WAYERZ, the integrated platform that optimizes bank-to-bank business has taken a big step with their recent acceptance into Barclay’s new program. The program is uniquely designed to take your business further. They’re fintech-focused, overflowing with opportunities, and for the first time are being hosted in NYC. In the coming months Wayerz hopes to attract top banks in the US and UK to adopt their platform.

Today, we sit down with Igal Chemerinski, SVP Marketing & Sales to discuss the startup.

Tell us about the decision to apply for Barclays Accelerator.

We decided to apply because we learned that the best startup accelerator TECHSTARS was opening a program for Fintech in NYC with a top TIER-1 bank like Barclays. For a company based in Tel Aviv, this is a major stepping stone for us to be part of a program specifically dedicated to FINTECH in the biggest and most important financial center in the world with a TOP accelerator like Techstars, and a TOP Financial Institution like Barclays committed to innovation in financial services and the success of the program and the startups who were selected.

Tell us about your product or service.

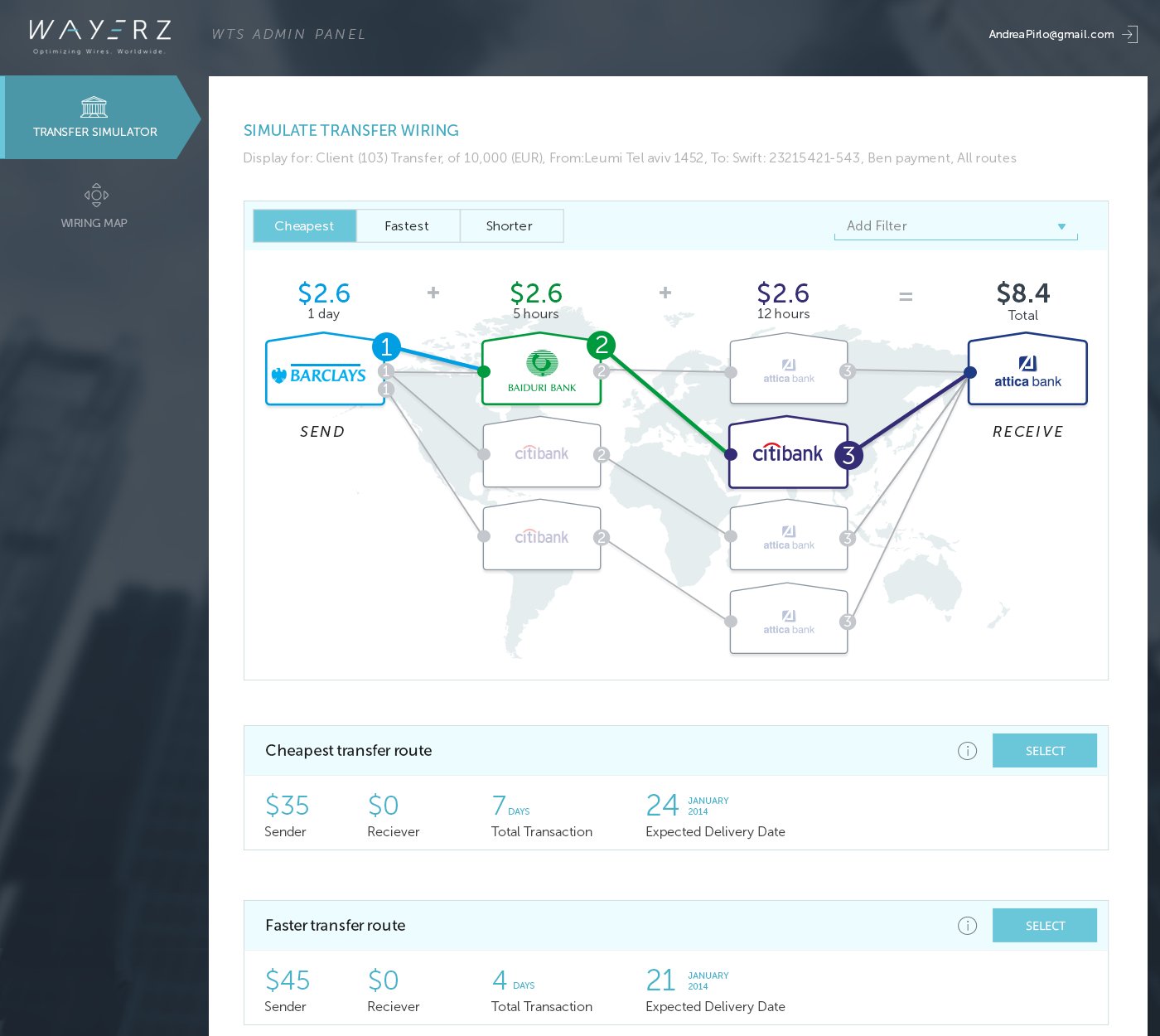

WAYERZ provides an integrated platform that optimizes international wiring, correspondent inter-bank reporting, and reconciliation. Our multi-solution platform focuses on improvement of productivity and automation of bank-to-bank systems, transactions and interfaces; increasing the real-time control and transparency of FI relationships.

By tracking global wiring schedules and statistics in real time, our technology enables banks and their corporate clients to choose the optimum route for every wire – based on wiring cost, wiring time, restrictions, and additional considerations. The latter may include preferred providers, benefits of a particular correspondent, blacklisted banks, restricted jurisdictions, and more.

How is it different?

We are focusing on an area in the bank commonly referred as “Correspondent Banking” that was put in place during the 70s with the birth of SWIFT. Correspondent banking is the system where banks that are giving and receiving services from other banks and connecting with each other for international wire routing and other financial services.

Our platform and routing module is a layer on top of SWIFT or other payment systems in place at the banks, so we are like the “navigation system” for the international wire transfers on top of the Swift system.

We allow the banks to optimize their wire transfers and choose the best optimal route for each wire.

What market are you attacking and how big is it?

The Correspondent Banking machine circulates about $21 trillion annually in wire transfers. Worldwide revenues from processing cross border payments have been climbing at an 11 percent annual clip since 2010 and will hit $77.4 billion in 2020. Cross border e-commerce alone is projected to triple to $900 billion in 2020, and remittances are now a $500 billion annual business,

What is the business model?

We offer Financial Institutions the platform on Annual Licensing Fees for On Premise and Saas Based Solution. We also offer the platform as a managed service or a standalone. On top of the Annual Licensing Fees we provide the banks with integration, training, and other managed services.

What inspired you to start the company?

We had several bankers from the correspondent banking community that approached us before developing the platform to go source a Routing Optimization Platform and Bank to Bank Billing and Reconciliation….we went to more than 20 banks to research their existing infrastructure and how they worked, and we found out they actually don’t have a system in place and told us if we build it they would actually source it.

What are the milestones that you plan to achieve within six months?

By the end of 2015 we will be integrated with a top US Bank, and a Top UK Bank with several modules installed including the Routing module, Agreement Manager, Billing and Reconciliation.

We expect to complete the development of the bank to bank Messaging Platform and Inquiry

What is the one piece of business advice that you never got?

The best business advice I never received was “Don’t do it Alone”. I worked for many different startups, and I also created several business on my own, and the level of stress was very visible in these. I joined CEO Menny Shalom right after he founded the company, and we are building the company as a collaborative team with great people from many disciplines. Without great people you cannot build a good business.

If you could be put in touch with one investor in the New York community who would it be and why?

Bain Capital Ventures. Bain Capital Ventures has a team of experienced entrepreneurs that allow for a unique approach in helping executive teams develop strategies, go-to-market initiatives, and overall execution. They understand Fintech and can take the company from post-seed funding, Series A and also further.