In the past few months, almost every discussion I have with founders who recently started their companies start the same way.

“We are really excited to have you help us, do you know of any investors that might want to invest?”

These are companies that were literally just started, whose product does not yet work and who have no customers. They haven’t even figured out what their business might look like, but they want to immediately jump to raising $1M using a convertible note with a $5M cap (yes, those terms are so common I’m not even making them up).

Why is everyone rushing to raise money? Most of the blame falls to the frothy funding market right now and how easy it is to raise seed funding for new ventures. If you look around and see everyone else doing it, why shouldn’t you? It would be nice to have the money to pay a small salary and remove some of the financial stress that goes along with being a founder. Besides, the market might crash at any time and you should act while the market is hot.

It’s tempting, but dangerous.

Fundraising too early can be very risky for your new company. It will distract you from building your product, recruiting customers and learning about how your business will change from your initial vision (and it will change). In fact, you might not end know what kind of financing is right for your business since it is too early to tell.

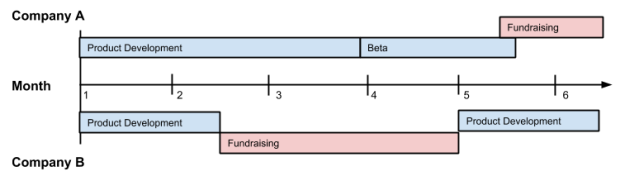

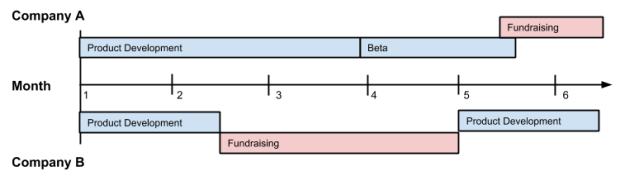

Let us look at the difference between two example companies, Company A and Company B, in their first six months of existence. Company A decides to focus on product and customers, delaying fundraising until after their Beta. Company B decides to raise money right away to remove some of the financial stress from the founders. We can give both companies the benefit of the doubt and assume they did sufficient customer development ahead of time so they are working on business concepts that have potential.

Below is how the first six months play out for both companies:

As you can see, after the first six months Company A is already in their Beta and has started fundraising, while Company B is still working on their product because they took three months out for fundraising. This is being conservative, since it’s quite likely that fundraising takes Company B more than 3 months.

But wait! Why didn’t Company B just continue their product development while fundraising? Because there just isn’t enough time in the day. Raising funding is incredibly time intensive, requiring meetings and discussions with many investors, only a few of whom will invest in your company. Assuming both companies had co-founders, there are 2 people on the team and at least 1.5 of them would be working on raising money.

Not only that, but when Company A is fundraising they can speak to investors with confidence about their product and business since they have tested it in the market with customers in their Beta. Company B was pitching investors on an idea that may or may not need to change. This means that Company A will likely be able to raise more money on more favorable terms than Company B.

Well, so what? Company B raised money, right? They have plenty of time to figure it out.

Maybe and maybe not. Again, they have yet to understand what their business might look like as they learn from the market. It is possible that the market completely rejects their business model, or perhaps their product is significantly harder to build than they thought. If they cannot get to market with the financing they raised it is very unlikely they will be able to raise more.

Just in case you don’t believe me, there are countless cases of companies that raised money too early and ended up failing because of it. Color burned through $41M in premature financing before failing. Clinkle is in the process of failing after raising $30M too early.

I know it’s hard to work for free and watch your bank account dwindle. I know that it’s hard not being able to hire a few more people to help build your business and make it move faster. I know that you worry about the market turning and financing getting harder to raise. These are things you will worry about for most of the life of your company. Paying a long term price to address them in the short term is only hurting yourself in the long term.

Raising your first capital is an important event in the history of any company. Be sure it is the right time for yours.

This article was originally published at Sean on Startups, a blog about starting and growing companies.