Why do you angel invest?

I started out as an entrepreneur—just like you—and learned the hard way that sometimes, VC money is not all that it appears to be. It can make you feel like you gave your shirt, your house, your car, and your shoes away. I know what it takes to be an entrepreneur and put everything you have: your blood, sweat, tears, ALL your time and sleepless nights, into a startup. So to have an angel come in and support us would have been a godsend. This perspective probably makes me more sympathetic towards entrepreneurs than it does non-entrepreneur investors. VC money is good for some ventures, but just be very clear about what you are getting into, especially if you are post revenue and can get better funding elsewhere.

I’ve done three startups and they’ve grown. Angel investing, if done correctly, can be a wealth generation tool, but it is not an exact science. A lot of it is your gut. A lot of it is your experience and your belief in the product, the person, the team, or the market.

What was your first angel investment? How did it turn out?

Wow, this was a while ago – let me think. I started in my late 20’s. I invested in a Mexican “white glove service” bank that catered to well-heeled Mexicans in the US. These guys are very well off, they travel to the US all the time and when they do, they expect the same level of service that they get in their home country. and there was a gap: there was nobody doing it. There was a pay out a last year so, yeah, I’d say that this investment went pretty well.

What investment do you most want to brag about?

Yes! How did you know? The one that I really want to brag about is actually a company I invested in called New York Distilling Company. It is an artisanal gin and whiskey distillery right here in Brooklyn and was co-founded by folks from the Brooklyn Brewery. I just love the idea of supporting local jobs and food and it has been great to watch them grow. Another is Hayward, one of the first American lifestyle luxury brands – they make stunning bags and accessories and is getting ready to open their first retail experience location in NYC!

Can I tell you about another company I invested in? The other one is a Vietnamese-style sauce company The Saucey Sauce Company. (getsauceynow.com) They produce all natural, artisanal Vietnamese inspired sauces and ketchups – they are awesome and makes everyone look like a rock star home chef!! I use it daily when I cook. I am proud of that one because I’ve seen it really seed and grow as a family endeavor.

Any notable or amusing train wrecks? Any lessons learned?

It’s still too soon to say if there are any train wrecks yet. That said, there are some that are struggling and pivoting. An example is a curated personal healthcare “birch box” concept – we thought it would be snapped up quickly by the big box pharma chains but that hasn’t happened.

I have found that a good way to manage your angel investments is at the beginning of the year you say to yourself, “Here is my bucket of money for angel investments this year” and it makes up a certain % of your overall investment portfolio And you tend to be generous at the beginning of the year – as the year progresses, angels may start to think, “Wait, I invested here, I invested there, my portfolio’s filling up. I don’t have room for more investments.” So you have to be more picky and do more due diligence.

Any startups you backed that should have hit but didn’t? Any idea why not?

Yeah, there was a social media site, like a digital “Dear Abby” for the young women of today. Say you get a text from a boy and you don’t know what it means. You post it and all the lady friends you know log on and comment. You also have male ambassadors commenting as well. Essentially, it allows you to crowd-source advice about dating based on texts guys send you. They had a movie deal with major networks, they had a series deal, like they had all this stuff kind of going on. Those projects probably are still in the works and will probably grow in the next several years as consumer trends change .I’m still waiting for the up, though. [laughs]..but I am patient!

Most humbling experience (related to angel investing)?

Humbling? Well, I am turned off when an entrepreneur is obnoxious enough to say that you cannot invest unless you write a huge check. Entrepreneurs like that sometimes miss the point of angel investing. It is not just the money. It is the entire network that that person could bring to bear – if they care about you and buy into your vision, the angels can bring a lot to the table. But humbling? Gosh, I don’t know.

What’s the smartest thing someone pitching you said or did?

Once I asked an entrepreneur, “Tell me what I would miss if I don’t invest.” He said, “Look, if you didn’t invest – and I get why you are not investing – but just picture this: 5-10 years from now, I’m going to be here…. I’ve put it all on myself. I’ve put in all my life savings.” He understood that in order for me to buy in, I had to understand my return pretty explicitly and that he was willing to be in that ride with me.

One of the first red flags for me when evaluating an investment is to understand how much money the founder has put in himself. This is actually pretty key, because you want them to have skin in the game, right? You have to make sure you understand the motivation behind a business and that you agree with it.

What financial returns do you target for an angel investment?

I don’t have lofty dreams for angel investment, to be honest. If I or anyone else gets a 10x or 100x return, it’s a rarity. You look for a 10x plus return, knowing that you are lucky to get a 2x plus return. And I’m pretty realistic on time frame – between 3–7 years. I know the funds are locked up and I’m not going to see that money any time soon.

What makes you better than the average angel?

Hmmm, I don’t know if I am better than the average angels. but I manage the angel investment like a portfolio. It’s an investment vehicle; it’s not emotional. My husband and I agree this is what we have and that’s it. If later anyone finds something really interesting, we’ll say, “Look, we can’t do it this round, but maybe next year.” We run it like a little PE shop.

Sometimes, when you get excited about an idea or a team, you do make emotional investments. When it is emotional, I cap it.

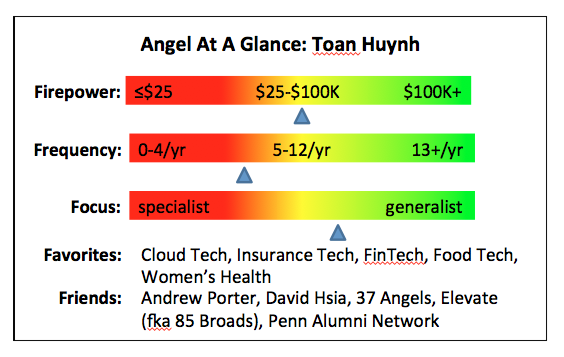

I do have specific expertise in cloud technologies, food tech, fintech and a personal interest in education and women’s and children’s health – so I have view points on these that might be helpful.

Pretend that it’s 2019 and complete this sentence, “[Technology X] is less than 5 years old and now I can’t imagine life without it.”

I think that five years from now I’m going to have a home device or office device that can actually know my habits: know what I want, know what I need, know what I do in what order, and help me manage my personal and professional life in a meaningful way. A life assistant – you know what I mean? I would love to see a product like that.

What’s the best way for entrepreneurs to reach out to you?

Check me out on LinkedIn.

If you are an active NY-area angel (or know someone who is) and would like to be profiled for AlleyWatch, please contact me here.