So far so good. You gathered the materials I described in Step 0, and you made a successful introduction to a VC using techniques of Getting VCs to notice. The VC responded and he wants to schedule a meeting or a call. In most cases, these are meetings, but, today, a WebEx (Fuse, GoToMeeting) can serve the purpose especially if you’re in different cities. In the old days, VCs only invested in companies within driving distance. That is slowly changing. But, if you happen to be in town and can meet in person, it is always better. So, what should you do?

YOU should…

- Be flexible. Most VCs like to complain about how busy they are. Some of them actually are and the busy times do come and go. Schedules are usually filled for a week or two in advance. Don’t consider it a sign of rudeness or disinterest if a VC offers a time two weeks out. It should never be more than four weeks (come on, no one is that busy unless vacations are involved). I use scheduleonce.com and my make my schedule available for you to self-schedule. Other “important people” (or people trying to look important) do scheduling through their admins. In either case, you will have a choice to pick a couple of one hour time slots. My advice: pick mornings, definitely before lunch. You want to have everyone’s undivided attention.

- Do your homework. You should know a little about the individual(s) you are meeting — look at their LinkedIn profiles, read their blogs, look at their twitter stream. Are they business or technical? Do they have strong opinions about your competitors? Do they have a sense of humor? If they have shown up on any videos, how do they sound? Are they dry as a bone or is there still a spark in their eyes? The more you know, the better prepared you are and it will help set the tone for subsequent discussions. Understand the roles in the firm: Partner, Principle, Associate and what they mean. Meeting with ANYONE at the firm is a good thing, so don’t let the titles bother you, but realize that the person you meet in the first encounter is unlikely to say “yes” — but that any one of them, no matter what the title, can surely say “no.”

- Bring enough people, but not too many. Unless you are a one-man startup (and probably shouldn’t be talking to VCs), there are other team members. You should bring one or two (but not more) to the first meeting if possible. Don’t make it crowded, but since team quality often sets the tone for events that follow, showing as much team depth as you can is important. Your “technologist” should be capable of speaking and your “sales guy” should not be obnoxious.

- Arrive a little early. Unless you’re stuck in traffic, it’s a good idea to show up on time. Chances are, there is another meeting following yours and you don’t want to be cut short.

- Dress appropriately. OK, in this day and age, you don’t have to wear a suit and tie. There is nothing wrong with dressing up, but not if it looks contrived and unnatural. However, don’t show up in shorts, T-shirts, rubber shoes that look like feet. Take a shower. You’d be surprised how many people don’t do that. Polo shirt + slacks — totally fine.

- Bring the right equipment. Sadly, most VCs are still a Windows/PowerPoint/VGA shop. Some, strangely, don’t have a whiteboard. Pretty much all have WiFi. I always brought my Mac, a VGA and HDMI dongles, a WiFi modem (just in case), and a USB key with the presentation in Keynote, PPT, and PDF. I had a pad of paper in my bag to draw things in case the conference room didn’t have a whiteboard.

- DO NOT: bring printed copies of your presentation. VCs will skip ahead and not listen. You should have sent them the deck and offer to send it again if they need it. However, if there are spreadsheets with hard to see figures, offer to hand those out, but later in the presentation.

- Try to relax. VCs are not as intimidating as they seem. We understand that you’re nervous and that this moment is important to you. Try to be casual and relaxed in your demeanor.

- Keep the pitch to 40 minutes. You will typically have an hour on the calendar. However, there may be time spent getting the machine hooked up for the presentation or a demo. But, more importantly, you want to leave time to get feedback and answer questions. If there are 10 minutes left after all the Q&A it makes it harder for VCs to dodge the “What did you think?” question with the usual “I have to discuss this with my partners” line.

Use basic, good presentation techniques

- Speak at normal speed. Often, companies presenting try to squeeze too much information into the allotted time by using “too many words.” Make the points, be succinct, make sure the audience has time to digest.

- It is OK to pause for a second between sentences as God intended. It’s not a sign of not knowing what to say.

- Avoid jargon. Try not to use the “hip phrases” you read in the press. Some professional terms are fine, but sentences composed of clichés are annoying. That doesn’t mean you should not be technical where appropriate… there is a difference between being specific and spewing meaningless phrases.

- Avoid superlatives and bombast. If you are really the next “Google” or will “revolutionize the way people work” — let us be the judges of that.

- Show you’re human. It’s OK to smile, respond to the audience, and look like you’re enjoying this (even though you may not be).

- Don’t go off on tangents or let your “flow” be ruined. If you are really going to get to this point later in the presentation (remember, they can’t skip ahead), say so politely. Nothing wrong with that.

- If you see that the other person is an asshole, wrap up quickly. No point in wasting your time with them. Just thank them, speed up, conclude, and move on.

- Keep the introductions short. Give a very brief bio and let your words show them how great you are. This is not an interview for a job and they don’t need to know how you blew away your numbers for the last six quarters or where you grew up.

- Keep the presentation simple.

- Talk about the problem. What is the world doing that you are trying to change, how is what it’s doing wrong, how you think it should be. Answer the “Why now?” question.

- Talk about your solution. What do you do? Is it a product or a service? How will it address the problem? What is unique about it? Explain the technology. You never know, someone like me might be on the other side of the table and I will want the gory technical details. With me, don’t ever refer me to the “technical guys” unless it is REALLY technical. The CEO should know how the product works. Answer the “Why this?” question.

- Talk about what you’ve done so far. I am amazed by the number of people who don’t talk about this. You should have done something already if we’re meeting. More than just putting together a slide deck that talks about the future. Explain what you have built, what customers you have, what they are doing with your product. Throw names (company names, not people names) around if you can.

- Explain the team dynamics. Is the team complete? Are you all working on this full time? Is everyone in the same city? Will any of these things have to change. Go light on the “advisors” you have — no one really cares who they are, we want to see the results of their advice in the presentation.

- Talk about how much money you need. We will want to know how much money you are raising. This number contains an “implied valuation” that, depending on the series of funding you are seeking will let the VC calculate some financial ramifications of the deal. If you are raising $1M, you can’t possibly expect to have a $20M pre-money valuation. You should be raising $5-$10M in that case. Importantly, explain why this is the amount of money you need. Where will it get you? When will you be having this conversation again with your investors and at what stage you will then be. Talk about getting to profitability, but be realistic — most companies will need to raise more money. Just make sure we understand how much and when.

- Summarize. Tell them what you’ve just told them. Sometimes I like to pre-empt this and give my own summary to the company that just presented to make sure they see that I understood what they just explained and that I listened. Companies feel good when a VC actually “gets” them. This does not mean that you will get the money. There are still many things that need to happen, but it’s a good sign nonetheless.

After the meeting

- Wait up to a week. Unless you get a clear signal that there is a next step (10% of the time) or that this is not going to work out (40% of the time), you should wait, patiently, for the response. What you are hoping for is another invitation to present, to a larger audience. You may be asked to speak to someone else in the firm or to an expert that the VC knows. Do it — it’s a next step.

This wait, painful as it is, can last a week or so. No one should leave you hanging longer than that. During this period, the VCs will be doing some “individual diligence” on you and the company which can include…

- Finding out more about the founders

- Reading what the press/blogs say

- Looking at your competitors

- Reading and studying the market

- Anything that lets them prepare a better case for presenting your company for a review at the partner meeting, which usually takes place the following Monday.

Accept the decision. If the decision is a “no” it will come as a simple, short, email. Don’t argue, accept it, and move on. You have wasted one meeting and one week waiting. Chances are, if there wasn’t a “no” right after the presentation, the VC spent more time thinking about it than you spent presenting. Some VCs will offer to guide you to another investor, or to meet with you as a post-mortem. This is a good sign. Means they liked you, but just didn’t think an investment would fly at this stage of the game. Accept those offers. Some of my best VC relationships came from people who passed on my company at one time or another.

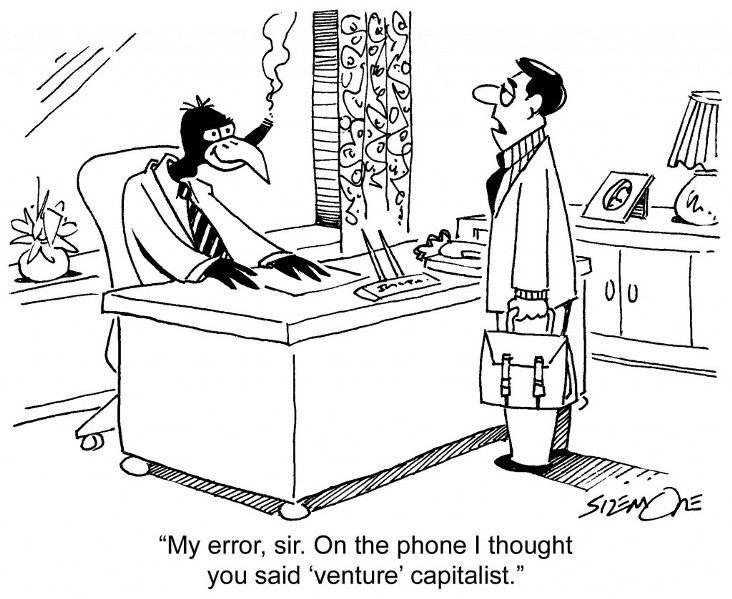

For the VC, the key rule is: don’t be an asshole.

It may seem like we are doing the company a favor by meeting with them, but that’s not the case. We need deals as much as they need money. We have a reputation that can spread in days of social media and global communities. We have to treat the companies that come to see you with respect and courtesy.

WE Should….

- Be prepared, within reason. Some VCs do a ton of research before the meeting. This is certainly not a bad thing. However, I don’t really think it is a good use of time (I’d rather see more companies). Of course, we should look at the materials, think about the questions we may have, and do research on the people we’re meeting. But too much research before the first meeting, in my opinion, tends to provoke pre-judgement. We should come to the table with ideas, but should let the company tell the story its way.

- Be on time. If we are late, there should be an excuse. We should not keep a nervous team waiting while we finish our call unless it is actually important and we can explain why.

- Keep it personal. Our first meeting should be informal and relaxed. We are meeting the team for the first time and we should make every effort to make them feel comfortable. Dispense with a lot of the formalities. Get them a soda. Smile. The more relaxed they feel, the better we will get a feeling for who they really are.

- Pay attention (no email, phone, etc.). As if a plane was coming in for a landing, all electronic devices should be off. This is why I don’t like people bringing laptops to the meetings. iPads are OK, but it’s all too tempting to start reading email. I do use an iPad to browse through the company’s web site or look up things during the meeting — but they are all meeting related and I explain what I am doing to the company presenting. I take notes with a LiveScribe pen so I can go back and review the audio. I often record the WebEx calls for the same reason. But, the focus should always be on the presenter. Eye contact matters.

- Not talk about ourselves. Our background is not all that interesting at this point. The only reason I sometimes bring up the details of my past is to give the team a sense of what I know so they can adjust the presentation. With me, they can go heavy on the technology side, they shouldn’t try to bullshit about certain areas.

- Not play the “do you know game.” I have seen the first 10 minutes of a VC meeting turn into the dreaded “do you know so and so” game that I recall from my frat party days. We shouldn’t do it. No one is impressed by having contacts in common and this is not a dorm social. Important is what you know and what they know, not whom.

- Make the entrepreneur feel relaxed and important. To quote Franz Liebkind from “The Producers,” “You are the audience, I am the author. I outrank you.” The entrepreneur is the author, even if the play is bad. Let them present, let them present what they want, how they want it. We shouldn’t ask people to skip around their presentations or deviate in new directions. We should keep the mood upbeat and friendly. We should not look bored. We should not fall asleep.

- Try not to sound too smart. We tend to come from fairly select backgrounds. Most good VCs have been around for a while, most have started companies, most have managed people, and most have seen economic waves, fads, and disasters. However, if we can, we should save our lectures for the closing remarks and not interrupt with self-promoting tirades. Ironically, the younger the VC, the less experience he has, the more he tries to appear smarter than necessary. Avoid it.

- Try not to sound too stupid. Occasionally, I’ve seen us try to pretend to need things dumbed down. Usually, there are smug comments like “this is over my head, heh heh,” or “pretend I’m your Mom and you’re explaining this to me for the first time.” Well, if this is over our heads, we should not be the ones listening to this and should say it. And I have always felt insulted by the “mom” comment — first, what does that say about mothers and, second, why am I talking to you when I could be getting a home-cooked meal from mom.

- Have someone credible at the meeting. If I don’t know the topic the presentation will cover, I won’t take the meeting or will ask to be treated as a student rather than as an evaluator. I will ask this before the meeting starts. Alternatively, we should have someone else at the meeting who actually understands what is about to be discussed.

- Summarize our understanding of the company. At the end of the presentation, we should be able to explain, in our own words, what the company is all about, its target market, its product, its revenue model. It is the entrepreneur’s job to make that summary accurate, it is our job to think through this summary ourselves and try our best to make sure we really heard what we were supposed to hear.

- If the answer is “no” say it there and then. We should not tell a company that we will “get back” to them later when the decision will clearly be “pass.” And everyone in the firm should be empowered to say “no.”

- Followup within a week. If we need some time to think and talk to others, that’s fine, but here is no excuse to take longer than a week unless you’re going on vacation or something unpredictable happens. None.

- Say no concisely, definitively. Short email. Explain why in a sentence. Wish the best. Move on (both parties). but…

- We should always keep the door open. We never know if the person that came to see you won’t be the next tech giant. And, we always want to make sure to offer help and advice to the people you want to see come back.

- Say yes and clearly outline the next steps. If this is a company we’re interested in, we should clearly outline the next steps the company will have to go through. This is typically the “partner meeting” presentation — a unique mating dance of its own which I will explain in the next post.

You can read the other pieces in this series by clicking here.