New York State has the lowest rate of home ownership of any state. A substantial part of the housing market is focused on multifamily dwellings, and that’s ResiModel’s sweet spot.

In fact, ResiModel® is the only deal management, analytics and valuation platform specifically designed for multifamily transactions, providing brokers, buyers and lenders with deeper analytics and the ability to capitalize on accumulated firm-wide data to win more business and make better investment decisions.

They’re definitely in the right place for it – with the right solution. CEO Elliot Vermes tells us about his platform – and how he had to turn investors away!

Who were your investors and how much did you raise?

In this seed round, we raised approximately $900,000, bringing the total amount raised to date to $3.5 million. Our high-profile investors include Axiometrics, the leading apartment market and student housing research and analysis firm; Kevin Quinn, former Global Co-head of Technology Investment Banking at Goldman Sachs; Kurt Roeloffs, former Chief Investment Officer at Deutsche Bank Real Estate; and Bob White, Founder and President of Real Capital Analytics. The round also includes funding from two venture capital firms—Osage Venture Partners and Leading Edge Ventures—that were eager to get involved with ResiModel early on.

Tell us about your service.

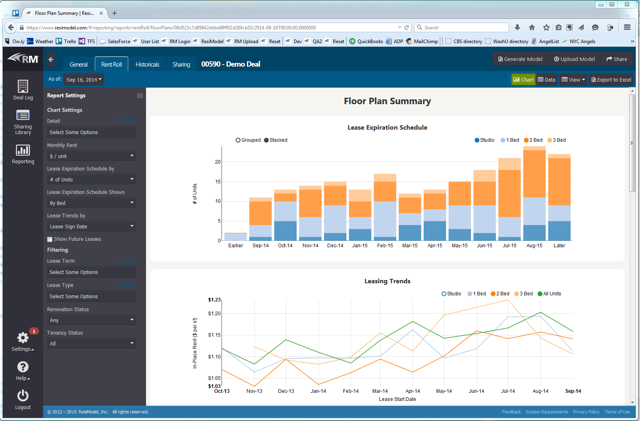

ResiModel is the leading platform for aggregating, standardizing and analyzing financial data for multifamily transactions. The platform provides the ability to share detailed rent rolls and historical operating statements between brokers, buyers, sellers, and lenders in a standardized, electronic format. It also includes sophisticated data visualization and analytics tools that enable users to gain deeper insight into properties they are analyzing.

What inspired you to start the company? Like most companies, this one was started out to solve a problem that I experienced first-hand over 10 years on the real estate teams at JP Morgan, Citigroup and Sequoia Debt Ventures. I have almost 20 years of experience in both the real estate and technology sectors. When I worked in real estate investment — analyzing potential investment opportunities —there was no standardized format for the data (i.e. rent rolls and operating statements). Effectively, this meant that most underwriting teams spent an inordinate amount of time entering data into their firms’ respective templates. Moreover, since all the files were then saved in network drives, firms were unable to easily capitalize on the vast troves of data that they collected.

How is it different?

ResiModelprovides a standard for processing, analyzing and comparing all the data that they possess.This data can then be shared amongst all the players involved in a transaction in a standardized, electronic format, effectively doing for privately-held multifamily operating data what Bloomberg has done for publicly-available company data.

What market you are targeting and how big is it?

ResiModel operates in the multifamily real estate transaction space. There are roughly $250 billion of multifamily transactions in the U.S. each year.

What’s your business model?

We have a subscription model. Our basic subscription provides dataaggregation, standardization and analytics. We currently offer basic subscribers a complimentary rent roll upload service. We also have an upgraded option that includes valuations and projections (i.e. we’ll project the cash flow for the apartment building you’re considering purchasing)

Which New York borough has the most multi-family homes?

I don’t have the precise numbers on this, but multifamily housing is extremely common in the city; in fact, the homeownership rate in the State of New York is 54.5% —the lowest of any state.

What are the biggest challenges that you faced while raising capital?

There has been a lot of interest and we actually had to limit the number of people investing in this round. Turning people away who are offering to give you money is one of the hardest things for a young company to do.

What factors about your business led your investors to write the check?Several of our investors are very familiar with the space in which we operate. They are aware of the significant market need for standardization and feel that our solution is a compelling one, as evidenced by our many high-profile clients and the testimonials that we have received (see our website for testimonials).

What are the milestones you plan to achieve in the next six months?

We intend on continuing to accelerate sales and grow our customer base. Over the past four months, sales have increased by almost 70%, as compared with the preceding 12 months. We will also be rolling out some exciting new features that will increase our clients’ productivity exponentially.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Don’t try to build everything at once; don’t try to think of every possible use case. Build something simple and then see how people use it. This will save an enormous amount of time and allow you to hone in on the true value proposition much more quickly and cost-effectively than other firms with deeper pockets.

Where do you see the company going now over the near term?

There are basically two things we’re focusing on right now: 1. Bringing on/onboarding clients: Because of the great value that ResiModel provides, we have a strong flow of new clients interested in learning more about the platform and getting started with it, and we will be focusing a lot of resources on making their adoption as seamless as possible; and 2. Enhancing the platform: All of the functionality that ResiModel currently provides is just the first phase in an ambitious long-term development plan. Over the next few quarters and years, we will be rolling out additional functionality and making all of the components even more fully integrated then they are today

What’s your favorite NY spot to bring the family?

There are so many great places in New York that it’s almost impossible to answer. There’s nothing better than grabbing a burger (and a beer) on a mild summer evening at the cafe in Riverside Park at 69th street.