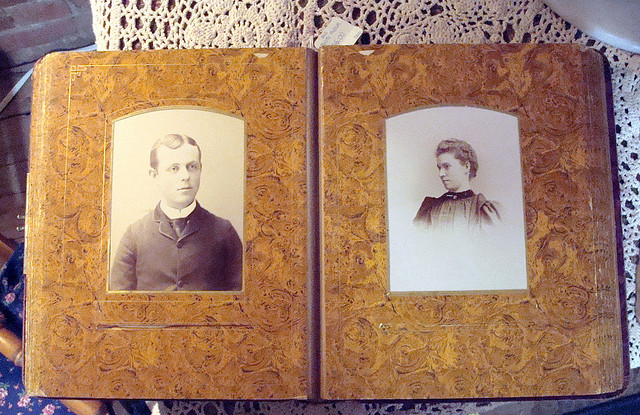

Next to the fireplace at my mother’s house, there are seven photo albums neatly arranged in chronological order. If I want any photo from my childhood, I know exactly where to find it.

Personally, I have taken more than 15,000 photos of my own young children. These precious photos are stored on my computer, external drive and social media accounts. But unfortunately, I have a very hard time accessing them. My mother’s system worked well in the print era; today, my company, Mosaic, aims to solve this ‘photo mess’ problem for serious photographers today in the digital age.

Telling this very specific story helped Mosaic raise over a million dollars in seed funding. Sure, investors liked our team, technology, traction and financial model. But in the end, they could relate to the story we told and believed that we were the team to solve it.

Storytelling is a powerful tool for entrepreneurs looking to raise a seed or venture round.

Humans are hardwired to love a great story. Stories inspire us. We retell stories. We remember stories. As the late Maya Angelou said: “People will forget what you did, but people will never forget how you made them feel.” The same is true with potential investors. They may forget what your company does or the specifics of your business model, but they will remember how they felt when they heard your company’s story.

We didn’t start off telling a great story to investors. We started like most first-time entrepreneurs, jumping right into what we were going to build, how much it was going to cost, how we were going to sell it and the business terms of our round of funding. All of these things are important, but if you haven’t made the investor care, then everything else is moot.

A good story needs to inform, inspire and involve.

Inform: This is the part that most people get right. This is the plot of your story. One sales trick I learned along the way is that people like ideas they think they came up with themselves. In other words, don’t just give your investor the number four. Give them two plus two and then help them realize the answer is four.

Involve: Make your pitch personal to the investor. This usually involves listening. Don’t spend all your time talking. All of us want to be listened to; better yet, all of us want to be heard. When you listen to people, they tend to listen to you back. Listening gives you great insight into their concerns and gives you an opportunity to overcome them. Use what you learned about the investor to make your pitch specific to them.

Inspire: This part is the hardest. You need to make the investor care. This is the emotional aftertaste. It’s about finding the essence of how your product will change lives, and then giving the investor the confidence that you are the person to lead that change.

For my investors, knowing that we were going to solve the ‘photo mess’ wasn’t enough. What inspired many of them to invest in Mosaic wasn’t the fact that we were solving a problem, no matter how real the problem was. It was because by solving this specific problem, Mosaic helps photographers better connect with the memories that are stored in their countless photos, experiencing them in powerful new ways. All of our investors could all relate to wanting to reconnect with old experiences.

There is an old sales adage to “tell, don’t sell.” If you want to raise money for your business, know the facts cold. But more importantly, figure out the story that your business is going to tell. If you want to raise seed or venture money, become a great storyteller.

The Young Entrepreneur Council (YEC) is an invite-only organization comprised of the world’s most promising young entrepreneurs. In partnership with Citi, YEC recently launched StartupCollective, a free virtual mentorship program that helps millions of entrepreneurs start and grow businesses.

Image credit: CC by Sean