Everyone wants to find the next big thing to invest in while it’s still small. But in this seemingly random market that runs this country, we need a better way to predict and manage our accounts if we are going to make it big in the stock market. Introducing BooleanGrid. The easily accessible iPhone/iPad app, lets you instantly pick stocks from your device. With their quantum simulation, an accurate predictor of the market, you will be as prepared as ever to finally do well on the market.

AlleyWatch takes us in to this new company which plans on disrupting Wall St.

Tell us about the product or service.

Tell us about the product or service.

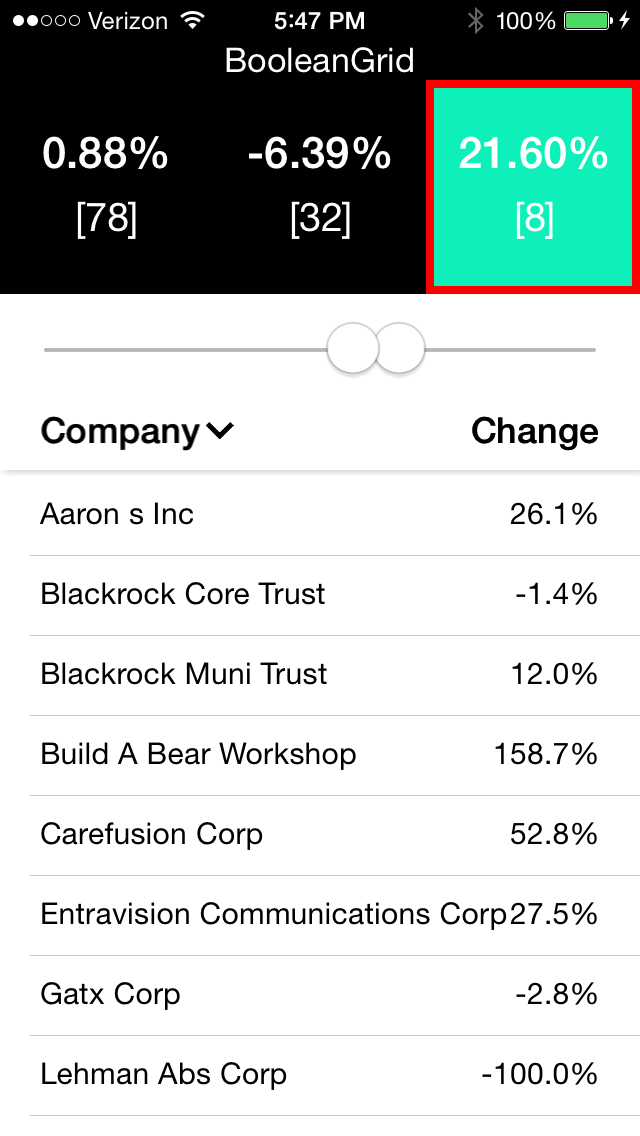

BooleanGrid is an iPhone and iPad app that can be used to pick stocks or create an instant hedge fund.

How is it different?

BooleanGrid views the market as pure chaos, and uses a quantum mechanics simulation to find, or impose, patterns in the chaos, which are used to predict future performance.

What market are you attacking and how big is it?

We’re aiming to disrupt all of Wall Street, or at least as an iconic example the Bloomberg Terminal, which may be around $6 billion or more.

What is the business model?

BooleanGrid is a premium iPad app but still accessible to most people, not just the super-wealthy.

What inspired the business?

I used to work on Wall Street designing software, and was amazed that pros using fancy equipment like the Bloomberg Terminal, Thomson, or TD Ameritrade often could not even tie the market average. Nobody said anything, even though Main Street, and now the Millennials, instinctively get it.

We understand that this is superior to current platforms being used but what makes your product inconsistent with the random walk theory?

The market does appear to be random, however BooleanGrid applies a quantum simulation to the market that reveals that, in fact, there is a hidden matrix driving things.

What are the milestones that you plan to achieve within six months?

They are strategic milestones around communication. The first message is that BooleanGrid can disrupt Wall Street, which so far has resisted startup-style innovation. The second message is that BooleanGrid can suck some of the toxic risk out of the financial system. It’s more democratic, and acts as a counterbalance to bad trends, insider trading, friction leverage, and other issues like those raised by Michael Lewis in Flash Boys. I touched on this a bit in my book Collaboration Technologies awhile back.

What is the one piece of business advice that you never got?

The advice I never got was that innovators have to work extra hard on communication, because the solution that is clear to the innovator is ipso facto not obvious to everybody else. Early on, everyone I talked to thought BooleanGrid was a crazy idea, so I put together an impossibly difficult test, that I knew would fail, so I could be done with it. But BG passed, much better than I thought.

If you could be put in touch with anyone in the New York community who would it be and why?

I’m doing some work on search and social, so perhaps somebody with an interest in those areas.

Why did you launch in New York?

New York is the only place where creativity and technology really merge, especially here in Williamsburg, Brooklyn.

What’s is your favorite restaurant in the city?

I guess it would be the Willburg Café, right nearby!