Show of hands: who thinks that looking for a new apartment in NYC is one of the greatest leisure time activities on the planet?

We know. Major pain point and that’s why Skylight just raised a $500k seed round from the likes of Tim Draper, Marc Benioff, and Great Oaks VC.

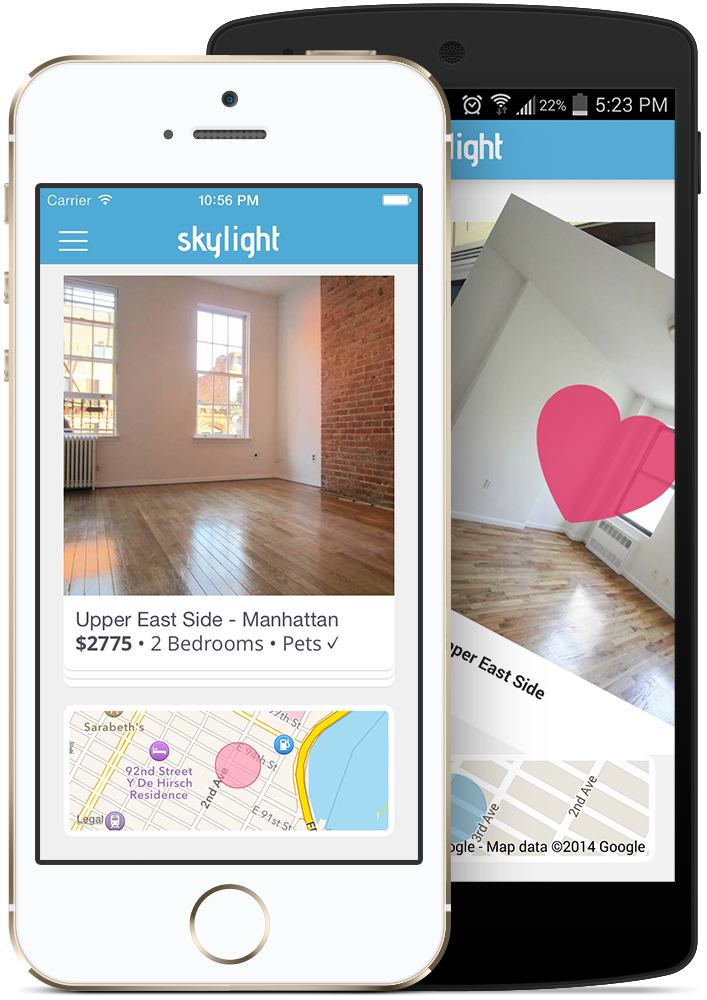

Skylight is a really easy and actually fun way to find your new place. It’s the “Tinder for apartments,” and about time someone reimagined the entire rental process and made it easier for agents and renters.

And you’re always one tap away from a vetted broker, to make it that much easier to seal the deal.

Cofounders Jason Marmon, Dean Soukeras, and Michael Lisovetsky explains how the team got the company up and running – and funded – so quickly.

Who were your investors?

Tim Draper (lead), Marc Benioff, Great Oaks VC, and several angels.

Tell us about your product or service.

We’ve built a mobile-first platform to help with the information overload of a typical apartment hunt. Aggregating apartments on a map is no longer a feat or particularly functional, and Skylight enables users to search effectively in a bite-sized manner by inputting their preferences and seeing apartments one card at a time. We’re building a platform that helps users from search to sign, slowly chipping away at the market’s inefficiencies and enabling both renters and agents to experience a smoother transaction.

How is it different?

We’re mobile first, and that enables us to acquire a lot more data to verify our listings. We have the cleanest database in the industry – our proprietary algorithms remove duplicates and use machine learning to improve our data over time. Having a strong database enables us to provide a high quality user experience – a lot higher than traditional competitors who emphasize quantity of listings. On our platform, one listing is one real apartment.

What market you are targeting and how big is it?

We’re starting out with a laser focus on the New York City rental market, with plans to expand nationwide, to both sales and rentals.

What’s your business model?

A SaaS model. While we’re not charging agents yet, we’ll be charging agents to market their listings.

What was the funding process like?

The funding process felt like a chicken or egg problem. At first it felt like we were unstoppable, but then we received a lot of pushback because of competition in the space. Fundraising was a humbling experience, and it kept us on our toes at all times. It helped us think about our business in a deeper manner, and reassured us towards the direction that we’re working in.

What are the biggest challenges that you faced while raising capital?

The biggest challenge was our stage. Our company is only about three months old, so investors were very concerned with a competitive industry and a very early company. Once we secured our lead investor, fundraising became a lot easier.

What factors about your business led your investors to write the check?

Our investors placed an emphasis on the team, and effective execution that they saw. Our investors knew the potential of the market, and they were enamored by the vision we set out for the industry.

What are the milestones you plan to achieve in the next six months?

We have a lot of interesting consumer facing features that will drive up the user our user’s experience ten-fold. We’re also working on very cool analytic tools for agents, that the industry has never seen before.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

“Be so good they can’t ignore you.” It may seem cliché, but that’s exactly what we did in order to fundraise. Fundraising is just an event, and it came after months of hustle. The co-founders went from a smidgen of an idea to many users in a very, very short amount of time, and our investors were convinced that we were a great team to work with.

Where do you see the company going now over the near term?

Building, building, building. We’re working to break out of what we consider an MVP, and blow away any competing apps.

Where’s your favorite spot to go and relax with your peers?

We don’t have time to relax.