There’s no question that biotech is a growing field with vast technological potential. But investors looking to improve their business growth strategies would also do well to pay attention. Biotech is an international industry, and its benefits span the globe.

When my father — a burn doctor in China — first entered the field of biotechnology, he did it because he wanted to improve the lives of his patients. He had witnessed the pain caused by traditional skin grafting methods and developed what he called “moist exposed burn therapy.” This not only reduced burn victims’ pain, but it also ended up being promoted by the Chinese government as a preferred method of treatment.

What was initially a pursuit of passion quickly became a full-time job. He left his position at a prominent national hospital and devoted his time to teaching his methods to other doctors across the nation.

This attitude of innovation continued to grow and flourish — and my father passed it on to me. What was once a single mission later branched out into a multitude of biotech ventures, spanning a variety of fields and reaching across two nations, China and the U.S.

For us, biotech has proven to be a field rich in opportunity and growth. With so much ground still left uncovered, the same holds true for investors.

The Beauty of Biotech as a Business Opportunity

International biotechnology investments can help companies build first impressions on an international scale. For instance, once a domestic company wants to expand globally, it needs investments that can show its position and reflect its willingness to connect to the world. Life science and health are two fields where borders are irrelevant — everyone can benefit from both advances, regardless of geography.

International biotechnology can also open new windows for potential development plans. Just like a regular macroeconomic market principle, the biotechnology market is an adjusted balance between supply and demand. This may help bring investors’ visions to a global platform and not restrict them solely to the nations they reside in.

For example, one may want to invest in biotechnology that helps neutralize water toxins in countries that usually encounter water shortages. A plan like this has the potential to open up previously untapped markets that will be enthusiastically receptive to these types of advances.

Biotech has an international reach that few other industries do — the potential for business growth is vast. You just need to know where to start.

How to Dive Into Biotech (Without Going in Over Your Head)

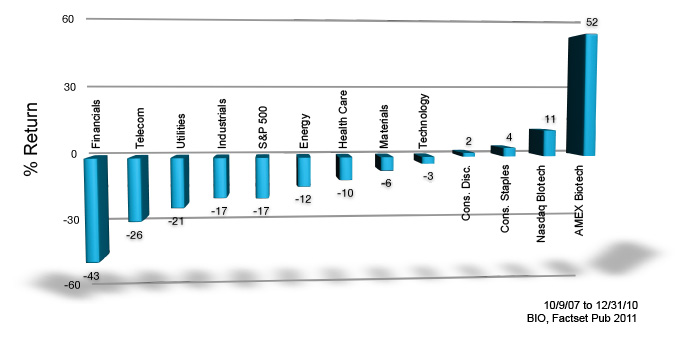

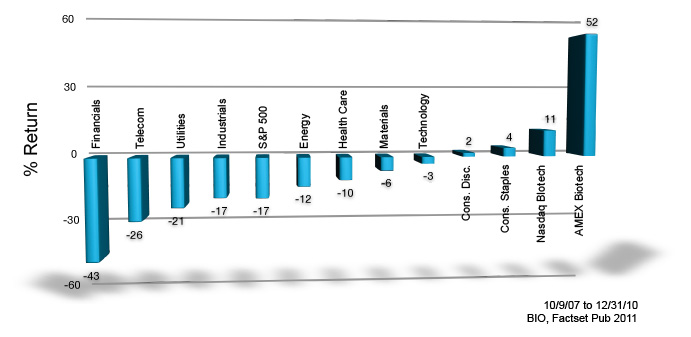

Like any market, biotech has its own pitfalls and obstacles for those who don’t necessarily know what they’re doing. For investors, it’s vital to keep the right perspective when it comes to scoping out potential investments.

Investors should pay attention to the difference between research and application. For example, a scientist or a company may be exploring treatments of certain uncured diseases, but that doesn’t mean either one is necessarily close to actually applying the concept. In other words, investors should know the difference between a clinical study and an approved commodity.

It’s important, too, to understand the logic between absolute truth and relative truth. Being closer to the moon and actually landing on the moon have significantly different values in terms of achievement — being closer might be an improvement, but it doesn’t guarantee you’ll get there. Always try to measure the actual likelihood of reaching the moon — not almost reaching it.

While there are risks in biotech, the rewards can be great. With biotechnology, the whole world is at your fingertips — you just have to be willing to reach out and grab it.