Over the past couple of years, the start-up industry has been buzzing about the Series A round. Seed-focused venture funds and seed investments have grown in number, but the A round remains an elusive and expensive yet necessary next-round target for seeded companies. This phenomenon, which spawned the phrase “Series A crunch,” has left many seed-funded companies without a Series A home.

Another topic of discussion, and the basis for the establishment of F Cubed, is the gender gap in venture capital, and, in particular, the difficulty companies with females at the helm have in obtaining funding. According to the Diana Project’s most recent report, only 2.7% of U.S. companies that received venture capital funding from 2011 to 2013 had a female CEO.[1]

As an early-stage investor in female-founded companies, we at F Cubed wondered how companies seeking A round funding with a female CEO fared in 2014, particularly in New York. Our definition of a Series A is a financing round led by an institutional investor with between $2.5 million and $15 million in funding. Given the dollar size of the average Series A round continues to increase in magnitude, this definition, which is our own, is somewhat blurry and ambiguous, so we did our best. Note that the data below contains information on Series A financings recorded publicly. If we are missing anything, please let us know. Our main sources are Mattermark and Crunchbase. Special thanks to Danielle and Ray at Mattermark for the support and assistance.

Let’s start with A rounds in 2014:

- Globally: 900

- United States: 615

- Bay Area: 228

- NYC: 90

- Boston: 26

- Los Angeles: 20

- Washington, D.C.: 11

- Seattle: 11

- Austin: 6

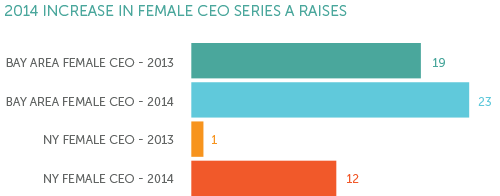

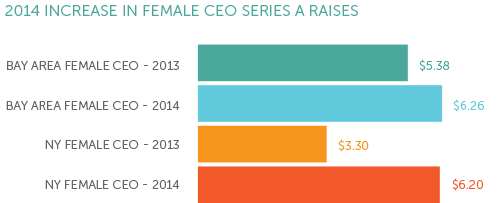

In NYC, 12 companies that received A funding in 2014, or 13% of all A rounds in NYC, had female founder CEOs and 19 companies that received A funding had female founding team members. Out of the 12 Series A rounds in NY in 2014 led by female founder CEOs, F Cubed seeded and invested in 3, or 25%. Note also that 75%, or 9 of the 12 companies in NYC, received funding in the second half of the year.

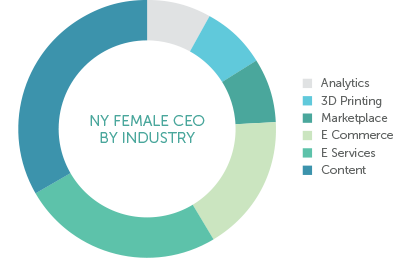

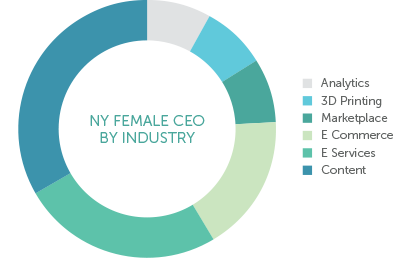

In NYC, the largest A with a female founder CEO was ClassPass, which raised $12.0 million, led by a syndicate of angels with participation from WME. The next largest was Glossier, which raised $8.4 million, led by Thrive Capital with participation from 14W. In terms of sectors, 4 of these companies are content-based (Food52, theSkimm, The Dodo and Lover.ly). Three companies are in the e-Services sector (Manicube, GLAMSQUAD and ClassPass) and 2 are in e-Commerce (ELOQUII and Glossier). There is one company in each of the Marketplace (Artbinder), 3D Printing (Sols) and Analytics (Shareablee) sectors.

On average, these companies spent 462 days in the seed stage. ELOQUII, an F Cubed portfolio company, was the quickest to make the jump from seed to A at 115 days. Additionally, only one of the CEOs had a technical/engineering background, with most companies possessing tech in-house or a CTO.

Venture fund involvement in these companies was almost 100% led by NYC-based venture funds. Greycroft, RRE and SoftBank were the market leaders, each having led or participated in 3 of these rounds (all in The Dodo, Greycroft and RRE in theSkimm, Greycroft in ELOQUII, RRE in Sols and SoftBank in GLAMSQUAD and Shareablee).

Likewise, with A rounds led by women CEOs, we witnessed a significant year-over-year increase in 2014. In 2013, in New York, there were 4 companies who raised an A with at least one female on the founding team, but only 1 company with a female founder CEO, or 1100% growth year-over-year. This growth is evidence of the exciting pattern F Cubed recognized at the inception of our fund: strong female-founded teams will continue to build solid business models that present a compelling investment opportunity.

In the Bay Area, 23 companies that received A funding in 2014. There were nearly twice the amount of Series A raises with female CEOs in the Bay Area compared to NYC in 2014, but these represented a smaller percentage of total A raises in the region. New York’s entrepreneurial heft is clearly catching up with the Bay Area. There is a dominance of technical backgrounds among the female CEOs in the Bay Area, with several CEOs possessing engineering backgrounds and/or PhDs. Google is the most common alma mater, with 4 female CEOs having previously worked at that firm. Additionally, 4 female CEOs in the region have prior venture capital experience, either as investors or as serially venture-backed entrepreneurs. For example, Joanna Strober is the CEO and founder of Kurbo Health and raised $5.8 million in Series A funding in July 2014. Ms. Strober previously served as a partner at Bessemer Venture Partners, and has 20 years of experience creating and marketing products and services to women.

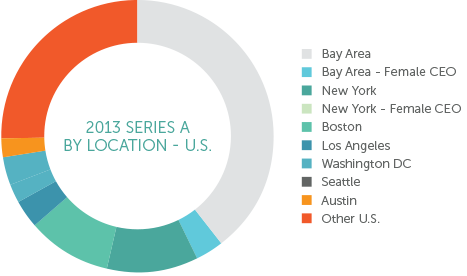

A Rounds in 2013:

- Globally: 712

- United States: 514

- Bay Area: 223

- NYC: 58

- Boston: 49

- Los Angeles: 16

- Washington, D.C.: 9

- Seattle: 15

- Austin: 11

*Note there were 2 large Series A rounds at Los Angeles-based companies with female CEOs in 2014: uBeam and PS XOXO, both led by Upfront.

All told, 2014 was a very good year for female founders seeking to attract venture capital, specifically in New York. F Cubed is very excited about these auspicious trends, which are indicators of the compelling investing era in which we operate.

- Women are taking advantage of accessible technology to build scalable and successful companies with a different skill-set than was pre-requisite ten years earlier. The current infrastructure is such that women with backgrounds in marketing, data analysis and brand building are taking advantage of affordable technology to build and scale tech-enabled businesses effectively, efficiently and inexpensively.

- Most of these companies have female-first audiences, where the initial customer base, or in some cases the only customer base, is women. Women understand why other women purchase, which is (clearly!) an important step in obtaining the dedicated female customer. These insights lead to better user experiences and ultimately to a loyal customer base.

- New York will continue to be a hub for entrepreneurial activity for female founders. From one A round led by a female CEO in 2013, to twelve in 2014, we will continue to see women entrepreneurs prove out strong business models that attract venture capital in NYC. Core industries with deep talent pools are based in New York, including media, advertising, retail, finance and fashion. These talent pools will spawn innovators capable of identifying new areas of opportunity; many of these future leaders will be women.

We look forward to seeing what 2015 has in store for these entrepreneurs, and anticipate another big year for female founders as the confluence of the aforementioned trends continues to build momentum.

2014 Series A Rounds – NYC

Female CEO

- ClassPass – $12.0 million – September – Payal Kadakia

- Glossier – $8.4 million – November – Emily Weiss

- GLAMSQUAD – $7.0 million – October – Alexandra Wilkis Wilson

- Sols – $6.4 million – April – Kegan Schouwenburg

- theSkimm – $6.3 million – December – Danielle Weisberg, Carly Zakin

- Eloquii – $6.0 million – November – Mariah Chase

- Food52 – $6.0 million – September – Amanda Hesser

- Shareablee – $6.0 million – May – Tania Yuki

- Manicube – $5.0 million – April – Katina Mountanos, Elizabeth Whitman

- The Dodo – $4.7 million – September – Izzie Lerer

- Lover.ly – $3.5 million – November – Kelle Khalil

- Artbinder.com – $3.2 million – July – Alexandra Chemla

Female Co-Founder

- Orchard Platform – $12.0 million – October – Angela Ceresnie

- Justworks – $6.0 million – October – Iris Ramos

- Memoir – $5.5 million – November – Angela Kim

- Docurated – $3.8 million – February – Irene Tserkovny

- Rocketrip – $3.0 million – July – Gillian Tee

2014 Series A Rounds – Bay Area

Female CEO

- 6Sense – $12.0 million – May – Amanda Kahlow

- StyleSeat – $10.2 million – January – Melody McCloskey

- Lever – $10.0 million – October – Sarah Nahm

- Twist Bioscience – $9.1 million – February – Emily Leproust

- Declara – $9.0 million – June – Ramona Pierson

- Weddington Way – $9.0 million – August – Ilana Stern

- Wickr – $9.0 million – March – Nico Sell

- Reselinc – $8.0 million – February – Bindiya Vakil

- Mattermark – $6.5 million – December – Danielle Morrill

- Darby Smart – $6.3 million – May – Nicole Shariat Farb

- Kurbo Health – $5.8 million – July – Joanna Strober

- Accompani – $5.6 million – June – Amy Chang

- Urban Remedy – $5.0 million – June – Neka Pasquale

- Vida – $5.0 million – October – Stephanie Tilenius

- Deliv – $4.5 million – February – Daphne Carmeli

- uBiome – $4.5 million – August – Jessica Richman

- Neon Labs – $4.1 million – July – Sophie Lebrecht

- Chairish – $4.0 million – August – Anna Brockway

- Full Circle CRM – $3.8 million – November – Bonnie Crater

- ApplePie Capital – $3.8 million – November – Denise Thomas

- Other Machine – $3.0 million – June – Danielle Applestone

- Yiftee – $3.0 million – January – Donna Novitsky

- Workboard – $2.8 million – February – Deidre Paknad

2013 Series A Rounds – NYC

Female CEO

- Zola – $3.3 million – November – Shan-Lyn Ma

Female Co-Founder

- Arkadium – $5.0 million – March – Jessica Rovello

- Floored – $5.3 million – December – Judy He

- Speakaboos – $6.2 million – August – Noelle Millholt

2013 Series A Rounds – Bay Area

Female CEO

- NovaTorque – $14.0 million – February – Emily Liggett

- Serena & Lily – $10.0 million – March – Lily Kanter

- BackOps – $7.0 million – July – Kristen Koh Goldstein

- Deliv – $6.9 million – September – Daphne Carmeli

- Brit + Co. – $6.3 million – June – Brit Morin

- Grokker – $5.5 million – December – Lorna Borenstein

- Peek – $5.0 million – November – Ruzwana Bashir

- Food Runner – $5.0 million – June – Mary Risely

- Stitch Fix – $4.8 million – February – Katrina Lake

- PokitDok – $4.0 million – June – Lisa Maki

- True & Co. – $4.0 million – October – Michelle Lam

- InstaEDU – $4.0 million – August – Alison Johnston Rue

- Pathbrite – $4.0 million – March – Heather Hiles

- Choose Energy – $4.0 million – March – Kerry Cooper

- Proxio – $4.0 million – March – Janet Case

- Science Exchange – $4.0 million – May – Elizabeth Iorns

- NuMedii – $3.5 million – June – Gini Deshpande

- RidePal – $3.2 million – September – Nathalie Criou

- Rackware – $3.0 million – June – Sash Sunkara

This piece was written by Claire Burke and is reprinted by permission.