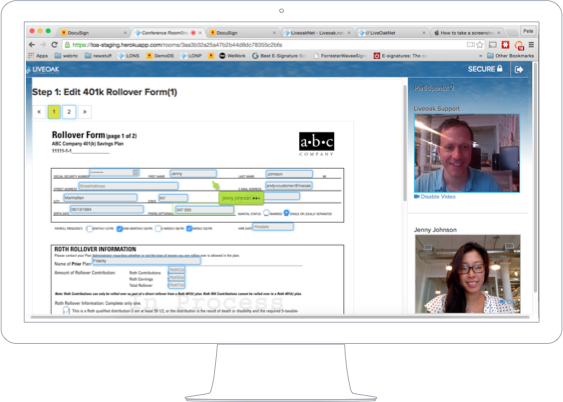

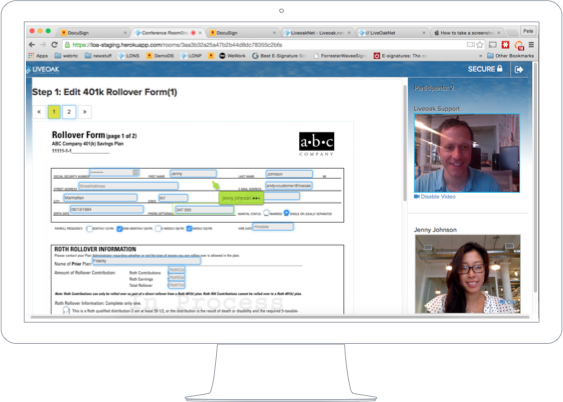

Our platform utilizes a virtual conference room where two or more people can collaborate seamlessly on forms in a simple secure video-conference, store compliant data, maintain an electronic audit trail, and electronically sign forms all without leaving a session.

How is it different?

We designed Liveoak to recreate the power and engagement of a face to face meeting with the ability to collaborate and execute complex paperwork in a single session from anywhere, on any device at any time.

What market are you attacking and how big is it?

We are first solving a huge pain point for the financial services industry – banking, asset management, and insurance. In the United States in 2014, financial services represented $1.26 trillion of economic activity (7.2% of U.S. GDP). Further, there is an estimated $20 trillion of retirement assets expected to change hands over the next two decades.

What is the business model?

Our business model is software as a service (SaaS). We license our product to small, mid-sized and large enterprise customers.

What inspired you to start the company?

What inspired you to start the company?

It started with a deep understanding of a giant problem. We have 20+ years experience in financial services and technology; and we knew that the industry was desperate for two things: 1) A new way to engage with customers in a virtual environment, and 2) A solution to the massive amounts of paperwork and inefficient workflow in on-boarding customers.

What are the milestones that you plan to achieve within six months?

We are engaged with several key enterprise customers in pilot and plan to expand our pilot program. We will continue to integrate the excellent feedback we’ve received on product-market fit. We also plan to raise a seed round of financing and have strong early interest.

What is the one piece of business advice that you never got?

If your live demo requires an internet connection, then bring your own wifi hotspot EVERYWHERE you go!

If you could be put in touch with one investor in the New York community who would it be and why?

TechStars has brought to the table some of the most influential fintech investors in NYC. In addition to these incredible resources, we are excited to continue to engage with the NYC investor community.