It’s no secret that the high-pressure world of business can have some negative effects on our health. Aside from the constant stress that comes with being a successful entrepreneur, there’s the ever-present risk of debt. We’ve all seen it happen – an investment goes awry, your forecasts turn out to be off or a global recession puts the boot on your business plans. When this happens it can be hard not to be depressed which could have terrible consequences, not just for your business but for your health too. Studies have shown that those suffering from depression are more prone to everything from heart disease and strokes to even the common cold. Going about your business in the right way, however, can mitigate or even ward off these effects and allow for a healthier mind-set. Here’s how:

Routines

The average businessperson juggles somewhere between 30-100 projects at any given time, making it easy to see how life’s responsibilities can become too much to cope with. This is why routines are important in business. In addition to giving your work-time a clear structure, routines can also absolve you of the stress decision-making can sometimes bring. Knowing what you need to accomplish and when you are going to do it can help with maximizing good mental health. Think about something as simple as making yourself a ‘To Do List’ for each day.

Keep Your Perspective

You’ve had a terrible day – you messed up at a client meeting, you’re behind schedule on a project and you have over-looked your monthly. It’s understandable you would feel awful, but remember to keep things in perspective. Unless your creditors are literally kicking down the door, things could be worse… Always keep an eye on the bigger picture.

Counting Chickens

Never assume a deal will go through or you’ll make a sale until it’s signed, sealed and the money is in your account. If you mentally start spending that £5,000 you think you’ve made, your confidence may falter if the deal or sale falls through.

Remove Interruptions

It’s a good idea to set some time aside each day when you’re free from the hassle of phone calls and emails. Ration these accordingly to avoid feeling stressed out. For example, choose 3 various times in the day to check emails.

Separate Work from Your Personal Life

The golden rule of business is to never take your work home with you. This is easier said than done! It’s important to give yourself an ending time each evening and simply stop, even if you haven’t done everything. Keep your home as a stress-free environment so you will be able to re-charge each evening.

Don’t Judge Yourself

Our own negative self-criticism is one of the primary causes of depression. If you find yourself stuck in a negative mental state, make an effort to think about your achievements or recall a recent success story. Try reminding yourself, out loud if you can, of three positive things about you or your life. For example, you’re in good health, have the ability to do this job and have a good family.

Accept Responsibility

Another huge cause of stress and depression is feeling out of control. If you make a mistake, even if there were mitigating factors, learn to move on. Pointing fingers or yelling at someone will only make you feel worse in the long run.

Don’t Overstretch Yourself

Business is always a gamble, but not everybody can be Richard Branson. It’s good to take risks, but only if you can easily absorb losses. Don’t go in for a risky deal that you can’t bounce back from. This is how people end up in serious debt, which then leads to more stress, anxiety and depression.

When in Debt

For those of you already in debt and possibly suffering depression, there are specific steps you can take to get you back on track.

- Talk to Debt Charities

If you’re already in debt and it’s making you miserable, you can turn to trusted debt charity advisors or a place where you can share your problems such as TalkAboutDebt. They will be able to advise you on the various solutions available, such as the TalkAboutDebt IVA – an arrangement that allows you to pay off only what you can afford over a 3-5 year period. A trusted debt advisor will not ‘sell’ you a solution, but will review your case and your specific circumstances and recommend payment options that are the most suitable for you.

- Budget Carefully

When you’re ‘in a hole’ you should stop digging. If you feel you’re at rock bottom early on in your start-up business, then you should think again. Don’t resort to any quick fixes, such as expensive loans – these rarely work. Go back to the basics: re-evaluate and consider if there really is a market for your product. Running out of cash is one of the most common causes of business failure, so be sure to budget carefully. Be aware of payments you will need to make to suppliers and advisors. Always revisit your budget on a regular basis and keep expenses down as best as you can.

- Create an Action Plan

A plan for getting your business on or back on track can help focus and stimulate your mind as well as avoid more debt. Revisit your business plan and concentrate on achieving more realistic goals. Ask yourself, who am I selling to? Is my pricing strategy right? Am I reaching the right audience and spending only where I need to? Take professional advice, if you can, on tax issues and do your own research on government grants that may be available to you and your business.

Jennifer is a graduate who has spent her career climbing the business ladder. She has worked in many industries, which has enabled her to grow her skills. Having worked in deadline driven environments she has learned how to project manage websites globally and develop strategies for success. She is passionate about life, innovation and engineering and motivates herself on a daily basis to achieve her very best and help those in need.

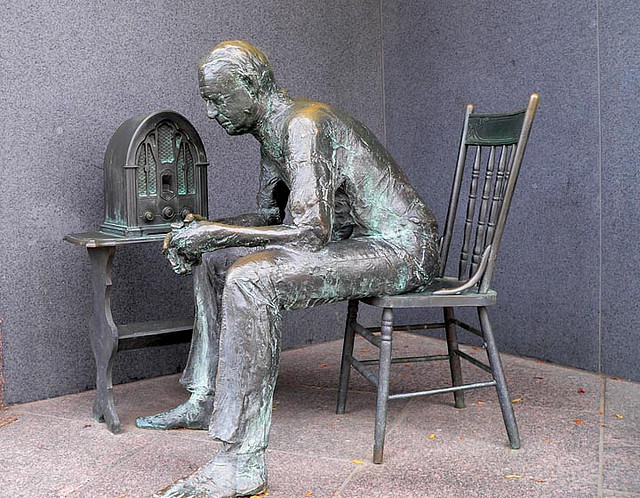

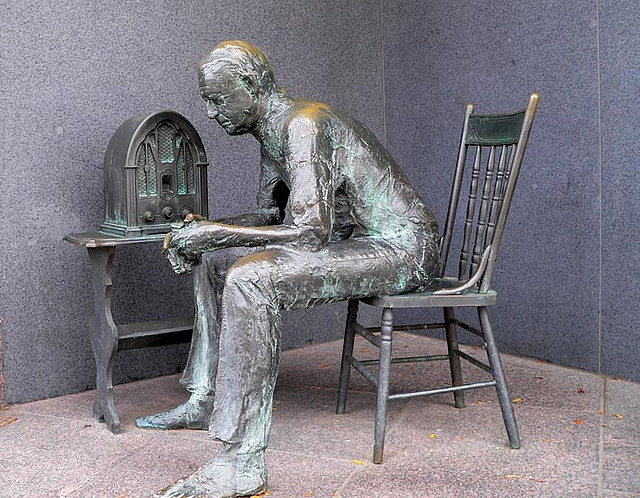

Image credit: CC by Koshy Koshy