Today we take a look at the state of venture capital and angel funding during the all of November, both in New York and nationally. Analyzing some publicly available data from our friends at CrunchBase, we break down the national aggregate statistics for all funding deals by stage of funding (Angel/Seed, Series A, Series B, and Series C+).

CLICK HERE TO SEE ALL THE NOVEMBER FUNDING DATA

Early Stage Financing Key Takeaways:

The number of early stage deals in New York and nationally both fell from October levels. Valuations in both segments also were more conservative as average deal size fell across the board.

For your tweeting convenience:

Average Angel/Seed round in NYC for November was $1.29M Tweet this

$19.73M was invested across early stages rounds in NYC in November Tweet this

Average Angel/Seed round in the US for November was $1.18M Tweet this

$131M was invested across early stages rounds in the US in November Tweet this

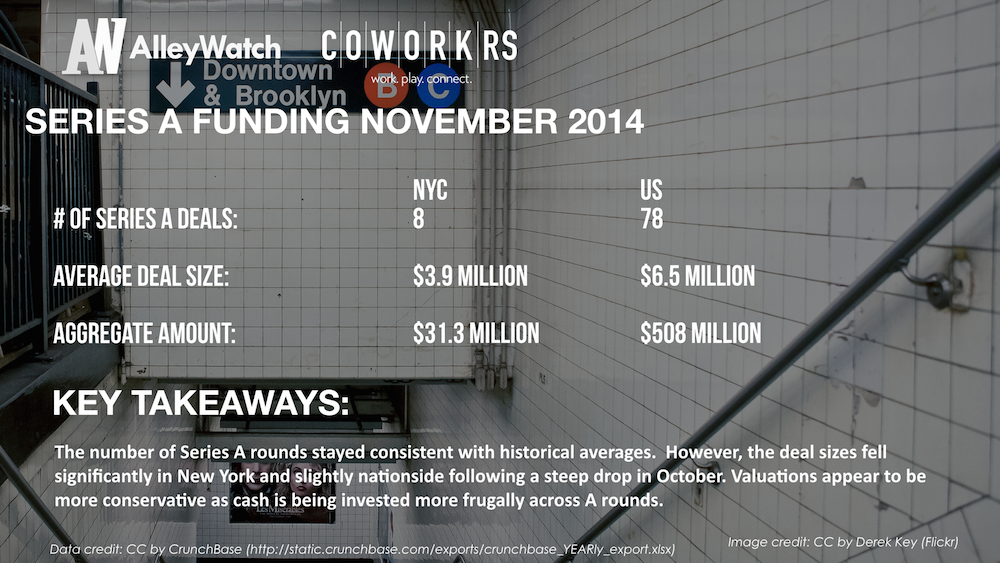

Series A Key Takeaways:

The number of Series A rounds stayed consistent with historical averages. However, the deal sizes fell significantly in New York and slightly nationside following a steep drop in October. Valuations appear to be more conservative as cash is being invested more frugally across A rounds.

For your tweeting convenience:

Average Series A round in NYC for November was $3.9M Tweet this

Average Series A round fell 27% in NYC in November Tweet this

$31M was invested across Series A rounds in NYC in November Tweet this

Average Series A round in the US for November was $6.5M Tweet this

Average Series A round fell 4.36% nationally in November Tweet this

$508M was invested across Series A rounds in the US in November Tweet this

The average Series A has fallen the last two months nationally and in NYC after increasing steadily over the year Tweet this

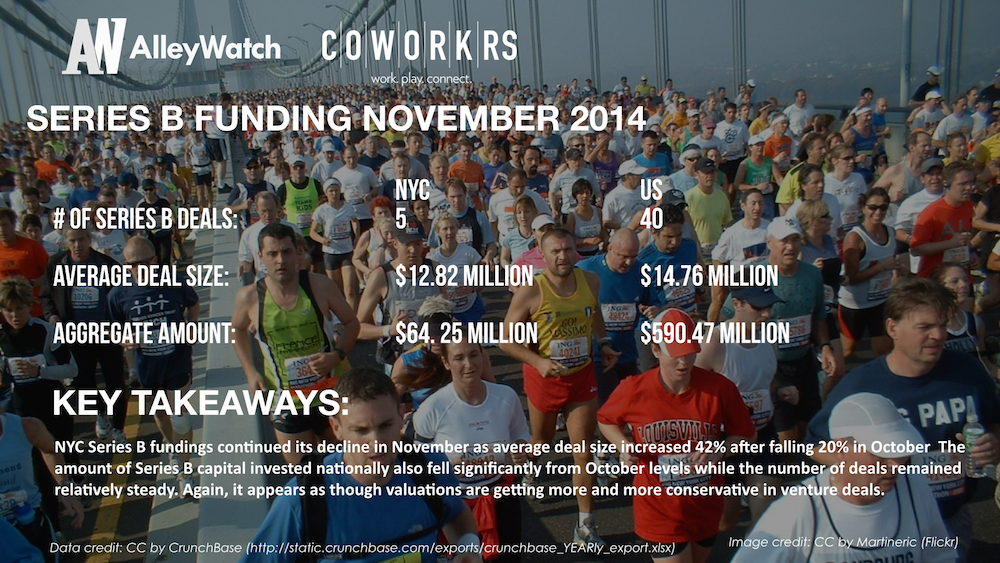

Series B Key Takeaways:

NYC Series B fundings continued its decline in November as average deal size increased 42% after falling 20% in October. The amount of Series B capital invested nationally also fell significantly from October levels while the number of deals remained relatively steady. Again, it appears as though valuations are getting more and more conservative in venture deals.

For your tweeting convenience:

Average Series B round in NYC for November was $12.8M, up 41% Tweet this

$64.12M was invested across Series B rounds in NYC in November Tweet this

Average Series B round in the US for November was $14.76M Tweet this

$590M was invested across Series B rounds in the US in November, down 22% Tweet this

Late stage Key Takeaways:

Only 1 late stage financing in NYC for November. Nationally, late stage financing fell below a $1B which is the lowest we have seen in quite some time.

For your tweeting convenience:

Average Series C+ round in NYC for November was $15M, down 22% Tweet this

$15M was invested across Series C+ rounds in NYC in November Tweet this

Average Series C+ round in the US for November was $30M Tweet this

$961M was invested across Series C+ rounds in the US in November Tweet this

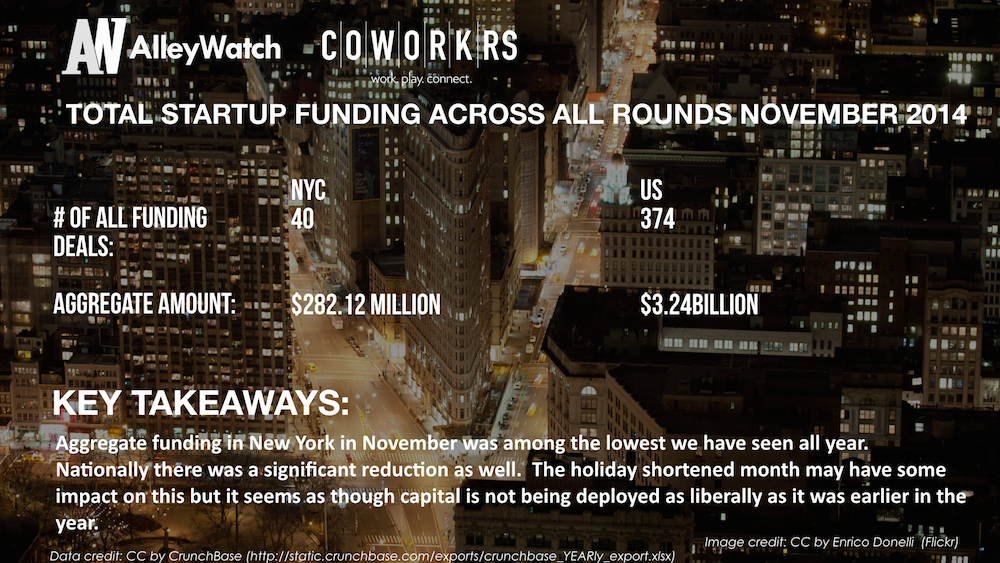

Aggregate Key Takeaways:

Aggregate funding in New York in November was among the lowest we have seen all year. Nationally there was a significant reduction as well. The holiday shortened month may have some impact on this but it seems as though capital is not being deployed as liberally as it was earlier in the year.

For your tweeting convenience:

$282.12M was invested in angel and venture financing for #startups in November in NYC across 40 deals, down 14% Tweet this

$3.2B was invested in angel and venture financing for #startups in November in the US across 374 deals, down 22% Tweet this