With digital currency, such as bitcoin, gaining strong support, it is bound to be the future of money. While digital currency is already a large market, it lacks many features which make it the best thing for now. Being able to make bitcoin payments like you do with Venmo or through Facebook is still lacking, and until we get there bitcoin will not take off.

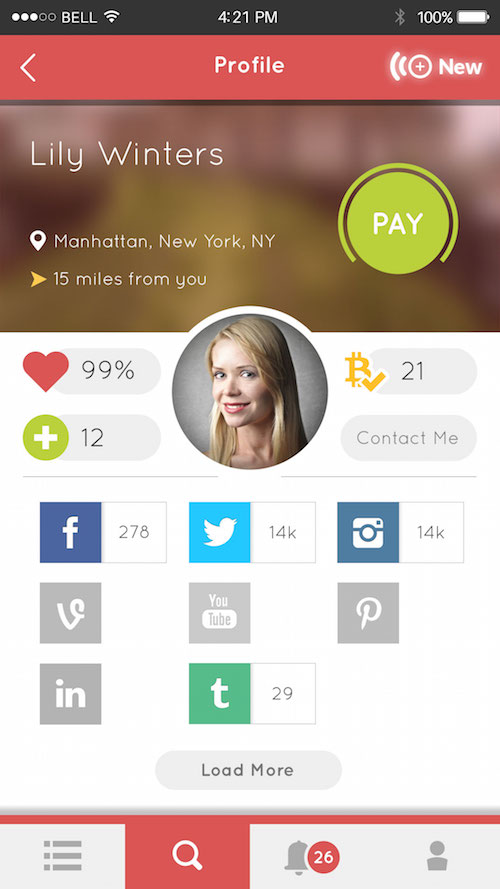

Sync.cr (pronounced sync-er) is a new app bridging this gap for us allowing us to finally pay for things on social media by way of bitcoins. Cofounder Joswell Valdez takes us through his new product as he explains more than just his product.

Tell us about the product or service.

As our society is becoming globalized, so are our networks. People are traveling internationally more and more for work and for school, and keeping connected with friends and family all around the world. If you want to send money to someone internationally through a bank transaction or Western Union, you incur a fee for every transaction.

How is it different?

We are a mobile platform streamlining Bitcoin payments so you can send funds via trusted social media apps. We eliminate the need for emails or even a Bitcoin email address. It’s so much simpler. There’s huge cost savings potential with using Bitcoin, but until now the process hasn’t been very user-friendly or efficient. We’re changing that.

Also, the integration with social media opens new marketplace possibilities. Your connections may not be just friends and family, but also businesses who make products and services available online. Our app allows you to shop and pay using social media. It’s fast and convenient.

Brands or businesses can leverage the app to provide payment solutions, view user analytics, and engage in social media marketing. It’s a big leap, and a powerful tool. In the long term, we plan to extend the service to other digital currencies such as Dogecoin and Litecoin.

It’s a huge market. 39% of 18 – 26 year olds are using mobile payments, and it’s projected that millenials will have used mobile payments to spend a total of 2.45 trillion by the end of 2015, 53% on retail purchases and 34% on remittance payments.

Mobile payments are quickly overtaking other payment methods. According to research by visa, a majority of consumers believe smartphone payments will eventually replace both payment cards and cash, it’s just a matter of when. I think that’s true, and that it’s happening faster than people realize. In 2014, It was said about 1.2 million people held bitcoin. Many people like myself believe this will spike. There’s a lot of potential and a lot of advantages for online users. And only halfway through 2015, there are more developers building with Bitcoin more than paypal according to Github repository. I think this is pretty huge!

20% of millenials in America are already using mobile banking, and North American mobile transactions have almost doubled in the last year, up to 17% of all transactions made – and that’s just in North America. Worldwide, mobile payments use has tripled over the past two years. There is 30% adoption in parts of Latin America and in 2013, global mobile payments exceeded $235 billion. The future is cashless.

Our business model is to provide tools that enable businesses to leverage their social media and website presences to increase profits. We will be selling credits and lending people credit for a small fee, and are still exploring different ideas. For example, advanced users might pay a small fee for the ability to make unlimited transactions per month.

What inspired the business?

As is often the case with innovation, we saw a need to be met. On social media, we noticed businesses promoting items, people raising money for charities, or people sending money to friends and family for personal reasons – but there was always the extra step of moving out of the network to make the transaction. In some cases users needed to enter their bank or credit card information over and over again to make payments. Both my co-founder and myself have family and friends in our native countries to whom we transfer money on a regular basis, like many people do, so simplifying everything was addressing a personal need as well.

What are the milestones that you plan to achieve within six months?

It’s going to be a big year for us. First off, we’re planning to launch the app. We want to attract users and engagement to prove our concept is strong, and that the Bitcoin use case can really become reality. We have plans for the future, too, so we hope to raise seed funding for those. I’m really motivated to take on this challenge.

What is the one piece of startup advice that you never got?

The piece of advice that I had to learn on my own this: You can have a great product, a great team, and a great solution, but if your message is not on-target, you can miss opportunities. A different product with the exact same features could come along, and with the right message, win a cult following. We see this all the time with startups in different markets. The “why” message in a startup is so important.

Why did you launch in New York?

NYC has one of the best tech ecosystems in the world. The special thing about NYC is there is so much potential in all fields. People are hungry to add their value to new teams, and it’s an open market to excel in. For entrepreneurs especially, all the different cultures that NYC houses provide opportunity to gain traction in international circles. Also, I was born and raised in NYC!

Where is your favorite outdoor bar in the city for a drink?

I really like to Bar 13 rooftop. Just sitting up there on a summer night, sipping a Guinness or a Modelo. It’s a chill spot and I love the Union Square area.