This week, we take a look at the state of venture capital and early stage funding in NYC and nationally over the last 10 quarters from the 2nd quarter of 2012 through the third quarter of 2014. Analyzing some publicly available data from our friends at CrunchBase, we break down national and NYC aggregate statistics for deals by stage of funding (Angel/Seed, Series A, Series B, and Series C+). To further the analysis, we have included some data that demonstrates historical trends in terms of average round sizes as well as New York’s relative share of the total funding market over time.

CLICK HERE TO SEE ALL THE NUMBERS BROKEN DOWN AND SOME PRETTY CHARTS

Key Takeways:

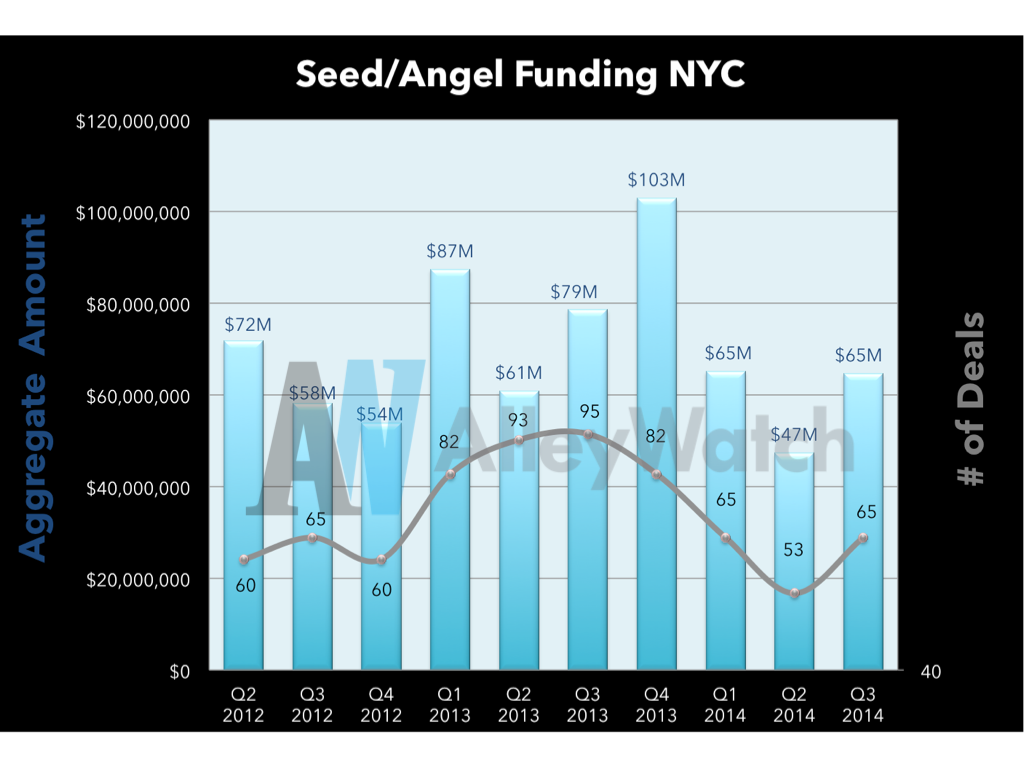

In 2013, there was a relative increase in both the number of and aggregate amount invested in seed and angel deals. This year, the amount and number of deals in seed and angel has returned to 2012 levels.

Tweetables:

$65M was invested in 65 seed/angel rounds in Q3 of 2014 in NYC Tweet this

$691M was invested in 720 seed/angel rounds in NYC over the last 10 quarters Tweet this

Key Takeways:

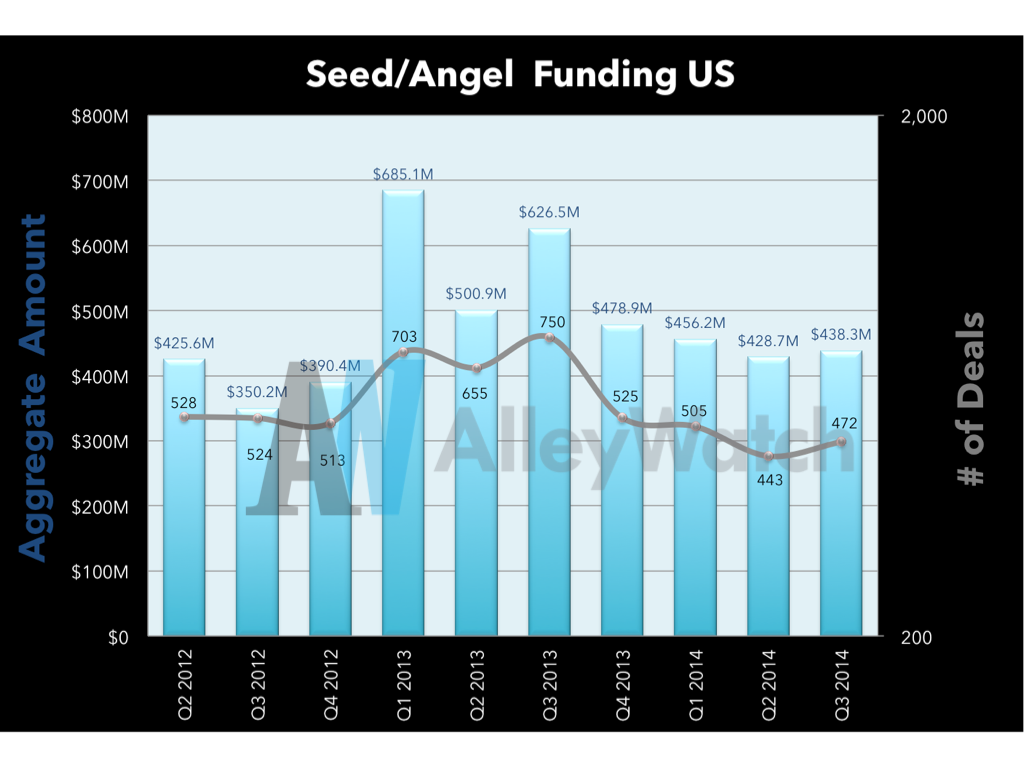

Similar to the New York market, the national funding market for seed and angel deals returned to relative normalcy as compared to 2013 levels where the number of deals and aggregate funding was up significantly.

Tweetables:

$438M was invested in 472 seed/angel rounds in Q3 of 2014 in the US Tweet This

$4.8M was invested in 5640 seed/angel rounds in the US over the last 10 quarters Tweet this

Key Takeways:

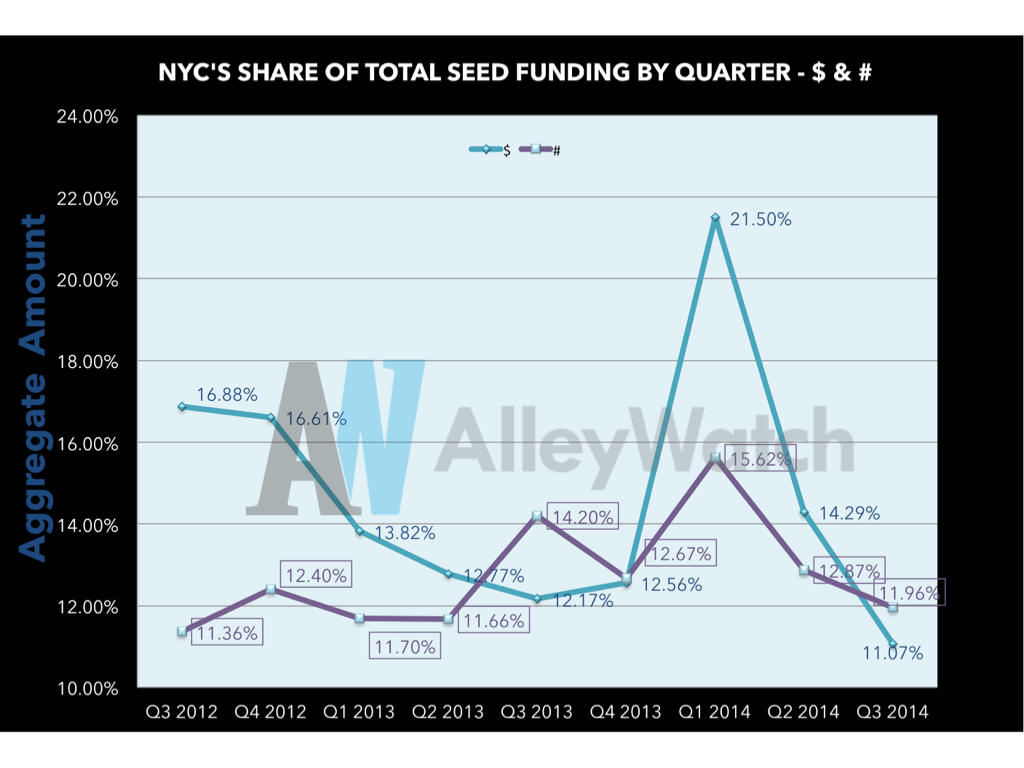

Over the last 10 quarters, NYC’s share of total seed and angel financing has remained relatively steady at ~11% in terms of the number of deals. However, the city’s share of the total amount has fallen from ~17% over the same period with the exception of the first quarter of 2014 where NYC angel and seed fundings comprised a whopping 21.5% of the total funding across the US.

Tweetables:

NYC seed and angel funding comprised 11% of the aggregate startup fundings in the US both in terms of $ and # in Q3 Tweet this

Key Takeways:

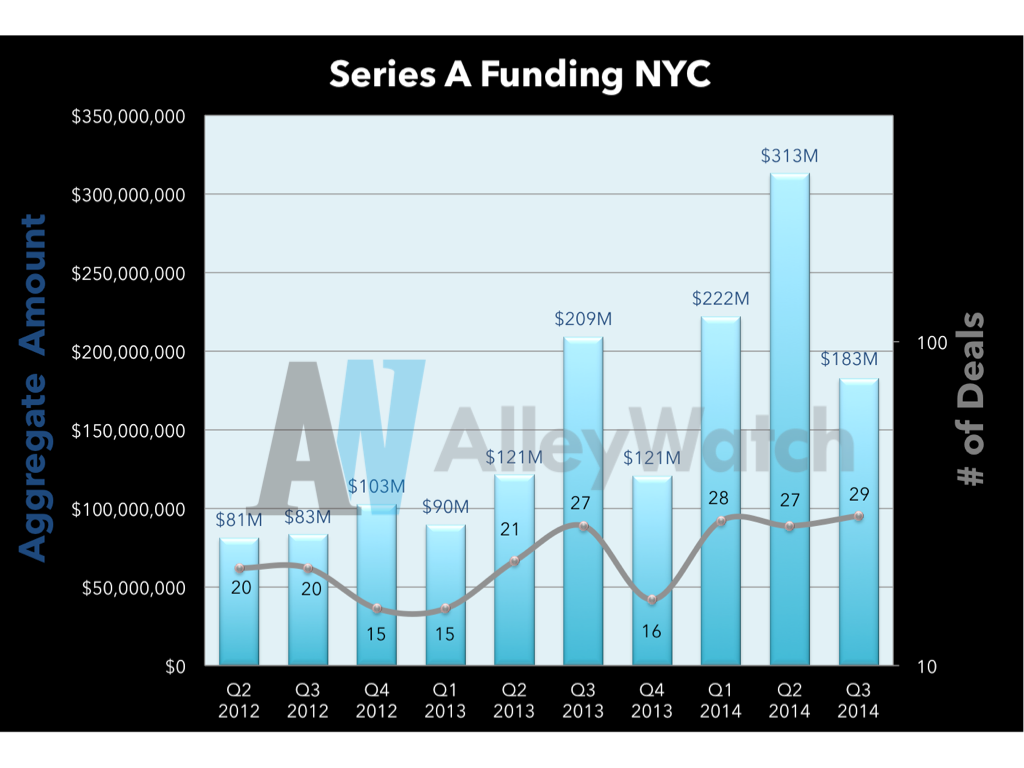

Series A financing has been healthy in NYC across the last 10 quarters with steady increases over time.

Tweetables:

$183M was invested in 29 Series A rounds in Q3 of 2014 in NYC Tweet this

$1.5B was invested in 218 seed/angel rounds in NYC over the last 10 quarters Tweet this

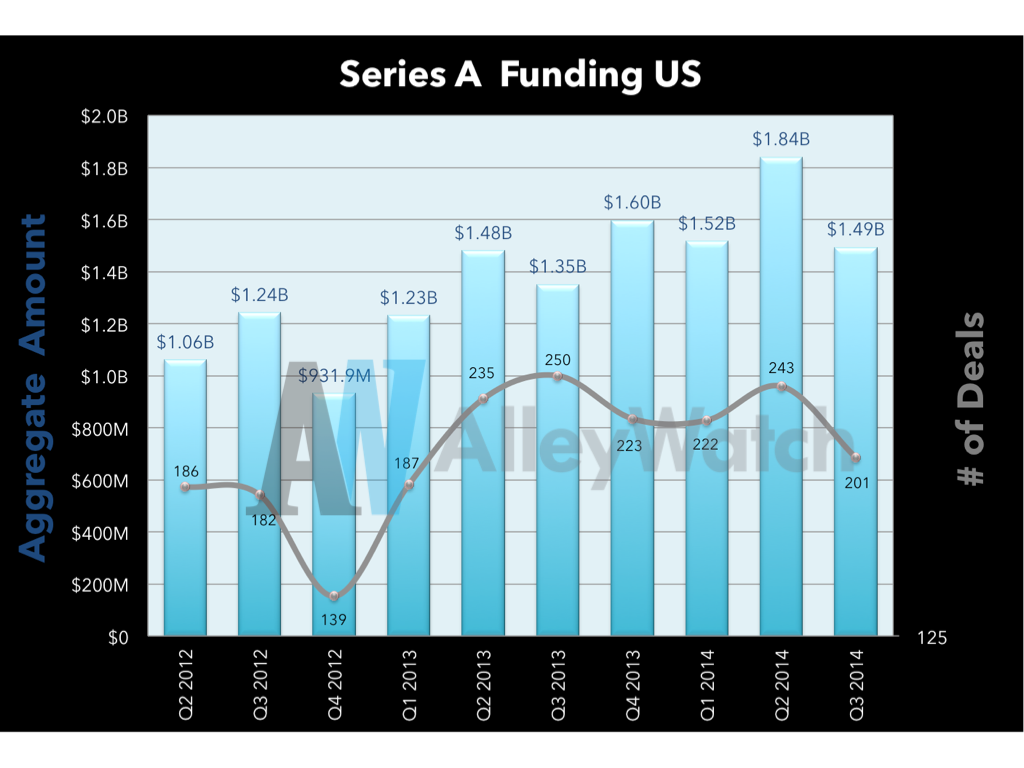

Key Takeways:

There has been relatively modest increases in the number and aggregatve amount of Series A rounds financed over the last 10 quarters.

Tweetables:

$1.49B was invested in 201 Series A rounds in Q3 of 2014 in the US Tweet this

$13.9B was invested in 2084 Series A rounds in the US over the last 10 quarters Tweet this

Key Takeways:

New York’s share of the total Series A market has increased steadily and rapidly over the last 10 quarters, increasing 2.5x in terms of dollars while the number of deals has remained steady at ~11%.

Tweetables:

Q3 NYC Series A rounds comprised 17% of total $ amount in the US with 11% of deals Tweet this

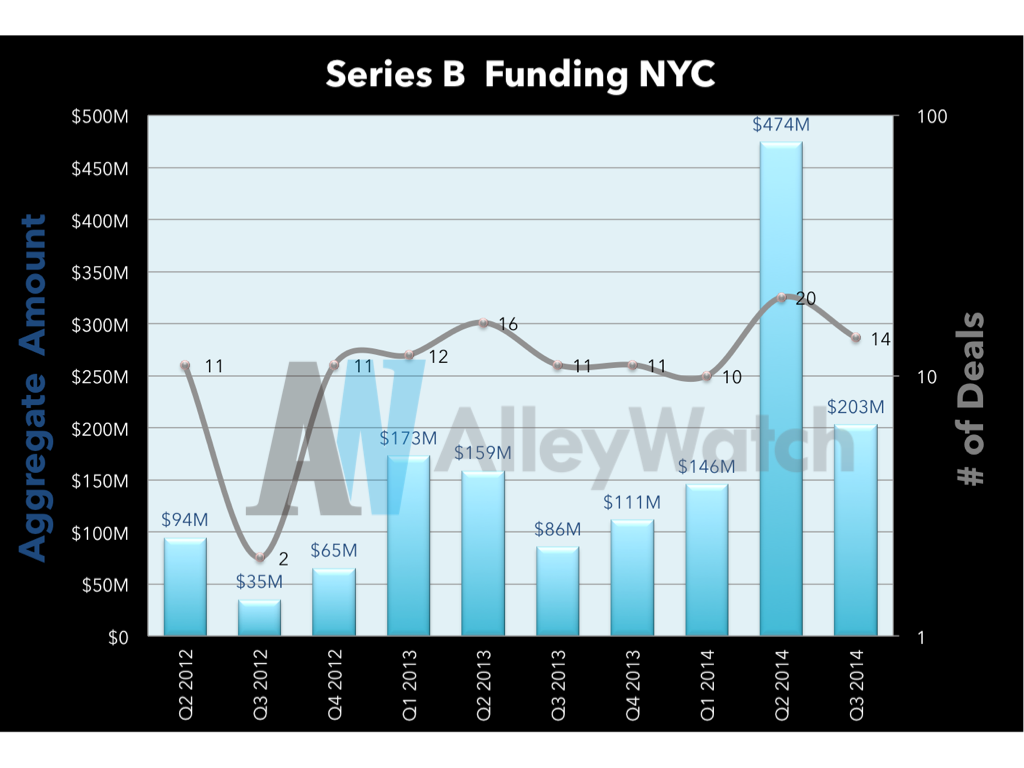

Key Takeways:

Series B Funding has been incresasing steadily over the last 10 quarters while the number of deals has shown modest increases in NYC.

Tweetables:

$203M was invested in 14 Series B rounds in Q3 of 2014 in NYC Tweet this

$1.5B was invested in 120 Series B rounds in NYC over the last 10 quarters Tweet this

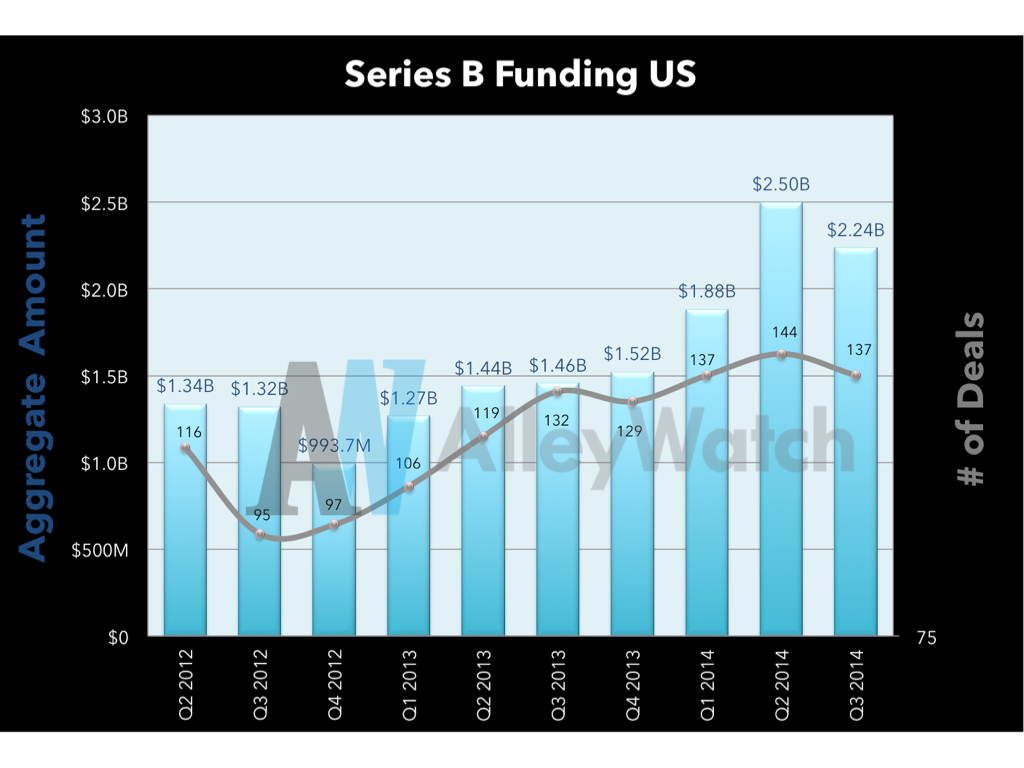

Key Takeways:

The number of series B deals in the US has been increasing at a robust rate and echoing New York the deal sizes have increased as well.

Tweetables:

$2.24B was invested in 137 Series A rounds in Q3 of 2014 in the US Tweet this

$16.5B was invested in 1223 Series A rounds in the US over the last 10 quarters Tweet this

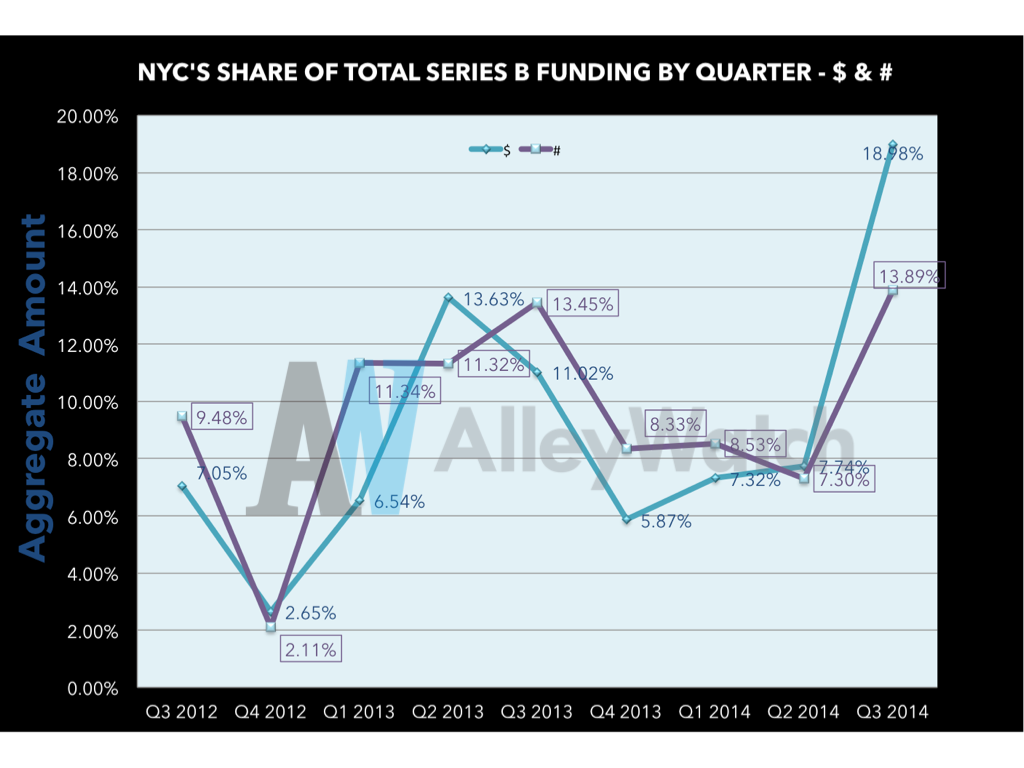

Key Takeways:

New York’s share of total Q3 Series B deals and dollars invested increased in proportion to the US market. It will be worth watching if this trend continues through Q4 of this year.

Tweetables:

Q3 NYC Series B rounds comprised 19% of total $ amount in the US with 14% of deals Tweet this

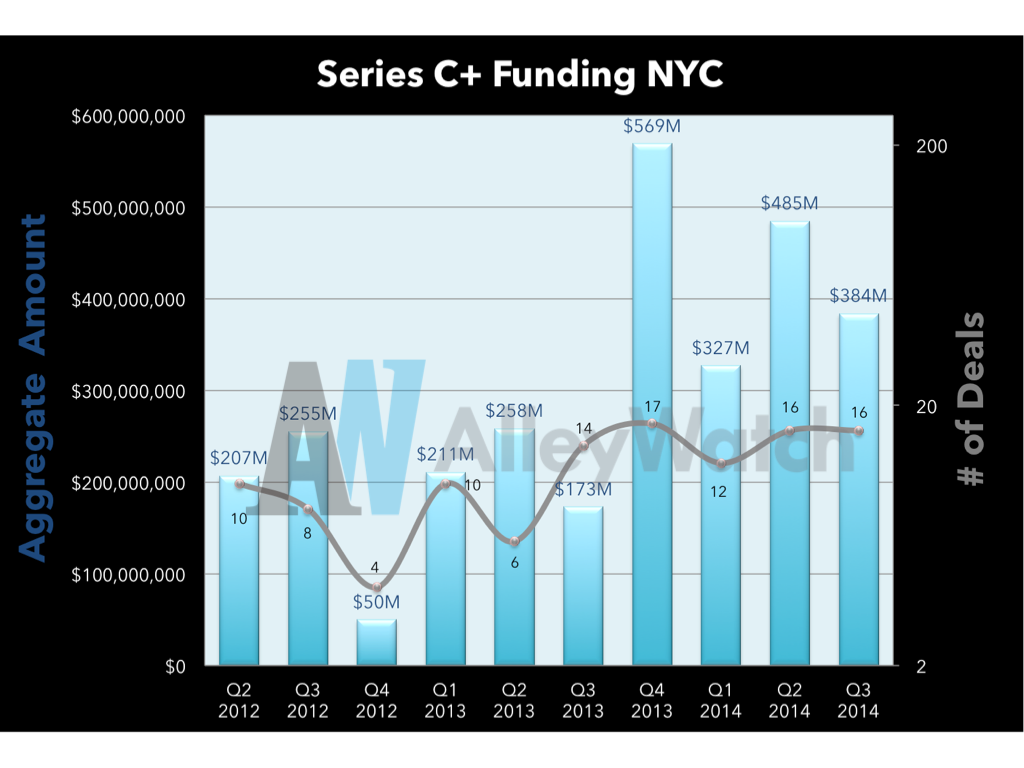

Key Takeways:

Both the number and aggregate dollar amounts of late stage rounds have been increasing since 2012.

Tweetables:

$384M was invested in 16 Series C+ rounds in Q3 of 2014 in NYC Tweet this

$2.9B was invested in 107 Series C+ rounds in NYC over the last 10 quarters Tweet this

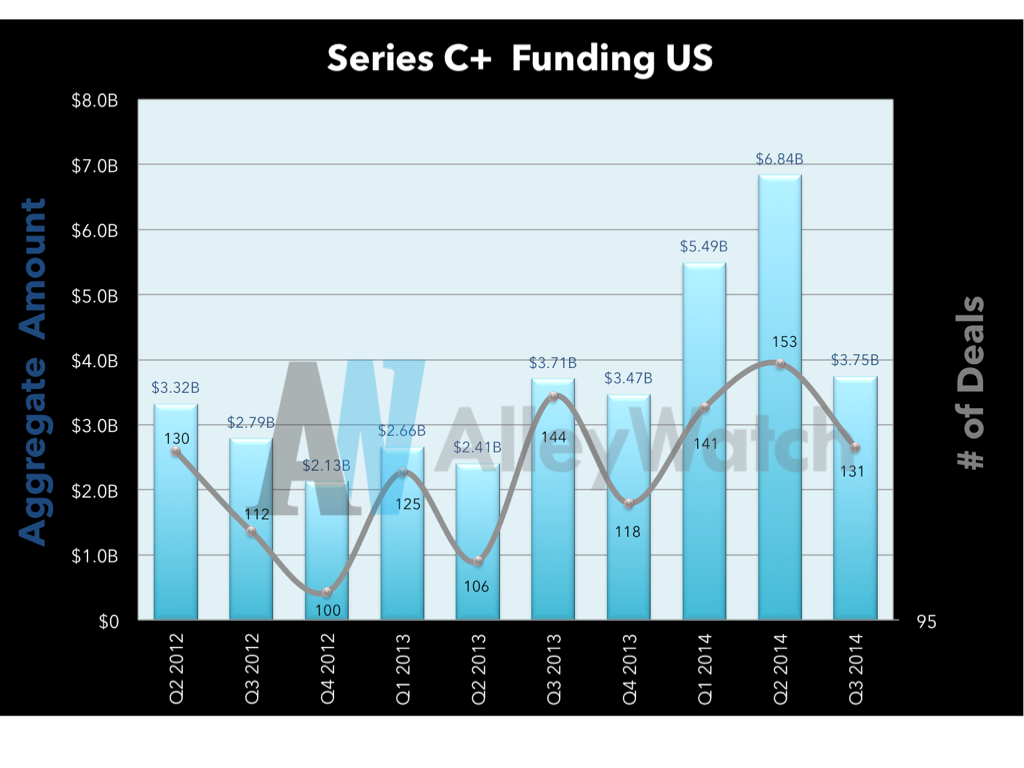

Key Takeways:

With the exception of Q1 and Q4 of this year, late stage funding has remained relatively constant over the last 10 quarters across the US.

Tweetables:

$3.75B was invested in 131 Series C+ rounds in Q3 of 2014 in the US Tweet this

$37.1B was invested in 1223 Series C+ rounds in the US over the last 10 quarters Tweet this

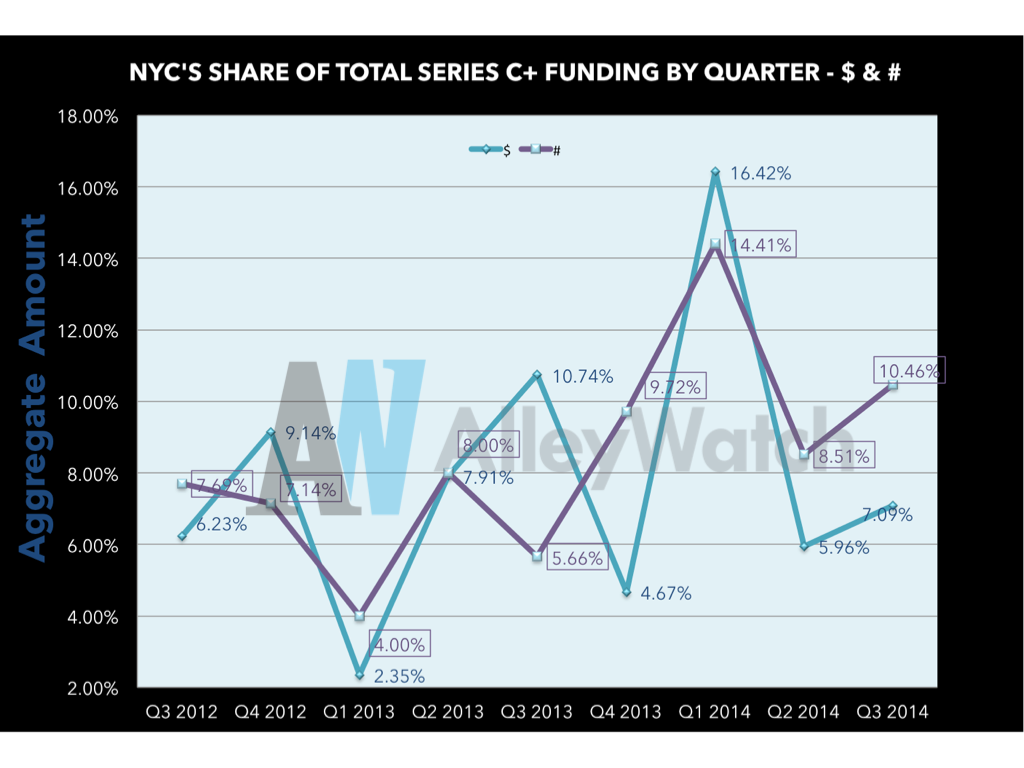

Key Takeways:

Late stage rounds in New York in proportion to the US aggregates has been erratic over the last 10 quarters. The expectation is this will level out in the future as the aforementioned increases in Series B funded companies move towards their next rounds.

Tweetables:

Q3 NYC funding rounds comprised 10.5% of total $ amount in the US with 7% of deals Tweet this

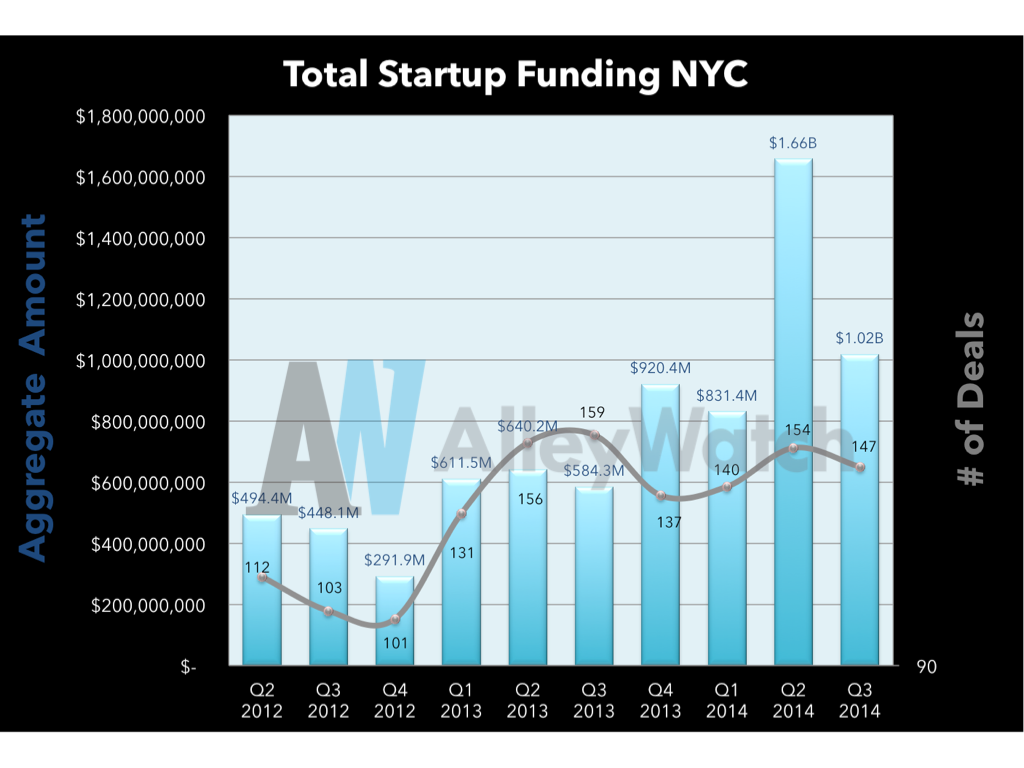

Key Takeways:

Funding in NYC startups has recorded an impressive increase when comparing from a quarterly standpoint. Q2 of 2014 was the first year that over $1B was invested and this continued in Q3. The total number of companies receiving funding has also exhibited an impressive increase as well with nearly 40% more companies receiving funding.

Tweetables:

$1.02B was invested in 147 startup rounds in Q3 of 2014 in NYC Tweet this

$7.5B was invested in 1346 startup rounds in NYC over the last 10 quarters Tweet this

Key Takeways:

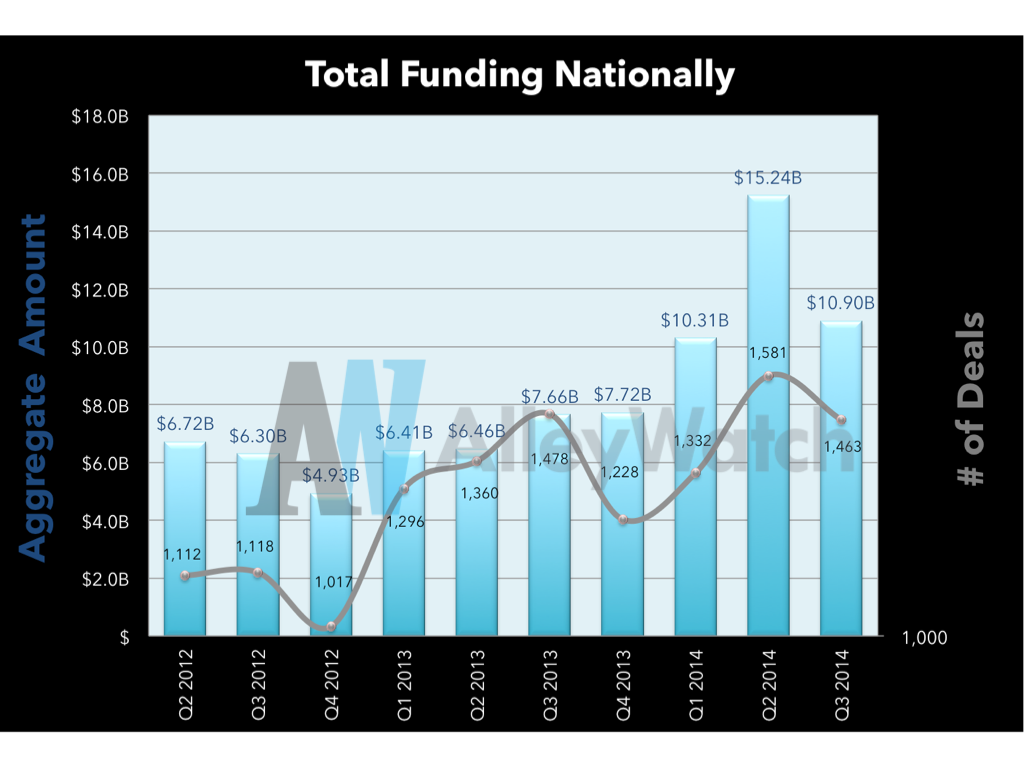

The number of companies receiving financing has increased significantly nationally as well over the last 10 quarters and the dollar amounts have followed suit as well.

Tweetables:

$10.9B was invested in 1463 startup rounds in Q3 of 2014 in the US in 1463 rounds Tweet this

$84B was invested in 13127 startup rounds in the US over the last 10 quarters Tweet this

Key Takeways:

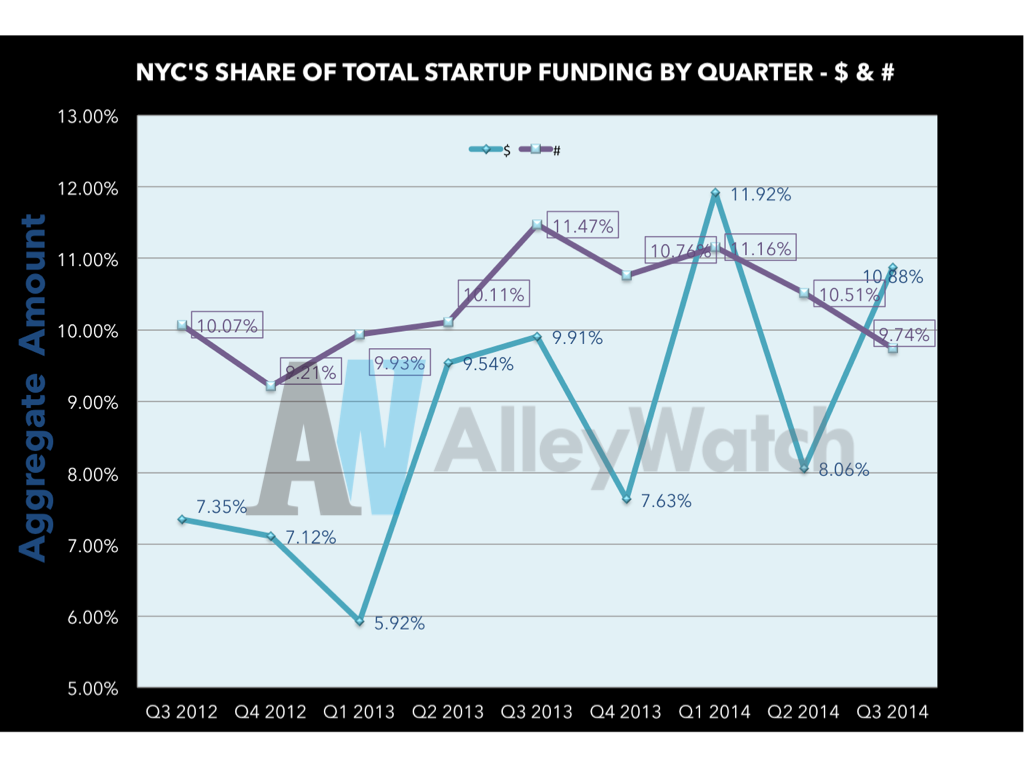

New York’s share of total startup financing in terms of dollars has increased a healthy 50% over the last 10 quarters while the percentage of deals has remained relatively stable.

Tweetables:

Q3 NYC funding rounds comprised 11% of total $ amount in the US with 10% of deals Tweet this

Key Takeways:

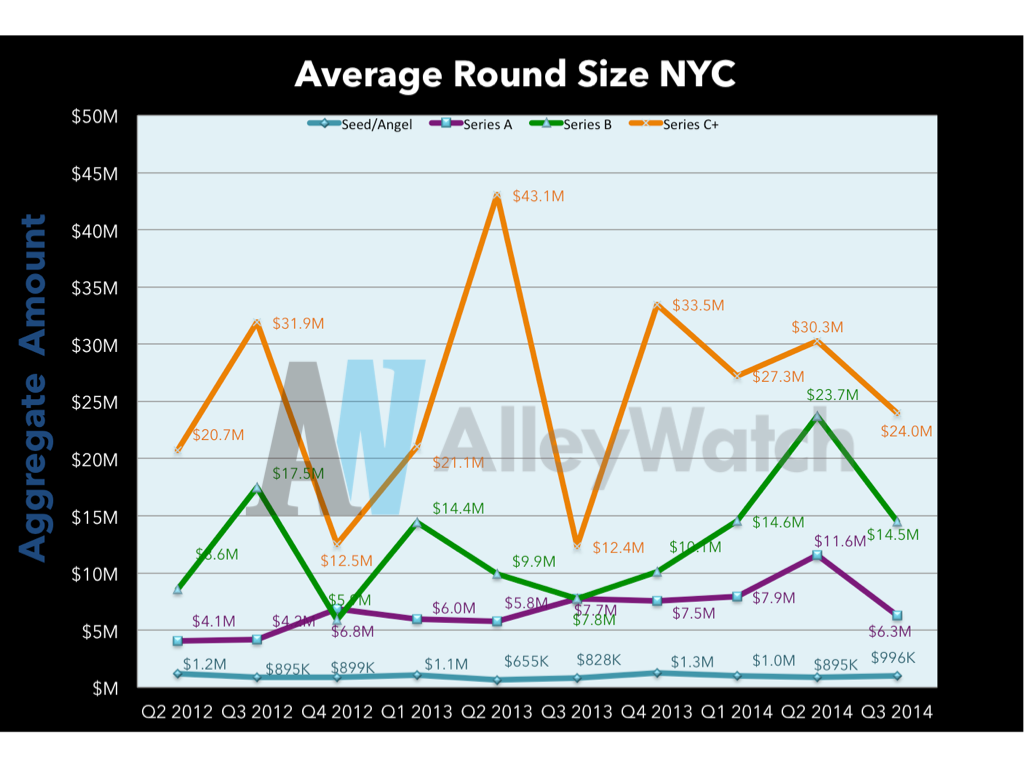

Average round sizes have increased steadily across all funding rounds in NYC over the last 10 quarters with the exception of angel/seed rounds. The largest increases have been seen in Series B rounds which have more than doubled and Series A rounds which are up ~150%.

Tweetables:

The average series B round has doubled in NYC over the last 10 quarters Tweet this

The average NYC series A round has gone up ~150% over the last 10 quarters Tweet this

The average seed/angel round in NYC in Q3 was $996K Tweet this

The average Series A round in NYC in Q3 was $6.3M Tweet this

The average Series B round in NYC in Q3 was $14.5M Tweet this

The average Series C+ round in NYC in Q3 was $24M Tweet this

Key Takeways:

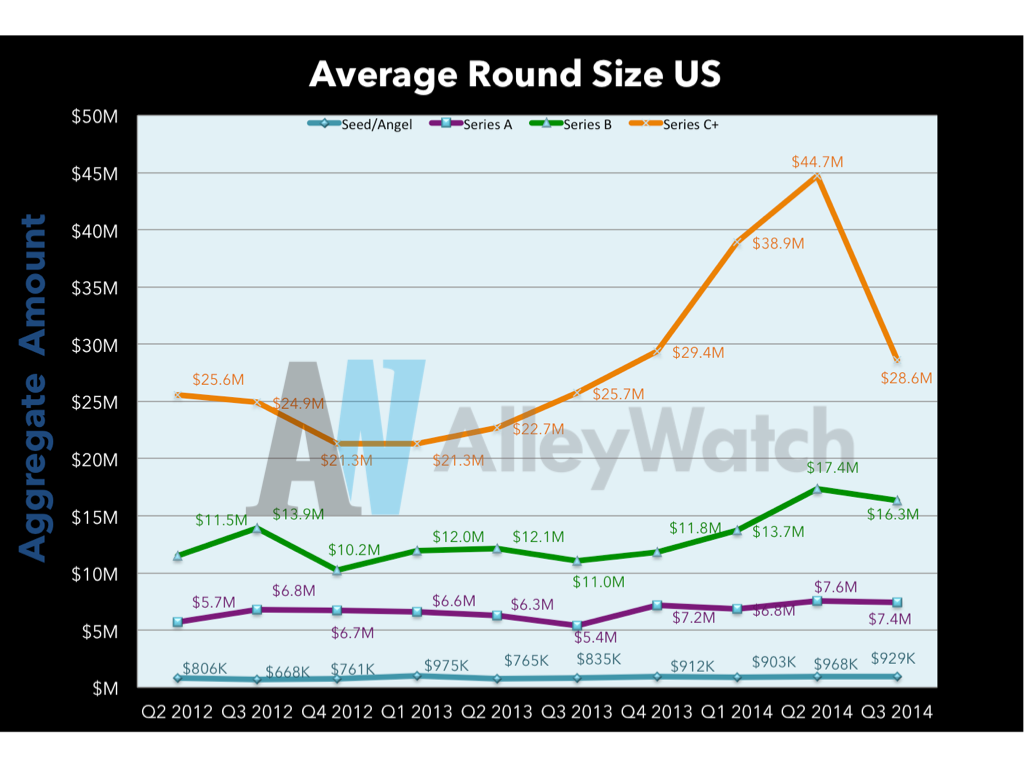

It’s interesting to note that the average last stage round in the US has been increasingly quite steadily over the last 10 quarters until Q3 where there was a sharp drop back to 2012 levels.

Tweetables:

The average seed/angel round in the US in Q3 was $929K Tweet this

The average Series A round in the US in Q3 was $7.4M Tweet this

The average Series B round in the US in Q3 was $16.3M Tweet this

The average Series C+ round in the US in Q3 was $28.6M Tweet this