TIE (The Indus Entrepreneurs) is the world’s largest non-profit dedicated to fostering entrepreneurship, with 56 chapters and 15,000 members globally. Our New York chapter, faced with robust local competition from for-profit accelerators, startup organizations and dozens of competing events each day, has been forced to evolve beyond the typical TiE chapter structure. We’ve tried many different programs in order to stand out and, about a year ago, chose to launch a new angel investment group. Having limited resources, as a non-profit, it was an uphill battle as we competed for both angel investors and investments.

Fast forward, 12 months and we’ve funded five companies while growing our charter member base by 50%.

CLICK HERE TO SEE THE 7 LESSONS THAT WE LEARNED THAT YOU CAN APPLY TO YOUR STARTUP

Image credit: CC by Temari 09

-

Start with your assets

The first thing we did was assess our assets. TIE had a network of connectors in NYC, including prominent investors and startup executives, and a track record of producing events. We had board members with active investment portfolios. We recruited several TIE members to join the TIE Angels board and asked them to nominate their recent investments to present. This allowed us to get off the ground with presenting companies that already had social proof. Given we were so new, starting with social proof was incredibly valuable.

Application: “The simplest way to start is usually in front of your nose. If you have existing relationships in the industry start there, either to make them your beta testers, advisors or referral partners. “ Alessandro Piol, President of TIE NY

Image credit: CC by epSos .de

-

Choose your audience

Even if you have customers (or in our case, members), that doesn’t mean that you know your audience. We had a number of existing investors in our network. This program brought out the existing investors as well as those who wanted to invest but didn’t know how. We could easily have missed this, had we only look at our board. We listened to our community and learned that most of our investors wanted to be part of a community of people learning how to invest. So we programmed classes on being an angel and made it easy for people to join – waiving fees for the first year and inviting in first time investors.

Application: “Your evangelists may be different from your core customers. Listen to feedback and ask your advocates and customers what they are looking for in a product – even if it’s not quite what you thought you were offering today. Make sure you are clear about what addressable market within your target market that you are serving. It is very easy to see one and go after another. As your business evolves, your audience may change – just be conscious of it and flow with it. Choose your audience and listen to them and they will show you the way. In this case, it turns out that we had a huge latent demand for a trusted angel investor community from within our existing network, including both professional investors and those who wanted to learn. “ Kiran Lingam, Co-Founder and Chairman TIE Angels NY; Board Member TiE NY

Image credit: CC by Jan Ramroth

-

Ask everyone for referrals

The best way to grow is often by word of mouth. Like attracts like. What we did is we asked each member to bring a qualified personal contact to each investor pitch event. We sent one on one messages asking members to refer new qualified prospects who might be interested. We tapped into complementary social circles. This led to an increase in buzz and new membership for the group.

Application: “Ask every customer or user of your product for a qualified referral. Make it easy. Give them content that they can share. The simpler it is for your customer, the more likely they will be to share. “Stephenie Skaferowsky, Executive Director TIE NY

Image credit: CC by Susan DelVecchio

-

Evolve your product

You may think that our product is capital: our product is really the nexus of capital, trusted community and event experience. We tested out several formats for investor meetings, from dinner pitch events to lunchtime board pitches. We kept testing and measuring turn out, feedback and results, eventually finding a format that works for our group.

Application: “You may think you are building X and end up with Y. Keep collecting feedback and evolving to where your customers want to take you. Great products evolve over time. The iPod eventually became the iPhone and iPad. The best ideas often come from evolution and feedback. Very few companies end up selling the same core product ten years after launching. People change. Businesses evolve. “ Anil Kappa, Co-founder of TiE Angels NY; Board Member TIE NY

Image credit: CC by Kevin Dooley

-

Patience

This is the most important element. Everything takes time. Learn from the stage before – evolution takes millions of years. Our goal was to make good investments and grow the group. We went into it with a time horizon and a big goal. We tested and optimized the angel group, cycled through members and got deals done, always learning, always having patience.

Application: “Assume everything takes twice times as long as you hoped and is three times more expensive. Be patient and roll with it. “ Hemang Mehta, Co-founder of TiE Angels NY; Board Member TIE NY

Image credit: CC by Tambako The Jaguar

-

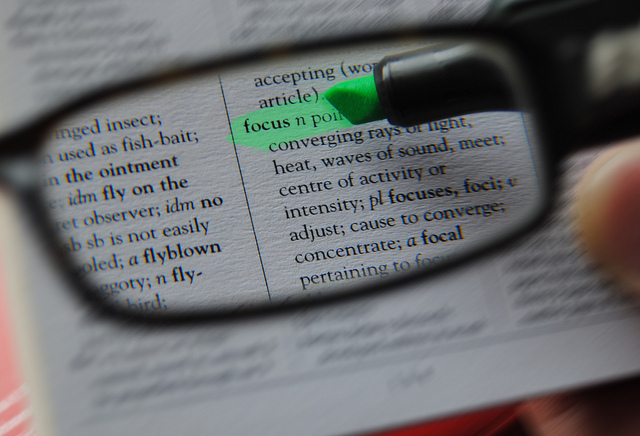

Focus

If you want to take over the world, start by delivering a small island first. Holding focus is one of the most valuable things that startups can learn. With the speed of change, it’s essential to learn how focus while being adaptable.

Application: “i.e. focus on stage of deals, type of sectors that we figured work well for our group and then focus on bringing in those type of deals. Similar lesson for startups. The story has to be focused, it needs to make sense. As a start up. you just cannot conquer the whole space when you are getting started, so focusing on one key differentiator or a specific need in the market to get things going is key.” Ramesh Kumar, co-founder TIE Angels NY and CEO Zakipoint Health.

Image credit: CC by Mark Hunter

-

Start with your existing network

You have a startup and need clients and money – where do you begin? You start with your existing network. Choose ten connections you have in the industry and ask permission to pitch each of them, and ask for one introduction. Then keep networking from there.

Application: “When we got started, we needed to build a network, so we started with an initial community and grew from there. There are many angel groups in New York,;TIE’s core audience is Indian investors and young entrepreneurs. We started there and networked our way in the community. If you’re an entrepreneur from the Indian community, then TIE would be a logical place to go. Tariq Khan, Co-Founder of TiE Angels NY, Board Member TiE NY.

The payoff

The group is working, members are joining, deals are getting done and people are happy. Bottom line is: business comes down to listening to and evolving with your customers. Do that and you’ll win.

Image credit: CC by U.S. Department of Agriculture