All founders dream of building everlasting public companies that will live on long after they are gone. However, after a few years of struggling and working for free, the idea of being acquired for a nice payday can seem very attractive. In fact, if you read TechCrunch too much, you might believe that an easy way to get rich is to start a company and sell it for $100 million after two years.

While getting acquired is a great exit for any company, planning for it is a very bad idea. Even worse, starting a company with the goal of being acquired will set you up for failure before you even begin. To understand why, let’s think about how potential acquiring companies look at acquisition targets.

Goals for Acquisitions

Large companies acquire smaller companies to gain assets they don’t have access to any cheaper way. Acquisitions, even small ones, are expensive ways to gain assets, so acquirers are highly motivated by what is necessary to improve their own business.

While you might think about your company as a living, growing organism with many dimensions and nuances, acquiring companies will look at it in the same way a butcher looks at a cow. Your company is made up of one or more assets and those are what they consider acquiring. Those assets may include:

- People. All of the employees, including the founders, and the expertise they have developed working at your company. If everyone works together extremely well, that teamwork chemistry can be considered an asset by acquirers looking for productive teams.

- Product. The product(s) you have built, whether or not they have been released to customers yet.

- Technology. Any unique algorithms, mathematical models or processes you have developed, even if they aren’t patented.

- Customers. Everyone using your products, whether or not they are paying you for them. In some cases, you may only have one large customer who pays you a lot of money over a long term.

- Profit. If your business is profitable, that positive cash flow is a huge asset since it produces a return for whoever owns the business. The same can be true of having a lot of liquid assets.

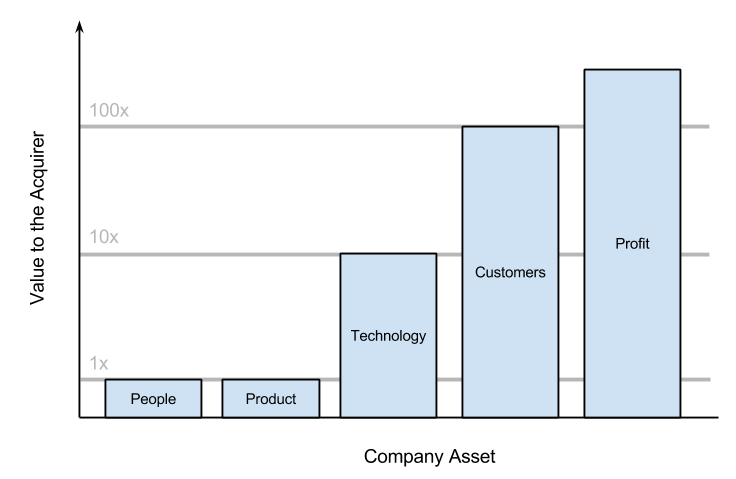

Not all of the assets are created equal. Below is an illustrative example of the comparative values of assets based on the acquisitions I have been involved with (both as the acquirer and the acquired companies).

Example of how corporate assets compare in terms of value to acquirer. Technology is 10 times more valuable than people or products, while customers are 100 times more valuable. Profit can be infinitely more valuable, depending on how much of it you have. Note that these are just illustrative.

Why are assets valued so differently? For the simple reason that the value of your assets are entirely dependent on how they apply to the acquirer’s business. For example, the value an acquirer assigns to your technology is not the value they would get from selling it themselves on the open market, but how much value it will add to their business. It is not enough that your technology is new and groundbreaking, it needs to help the acquiring company make money.

It’s not a coincidence that the assets that have the highest value are developed later in the life of a company (customers, profit, etc.). Those assets are the hardest to build and therefore will carry the most value. That is one of the many reasons that companies become more valuable the longer they exist and why it’s so rare to see a big acquisition of a young company.

The Exception Proves the Rule

It is almost impossible to make generalizations about acquisitions because each acquisition depends so much on the companies involved. One acquirer may value your company at $5 million while another values it at $20 million, because the second company believes they can use your assets to increase their own profits by $40 million. So remember that the previous example is only illustrative.

But that is exactly the reason you should never focus on being acquired! You have no way to control how potential acquirers will value the assets you are creating. Successful acquisitions require the right acquirer to value your company at the right price, at a point where you would consider selling. That combination of factors is rare and definitely not something you can plan.

So what does that mean? The best strategy, in fact your only strategy, is to focus on building a successful and highly profitable business. As long as you do that, you will control your own destiny and decide if and when you get acquired on terms you decide.

Or maybe you’ll go public! Then you can buy some companies yourself.

Image Credit: CC by Tim Pierce